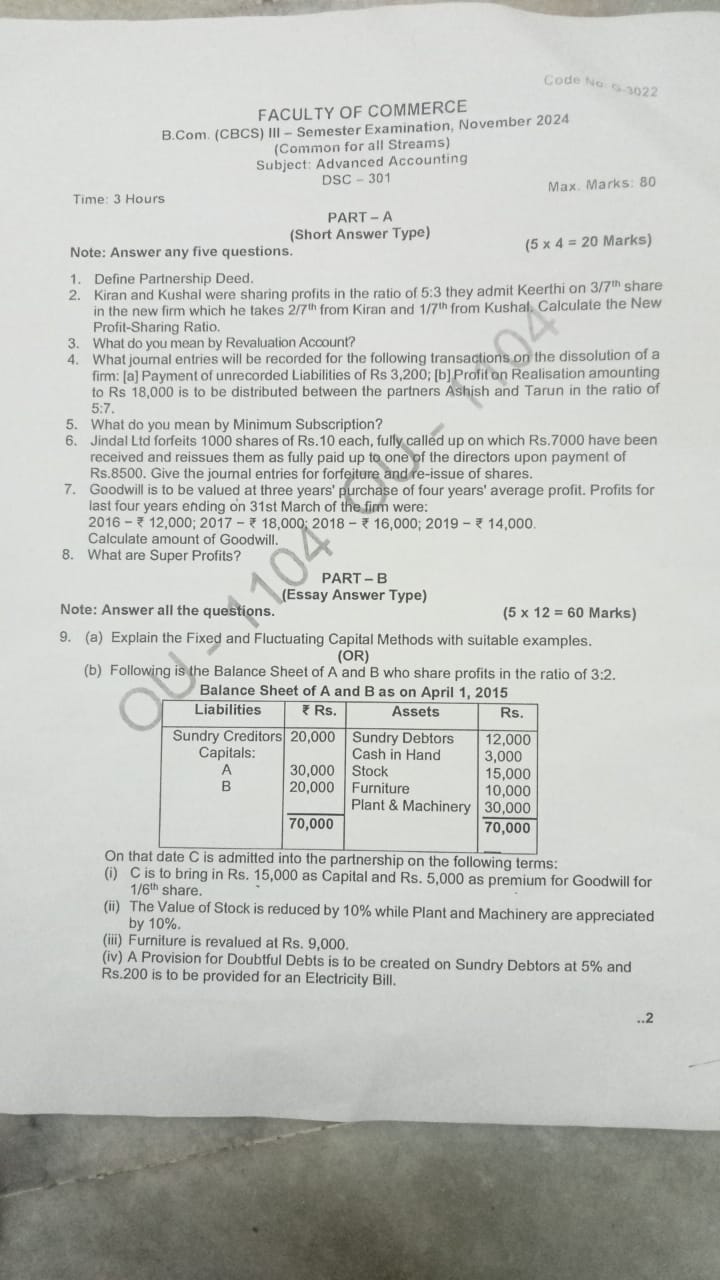

Define Partnership Deed. Kiran and Kushal were sharing profits in the ratio of 5:3. They admitted Keerthi on 3/7th share in the new firm, which he takes 2/7th from Kiran and 1/7th... Define Partnership Deed. Kiran and Kushal were sharing profits in the ratio of 5:3. They admitted Keerthi on 3/7th share in the new firm, which he takes 2/7th from Kiran and 1/7th from Kushal. Calculate the New Profit-Sharing Ratio. What do you mean by Revaluation Account? What journal entries will be recorded for the following transactions on the dissolution of a firm: (a) Payment of unrecorded liabilities of Rs. 3,200; (b) Profit on Realiazation amounting to Rs. 18,000 to be distributed between the partners Ashish and Tarun in the ratio of 5:7. What do you mean by Minimum Subscription? Jindal Ltd forfeits 1000 shares of Rs. 10 each, fully called up on which Rs. 7000 have been received and reissues them as fully paid up to one of the directors upon payment of Rs. 8,500. Give the journal entries for forfeiture and re-issue of shares. Goodwill is to be valued at three years’ purchase of four years’ average profit. Profits for last four years ending on 31st March of the firm were: 2016 = Rs. 12,000; 2017 = Rs. 18,000; 2018 = Rs. 16,000; 2019 = Rs. 14,000. Calculate amount of Goodwill. What are Super Profits? Explain the Fixed and Fluctuating Capital Methods with suitable examples. Following is the Balance Sheet of A and B who share profits in the ratio of 3:2. On that date C is admitted into the partnership on the following terms: (i) C is to bring in Rs. 15,000 as Capital and Rs. 5,000 as premium for Goodwill for 1/6th share. (ii) The Value of Stock is reduced by 10% while Plant and Machinery are appreciated by 10%. (iii) Furniture is revalued at Rs. 9,000. (iv) A Provision for Doubtful Debts is to be created on Sundry Debtors at 5% and Rs. 200 is to be provided for an Electricity Bill.

Understand the Problem

The question contains various problems related to advanced accounting principles, including partnership deeds, profit-sharing ratios, revaluation accounts, minimum subscription, journal entries for company shares, goodwill calculation, and partnership admission terms. It is a mix of short and essay answer types, indicating that it requires detailed accounting knowledge.

Answer

