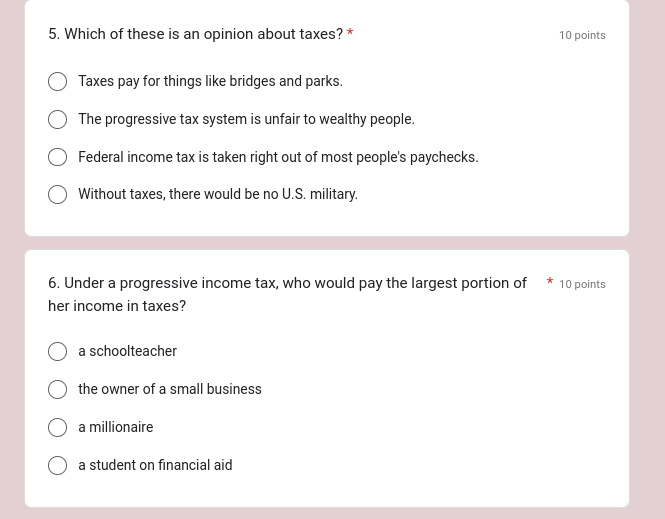

Which of these is an opinion about taxes? Under a progressive income tax, who would pay the largest portion of her income in taxes?

Understand the Problem

The questions are asking for identification of opinions about taxes and an understanding of how a progressive income tax affects different income levels. The first question differentiates between factual statements and opinions, while the second requires knowledge about tax structures.

Answer

Opinion: 'The progressive tax system is unfair to wealthy people.' Largest portion: 'a millionaire'.

The opinion is 'The progressive tax system is unfair to wealthy people.' The largest portion of income under a progressive tax would be paid by 'a millionaire.'

Answer for screen readers

The opinion is 'The progressive tax system is unfair to wealthy people.' The largest portion of income under a progressive tax would be paid by 'a millionaire.'

More Information

Progressive taxes are designed to have people with higher incomes pay more. Opinions about fairness vary, as some see this as equitable, while others see it as punitive to wealth accumulation.

Tips

Beware of confusing opinion-based statements with factual ones in such questions.

Sources

- Progressive Taxes - Econlib - econlib.org

- What Is a Progressive Tax? Advantages and Disadvantages - investopedia.com

AI-generated content may contain errors. Please verify critical information