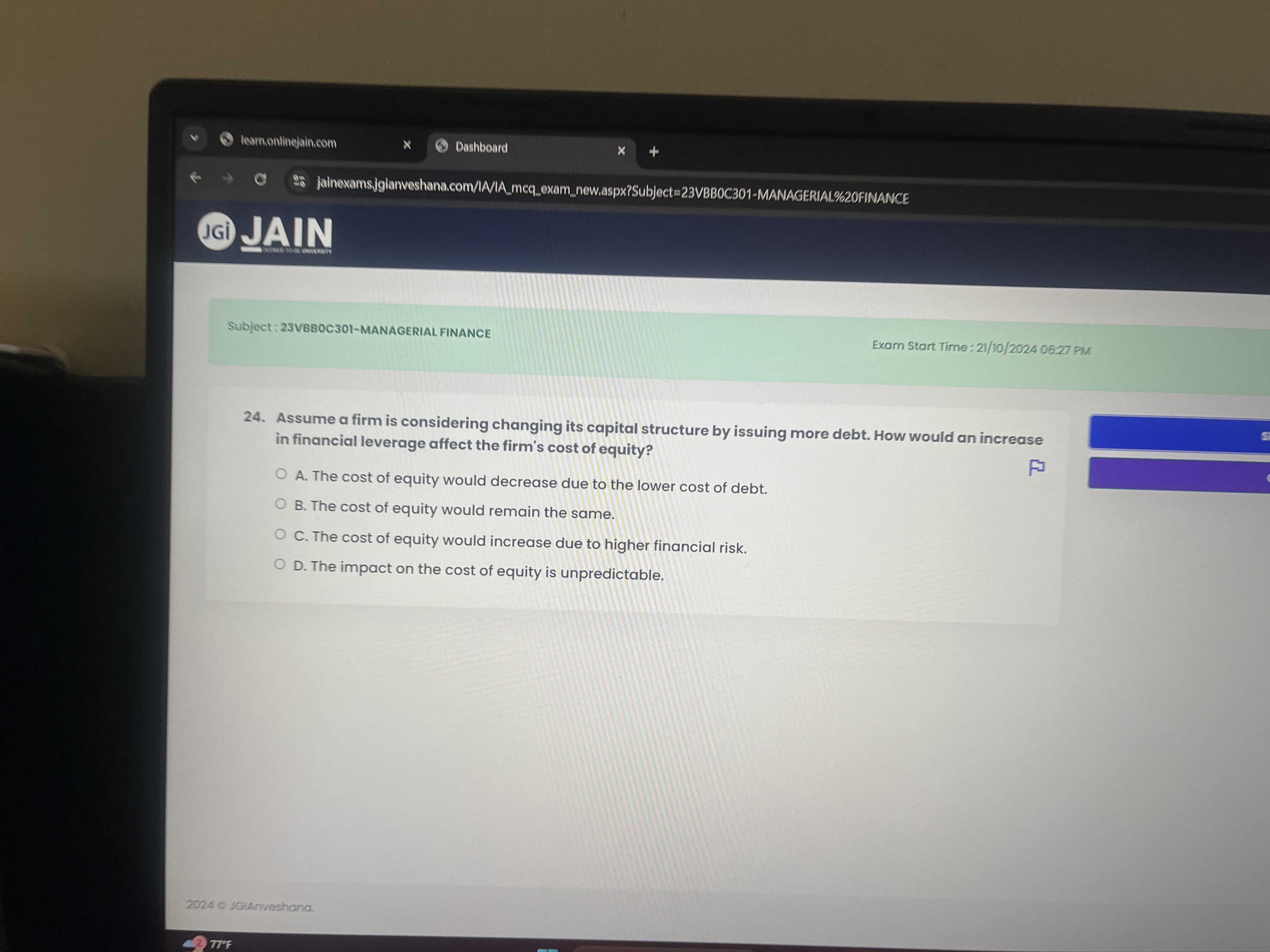

Assume a firm is considering changing its capital structure by issuing more debt. How would an increase in financial leverage affect the firm's cost of equity?

Understand the Problem

The question is asking about the impact of increasing financial leverage on the cost of equity for a firm. Specifically, it wants to know how issuing more debt would affect the firm's cost of equity.

Answer

C. The cost of equity would increase due to higher financial risk.

The correct answer is C. The cost of equity would increase due to higher financial risk.

Answer for screen readers

The correct answer is C. The cost of equity would increase due to higher financial risk.

More Information

Increasing financial leverage by issuing more debt elevates financial risk, prompting equity investors to demand higher returns due to greater uncertainty. This leads to an increase in the firm's cost of equity.

Tips

A common mistake is assuming that leverage impacts only the cost of debt, forgetting that equity investors factor increased risk into their required returns.

Sources

- Use of Financial Leverage in Corporate Capital Structure - investopedia.com

- Solved Companies that use debt in their capital structure | Chegg.com - chegg.com