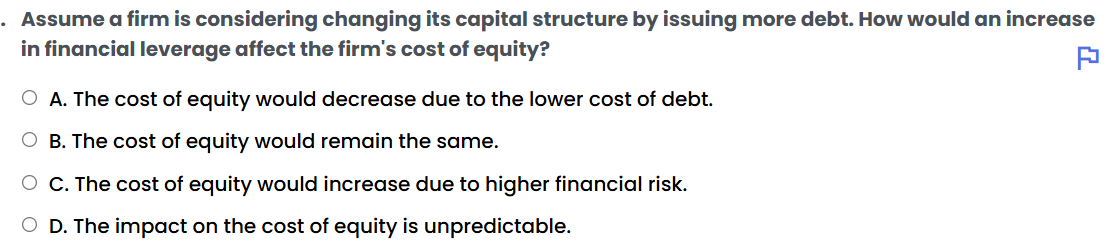

Assume a firm is considering changing its capital structure by issuing more debt. How would an increase in financial leverage affect the firm's cost of equity?

Understand the Problem

The question is asking how an increase in financial leverage, by issuing more debt, affects the firm's cost of equity, focusing on the relationship between debt and equity costs.

Answer

The cost of equity would increase due to higher financial risk.

The cost of equity would increase due to higher financial risk.

Answer for screen readers

The cost of equity would increase due to higher financial risk.

More Information

Increased debt raises financial risk, prompting equity investors to demand higher returns to compensate for this risk. This is why the cost of equity tends to rise with higher leverage.

Tips

A common mistake is to assume that an increase in debt doesn't affect cost of equity or decreases it due to tax shields. However, higher leverage often increases perceived risk for equity holders.

Sources

- Assume a firm is considering changing its capital structure by ... - quizgecko.com

- What Is Financial Leverage, and Why Is It Important? - Investopedia - investopedia.com

AI-generated content may contain errors. Please verify critical information