What are the key aspects of credit policies within a company and their implications?

Understand the Problem

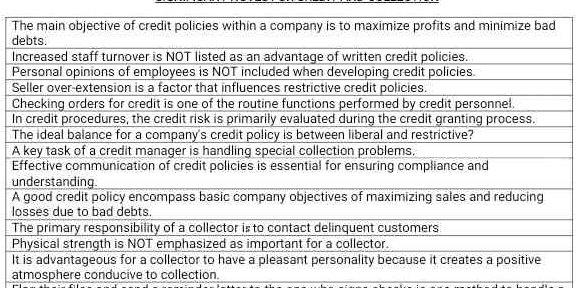

The question seems to be related to understanding credit policies within a company and their implications on profits and collections. It outlines various points regarding credit management, policies, and the role of collectors which might need further analysis or explanation.

Answer

Credit policies aim to maximize profits and minimize bad debts through clear limits and procedures.

Credit policies focus on maximizing profits and minimizing bad debts by setting clear limits, terms, and collection procedures. Personal opinions aren't included, and effective communication ensures compliance. Balancing liberal and restrictive policies is essential. Collectors primarily engage with delinquent customers, relying on pleasant personalities for effective collections.

Answer for screen readers

Credit policies focus on maximizing profits and minimizing bad debts by setting clear limits, terms, and collection procedures. Personal opinions aren't included, and effective communication ensures compliance. Balancing liberal and restrictive policies is essential. Collectors primarily engage with delinquent customers, relying on pleasant personalities for effective collections.

More Information

A well-developed credit policy helps companies efficiently manage credit risk and collections, ensuring financial stability and fostering customer relationships.

Tips

Common mistakes include not regularly updating credit policies or failing to communicate them effectively to all relevant staff.

Sources

- Credit policies - (Corporate Finance) - Vocab, Definition, Explanations - fiveable.me

- Credit Policy: Types, Components, & Examples - corporatefinanceinstitute.com

- Credit Policy: 20 Key Elements That You Should Definitely Include - highradius.com

AI-generated content may contain errors. Please verify critical information