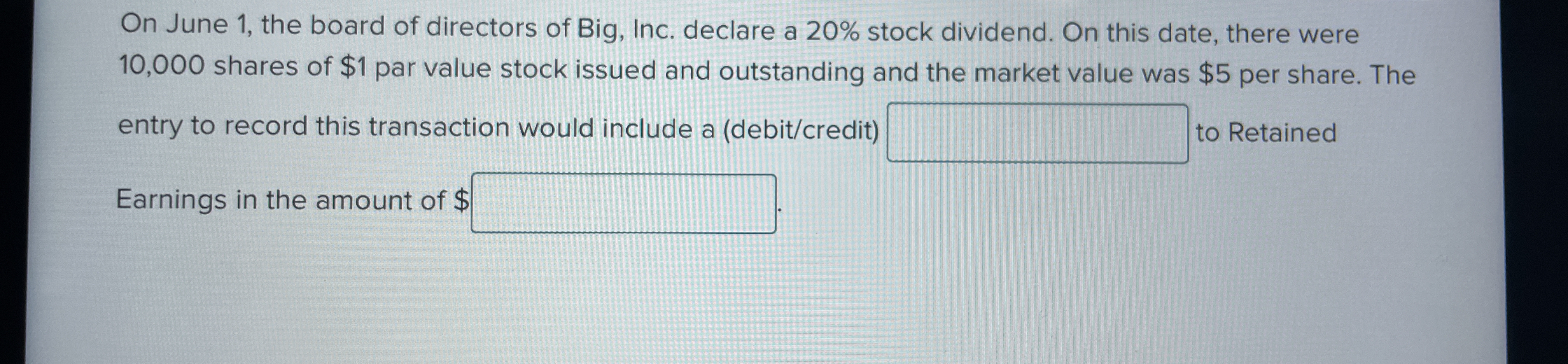

On June 1, the board of directors of Big, Inc. declare a 20% stock dividend. On this date, there were 10,000 shares of $1 par value stock issued and outstanding and the market valu... On June 1, the board of directors of Big, Inc. declare a 20% stock dividend. On this date, there were 10,000 shares of $1 par value stock issued and outstanding and the market value was $5 per share. The entry to record this transaction would include a (debit/credit) to Retained Earnings in the amount of $ ___ .

Understand the Problem

The question is asking for the accounting journal entry related to a 20% stock dividend declared by Big, Inc. This requires calculating the amount of the dividend and identifying the appropriate debit and credit entries to retained earnings.

Answer

The entry to record this transaction would include a debit to Retained Earnings in the amount of $10,000.

Answer for screen readers

The entry to record this transaction would include a debit to Retained Earnings in the amount of $10,000.

Steps to Solve

- Determine the number of new shares to be issued

For a 20% stock dividend on 10,000 shares, the number of new shares will be calculated as follows:

[ \text{New Shares} = \text{Existing Shares} \times \text{Dividend Percentage} = 10,000 \times 0.20 = 2,000 ]

- Calculate the total par value of the new shares

The par value of the new shares is calculated by multiplying the number of new shares by the par value per share.

[ \text{Total Par Value} = \text{New Shares} \times \text{Par Value} = 2,000 \times 1 = 2,000 ]

- Calculate the market value of the new shares

Next, calculate the total market value of the new shares to understand the journal entry impact.

[ \text{Total Market Value} = \text{New Shares} \times \text{Market Value} = 2,000 \times 5 = 10,000 ]

- Prepare the journal entry to record the stock dividend

The journal entry will debit Retained Earnings and credit Common Stock and Additional Paid-In Capital. The entries are:

- Debit Retained Earnings for the total market value of the new shares

- Credit Common Stock for the total par value of the new shares

- Credit Additional Paid-In Capital for the difference between the total market value and total par value

Thus, the entry looks like this:

[ \text{Debit Retained Earnings} = 10,000 ] [ \text{Credit Common Stock} = 2,000 ] [ \text{Credit Additional Paid-In Capital} = 10,000 - 2,000 = 8,000 ]

The entry to record this transaction would include a debit to Retained Earnings in the amount of $10,000.

More Information

When a company declares a stock dividend, it doesn't distribute cash. Instead, it increases the number of shares outstanding. This affects retained earnings and equity structure but not cash flow.

Tips

- Not calculating the correct number of new shares: Ensure to always multiply by the dividend percentage.

- Confusing par value and market value: Remember that par value is fixed, while market value can change.

AI-generated content may contain errors. Please verify critical information