1. Partnership Deed outlines partnership terms. 2. New PSR: 3:2:3. 3. Revaluation adjusts asset values. 4. Journal: (a) Liabilities, (b) Realization Rs. 18,000 (5:7). 5. Minimum Subscription is required share subscription. 6. Forfeiture/Reissue shares journal. 7. Goodwill Rs. 48,000. 8. Super Profits exceed normal profits.

- Partnership Deed: A written agreement between partners detailing the terms of the partnership. 2. New Profit-Sharing Ratio: Kiran (3/7) = 3/8, Kushal (2/7) = 2/8, Keerthi = 3/8 leading to a ratio of 3:2:3. 3. Revaluation Account: Adjustments to asset and liability values with a new partner. 4. Journal Entries: (a) Debit Unrecorded Liabilities, Credit Cash. (b) Debit Realization, Credit Profit Share 5:7 to Partners. 5. Minimum Subscription: Minimum shares subscription needed before securities can be allotted. 6. Forfeiture: Debit Share Capital 10,000, Credit Forfeiture 3,000 and Calls in Arrears 7,000. Reissue: Debit Bank 8,500, Credit Share Capital 10,000, Debit Forfeiture 2,500. 7. Goodwill = Rs. 48,000. 8. Super Profits: Profits exceeding the normal average.

Answer for screen readers

- Partnership Deed: A written agreement between partners detailing the terms of the partnership. 2. New Profit-Sharing Ratio: Kiran (3/7) = 3/8, Kushal (2/7) = 2/8, Keerthi = 3/8 leading to a ratio of 3:2:3. 3. Revaluation Account: Adjustments to asset and liability values with a new partner. 4. Journal Entries: (a) Debit Unrecorded Liabilities, Credit Cash. (b) Debit Realization, Credit Profit Share 5:7 to Partners. 5. Minimum Subscription: Minimum shares subscription needed before securities can be allotted. 6. Forfeiture: Debit Share Capital 10,000, Credit Forfeiture 3,000 and Calls in Arrears 7,000. Reissue: Debit Bank 8,500, Credit Share Capital 10,000, Debit Forfeiture 2,500. 7. Goodwill = Rs. 48,000. 8. Super Profits: Profits exceeding the normal average.

More Information

The valuation of goodwill and calculation of profit-sharing ratios are crucial in partnership changes. The revaluation process helps establish a fair asset value, and journals ensure proper bookkeeping at the dissolution stage.

Tips

In calculating profit-sharing ratios and goodwill, ensure values are accurately distributed among partners based on the specified conditions.

AI-generated content may contain errors. Please verify critical information