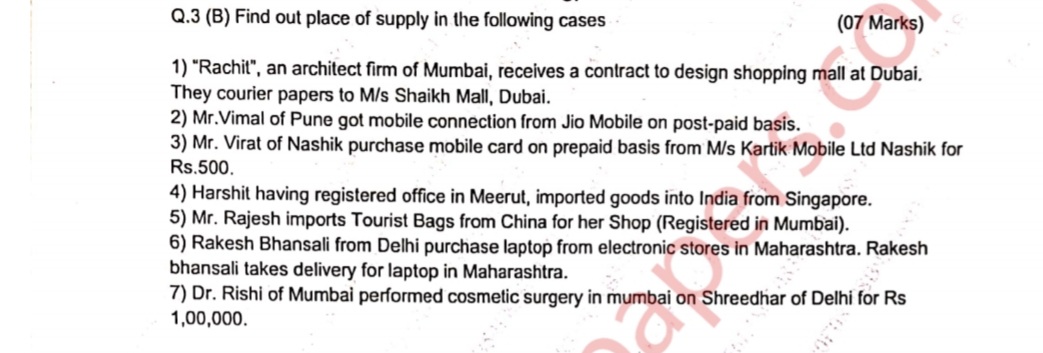

Find out the place of supply in the following cases: 1) 'Rachit', an architect firm of Mumbai, receives a contract to design a shopping mall at Dubai. 2) Mr. Vimal of Pune got mobi... Find out the place of supply in the following cases: 1) 'Rachit', an architect firm of Mumbai, receives a contract to design a shopping mall at Dubai. 2) Mr. Vimal of Pune got mobile connection from Jio Mobile on post-paid basis. 3) Mr. Virat of Nashik purchase mobile card on prepaid basis from M/s Kartik Mobile Ltd Nashik for Rs.500. 4) Harshit having registered office in Meerut, imported goods into India from Singapore. 5) Mr. Rajesh imports Tourist Bags from China for her Shop (Registered in Mumbai). 6) Rakesh Bhansali from Delhi purchase laptop from electronic stores in Maharashtra. Rakesh Bhansali takes delivery for laptop in Maharashtra. 7) Dr. Rishi of Mumbai performed cosmetic surgery in Mumbai on Shreedhar of Delhi for Rs. 1,00,000.

Understand the Problem

The question is asking to determine the place of supply for various transactions involving different individuals and businesses. It's assessing knowledge of supply chain and logistics in a commercial context.

Answer

1) Dubai, 2) Pune, 3) Nashik, 4) India, 5) Mumbai, 6) Maharashtra, 7) Mumbai.

- Dubai (location of immovable property). 2) Pune (location of service recipient). 3) Nashik (place of supply for telecom services). 4) India (location where goods are imported). 5) Mumbai (location where importer is registered). 6) Maharashtra (location of delivery). 7) Mumbai (location where service is performed).

Answer for screen readers

- Dubai (location of immovable property). 2) Pune (location of service recipient). 3) Nashik (place of supply for telecom services). 4) India (location where goods are imported). 5) Mumbai (location where importer is registered). 6) Maharashtra (location of delivery). 7) Mumbai (location where service is performed).

More Information

The place of supply is determined based on the type of service or goods, ensuring compliance with GST laws, including rules on location of services, immovable property, and import/export scenarios.

Tips

Ensure to distinguish clearly between services and goods when assessing place of supply.

Sources

- TYBAF - Indirect Taxation - GST - Set1 - Solution - scribd.com

AI-generated content may contain errors. Please verify critical information