What are the characteristics of equity shares and their importance in raising finance?

Understand the Problem

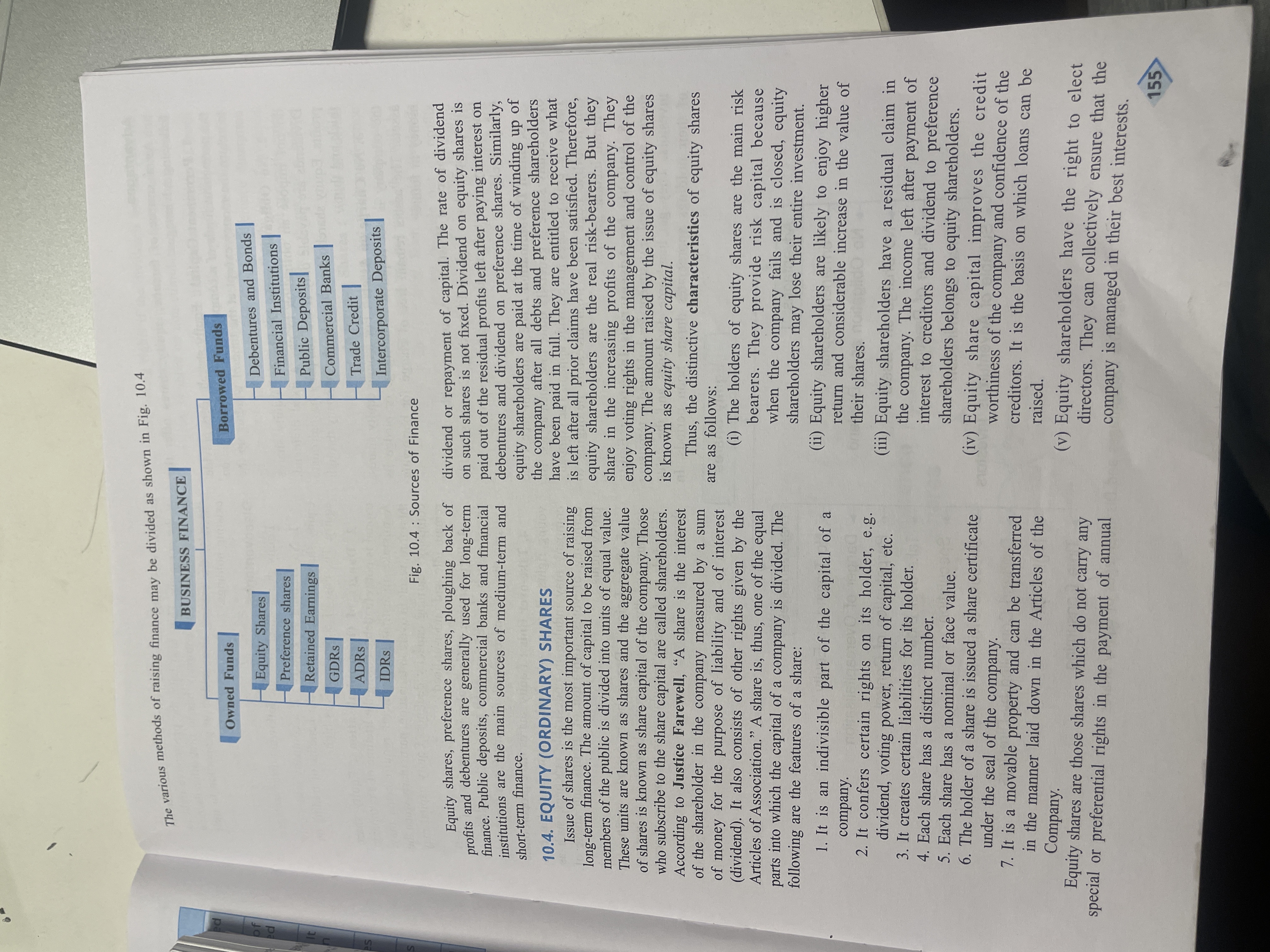

The text discusses various methods of raising finance, focusing specifically on owned and borrowed funds, and details the characteristics and significance of equity shares.

Answer

No fixed dividend rate, voting rights, higher return and risk, residual claims, improving creditworthiness, no repayment obligations.

The characteristics of equity shares include no fixed dividend rate, voting rights, higher return and risk, residual claims, improving creditworthiness, and providing no repayment obligations. They are vital in raising finance as they enhance a company's capital without incurring debt.

Answer for screen readers

The characteristics of equity shares include no fixed dividend rate, voting rights, higher return and risk, residual claims, improving creditworthiness, and providing no repayment obligations. They are vital in raising finance as they enhance a company's capital without incurring debt.

More Information

Equity shares raise capital by selling ownership stakes in the company, allowing it to fund operations and growth without the obligation of debt repayment. Shareholders benefit from potential dividends and appreciation in value but also face the highest risk.

Tips

A common mistake is assuming equity shares provide guaranteed dividends. It's crucial to understand that dividends are not fixed and depend on the company's profit situation.

Sources

- What are Equity Shares? Formula, Features & Advantages | Angel One - angelone.in

- What Are Equity Shares? - Groww - groww.in

- Features of Equity Shares Capital - byjus.com

AI-generated content may contain errors. Please verify critical information