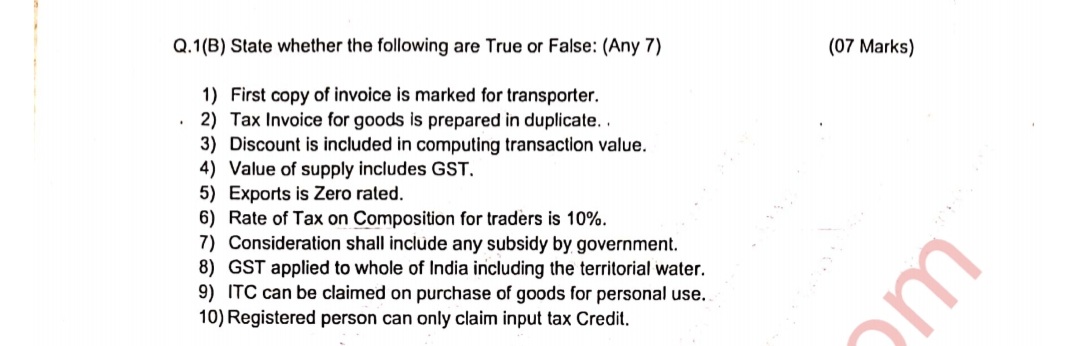

State whether the following are True or False: 1) First copy of invoice is marked for transporter. 2) Tax Invoice for goods is prepared in duplicate. 3) Discount is included in com... State whether the following are True or False: 1) First copy of invoice is marked for transporter. 2) Tax Invoice for goods is prepared in duplicate. 3) Discount is included in computing transaction value. 4) Value of supply includes GST. 5) Exports is Zero rated. 6) Rate of Tax on Composition for traders is 10%. 7) Consideration shall include any subsidy by government. 8) GST applied to whole of India including the territorial water. 9) ITC can be claimed on purchase of goods for personal use. 10) Registered person can only claim input tax Credit.

Understand the Problem

The question is asking for a determination of whether each of the listed statements related to taxation and GST (Goods and Services Tax) is true or false. The user is required to evaluate at least seven statements for correctness.

Answer

1) True, 2) False, 3) True, 4) True, 5) True, 6) False, 7) True, 8) True, 9) False, 10) True.

- True, 2) False, 3) True, 4) True, 5) True, 6) False, 7) True, 8) True, 9) False, 10) True.

Answer for screen readers

- True, 2) False, 3) True, 4) True, 5) True, 6) False, 7) True, 8) True, 9) False, 10) True.

More Information

Some answers are based on common GST practices, like exports being zero-rated and registered persons being eligible for input tax credits.

Tips

Ensure invoice preparation rules like duplicate copies for goods and triplicate for transporters are correctly noted. Consideration should include all subsidies.

Sources

- Frequently Asked Questions - CBIC-GST - cbic-gst.gov.in

- India - Corporate - Other taxes - Worldwide Tax Summaries - taxsummaries.pwc.com

AI-generated content may contain errors. Please verify critical information