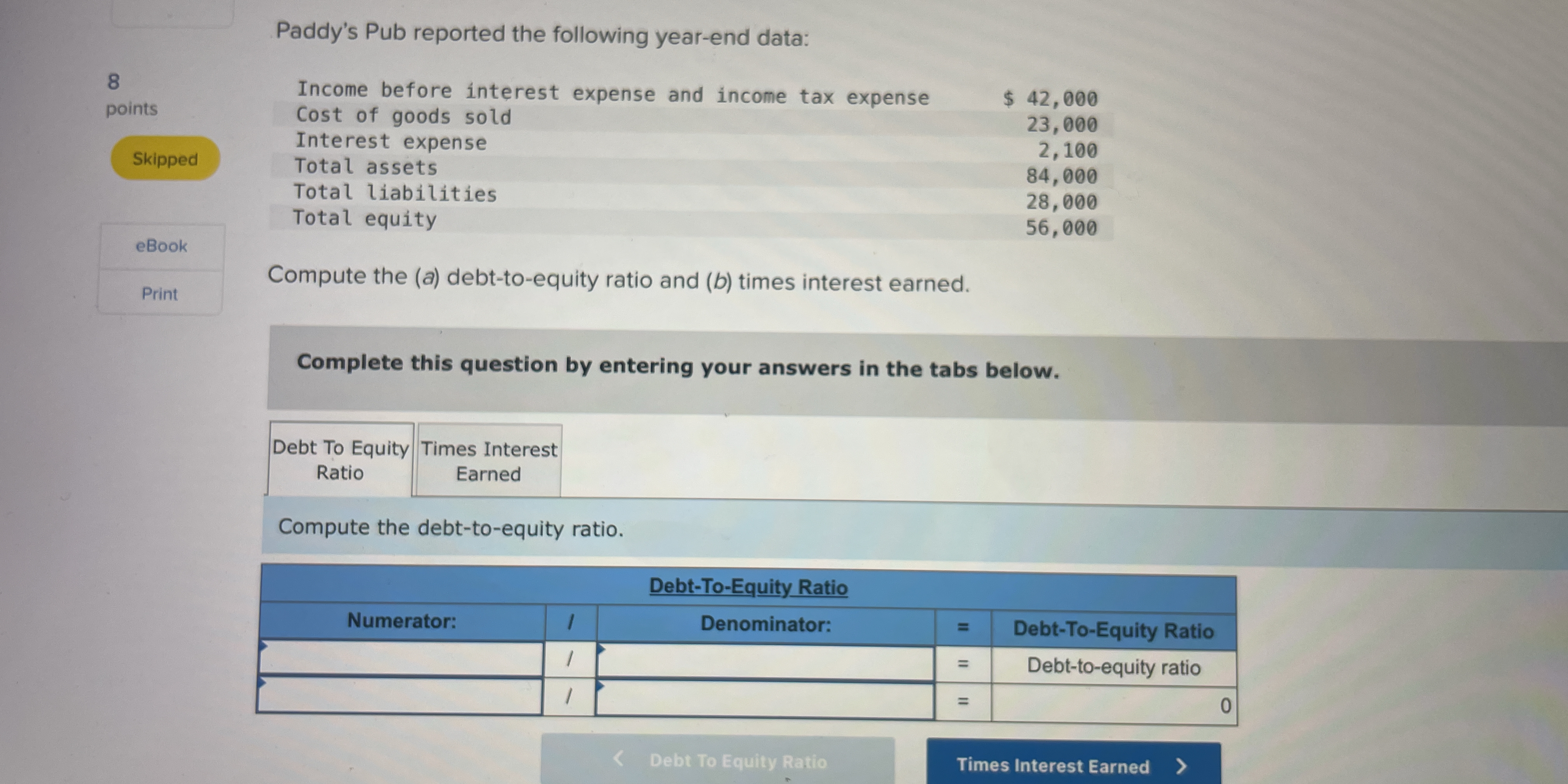

Compute the (a) debt-to-equity ratio and (b) times interest earned for Paddy's Pub given the following data: Income before interest expense and income tax expense $42,000, Cost of... Compute the (a) debt-to-equity ratio and (b) times interest earned for Paddy's Pub given the following data: Income before interest expense and income tax expense $42,000, Cost of goods sold $23,000, Interest expense $2,100, Total assets $84,000, Total liabilities $28,000, and Total equity $56,000.

Understand the Problem

The question is asking to compute two financial ratios, specifically the debt-to-equity ratio and the times interest earned based on provided financial data for Paddy's Pub.

Answer

(a) $0.5$; (b) $20$

Answer for screen readers

(a) The debt-to-equity ratio is $0.5$.

(b) The times interest earned is $20$.

Steps to Solve

- Calculate Total Liabilities

Total liabilities can be found directly from the financial data provided.

Given:

- Total assets = $84,000

- Total equity = $56,000

We can find total liabilities using the formula: $$ \text{Total Liabilities} = \text{Total Assets} - \text{Total Equity} $$

Plugging in the values: $$ \text{Total Liabilities} = 84,000 - 56,000 = 28,000 $$

- Compute Debt-to-Equity Ratio

The debt-to-equity ratio is calculated by dividing total liabilities by total equity.

Using the formula: $$ \text{Debt-to-Equity Ratio} = \frac{\text{Total Liabilities}}{\text{Total Equity}} $$

Substituting the values we calculated: $$ \text{Debt-to-Equity Ratio} = \frac{28,000}{56,000} = 0.5 $$

- Calculate Times Interest Earned

To compute the times interest earned, we first need the earnings before interest and taxes (EBIT), which is given as:

- Income before interest = $42,000

We can now use the formula: $$ \text{Times Interest Earned} = \frac{\text{EBIT}}{\text{Interest Expense}} $$

Substituting the provided interest expense of $2,100: $$ \text{Times Interest Earned} = \frac{42,000}{2,100} = 20 $$

(a) The debt-to-equity ratio is $0.5$.

(b) The times interest earned is $20$.

More Information

The debt-to-equity ratio indicates that for every dollar of equity, there is 50 cents of debt, showing a conservative leverage position. The times interest earned ratio of 20 indicates the business earns 20 times its interest expense, suggesting strong ability to meet interest obligations.

Tips

- Confusing total equity and liabilities: Ensure you're using the correct figures.

- Forgetting to subtract equity from assets: Total liabilities must be calculated correctly using the proper formula.

AI-generated content may contain errors. Please verify critical information