What is the format of a Profit and Loss account for the period ending on?

Understand the Problem

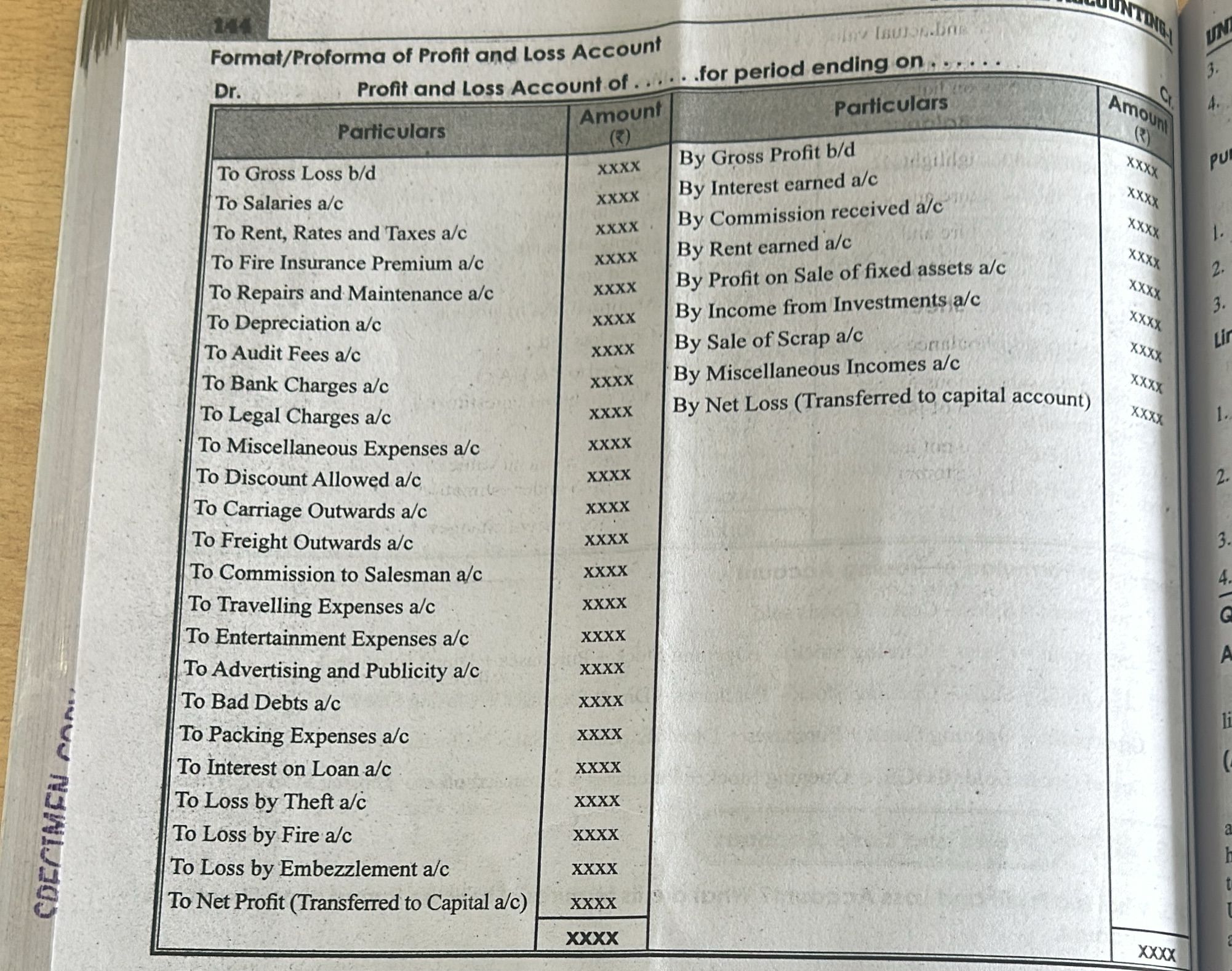

The question relates to understanding the format of a Profit and Loss account, detailing various items for recording income and expenses. This format is essential for accounting purposes and helps in tracking financial performance.

Answer

Revenue and expenses are recorded to calculate net profit or loss.

The Profit and Loss account format lists revenue on the credit side and expenses on the debit side to determine net profit or loss.

Answer for screen readers

The Profit and Loss account format lists revenue on the credit side and expenses on the debit side to determine net profit or loss.

More Information

The Profit and Loss account shows the financial performance over a period. It lists revenues and gains on one side, and expenses and losses on the other. The difference determines the net profit or loss, impacting retained earnings or loss carried forward.

Sources

- Profit and Loss Statement - Corporate Finance Institute - corporatefinanceinstitute.com

- Profit and Loss Statement: Definition, Examples & How To Do One - Paychex - paychex.com

AI-generated content may contain errors. Please verify critical information