Make entries in General Journal to record each of the transactions (items (a) to (i)). Open necessary T-accounts to represent the General Ledger accounts, post the transactions rec... Make entries in General Journal to record each of the transactions (items (a) to (i)). Open necessary T-accounts to represent the General Ledger accounts, post the transactions recorded in General Journal. Prepare adjusting entries to reflect (j) through (n).

Understand the Problem

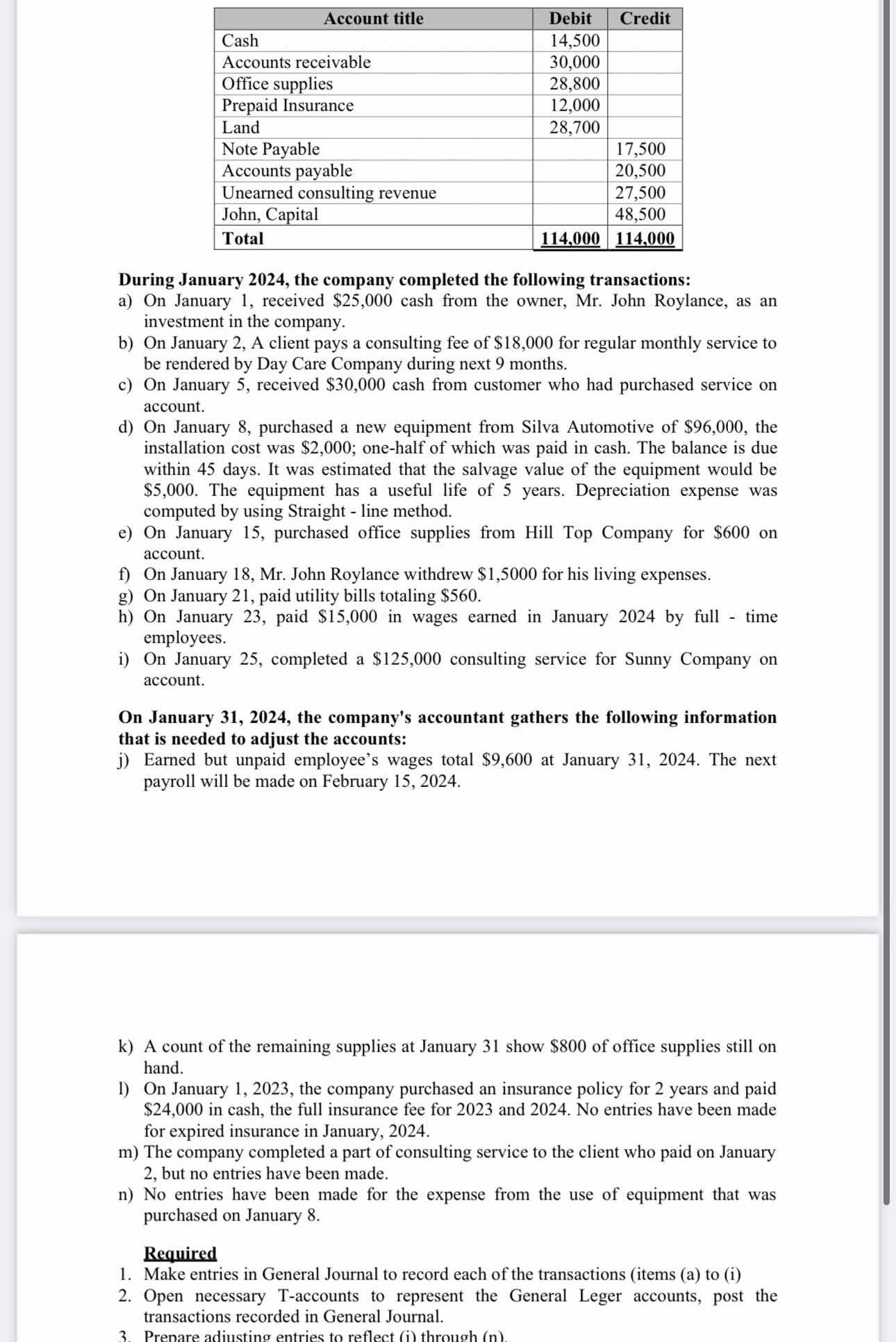

The question is asking for the creation of journal entries based on a series of transactions completed by a company in January 2024. This involves recording debits and credits for each transaction, posting to T-accounts, and preparing adjusting entries for specific items.

Answer

Record journal entries, post to T-accounts, and adjust entries as specified.

The general journal entries and posting to T-accounts for transactions (a) to (i) and adjustments (j) to (n) organize financial activity over January 2024, reflecting events and creating an accurate year-end picture.

Answer for screen readers

The general journal entries and posting to T-accounts for transactions (a) to (i) and adjustments (j) to (n) organize financial activity over January 2024, reflecting events and creating an accurate year-end picture.

More Information

Recording and adjusting journal entries ensure that financial transactions are accurately reflected, providing a truthful snapshot of the company's accounting records.

Tips

Common mistakes include forgetting to adjust for depreciation, not accurately calculating accrued expenses, or failing to match income and revenues.

Sources

- Use Journal Entries to Record Transactions and Post to T-Accounts - openstax.org

- Adjusting Journal Entry Definition and Examples - investopedia.com

- How to Post Journal Entries to the General Ledger - Patriot Software - patriotsoftware.com

AI-generated content may contain errors. Please verify critical information