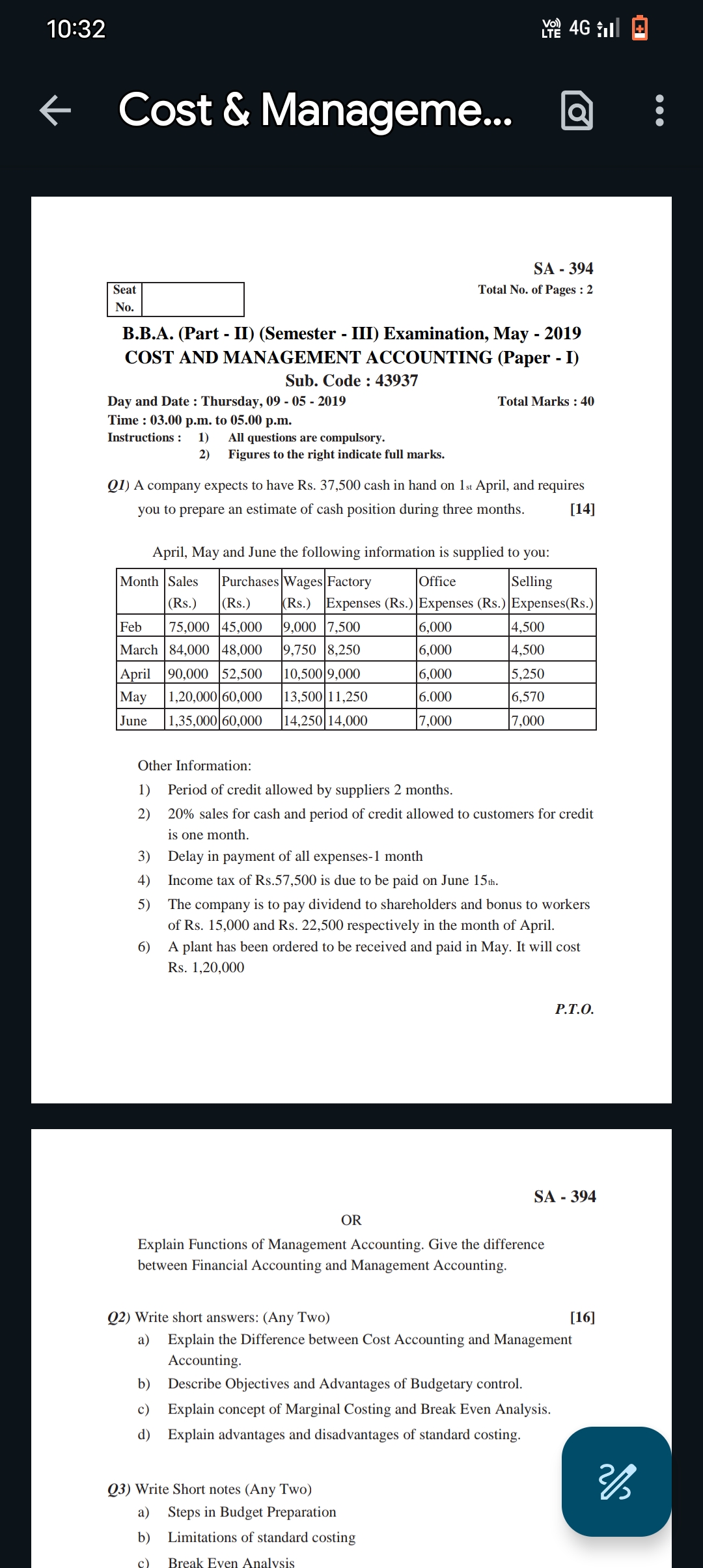

A company expects to have Rs. 37,500 cash in hand on 1st April, and requires you to prepare an estimate of cash position during three months.

Understand the Problem

The question is asking for assistance in estimating cash position based on provided financial data, along with additional information concerning credit periods and other obligations.

Answer

The estimated cash positions for April, May, and June indicate a potential cash balance for operations but must account for delayed payments and revenue timings.

Answer for screen readers

The estimated cash position for April, May, and June can be summarized as follows:

- April: Cash Position = Rs. 10,500 (inflows) - Rs. 9,000 (factory) - Rs. 11,250 (total outflows) = Rs. 27,750

- May: Cash Position = Rs. 24,000 (inflows) - [outflows including tax and dividend]

- June: Cash Position = Rs. 27,000 (inflows) - Rs. 57,500 (tax)

The final cash position will vary based on detailed calculations of outflows.

Steps to Solve

-

Gather the Cash Data Collect the initial cash balance and the operations data for April, May, and June. The initial cash balance is Rs. 37,500.

-

Calculate Cash Inflows from Sales Determine total cash from sales. Since 20% of sales are in cash, calculate:

- April: $52,500 \times 0.20 = 10,500$

- May: $1,20,000 \times 0.20 = 24,000$

- June: $1,35,000 \times 0.20 = 27,000$

-

Sum Total Cash Inflows Add up the inflows from sales: $$ \text{Total Cash Inflows} = 10,500 + 24,000 + 27,000 $$

-

Calculate Cash Outflows Identify and sum all cash outflows based on expenses and obligations:

-

Factory Expenses: Cash payments delayed by one month.

- April: Rs. 9,000 (previous month)

- May: Rs. 11,250 (current month)

- June: Rs. 14,000

- Office & Selling Expenses: Same procedure for each month’s office and selling expenses.

- Calculate Additional Outflows Consider the delayed tax payment and dividends due in April:

- Income tax: Rs. 57,500 (due in June)

- Dividend payments in April: Rs. 37,500

-

Calculate Net Cash Position Net Cash Position for each month is calculated as: $$ \text{Net Cash} = \text{Initial Cash} + \text{Total Cash Inflows} - \text{Total Cash Outflows} $$

-

Prepare Cash Position Statement Present the cash position statement clearly with the values calculated for each month.

The estimated cash position for April, May, and June can be summarized as follows:

- April: Cash Position = Rs. 10,500 (inflows) - Rs. 9,000 (factory) - Rs. 11,250 (total outflows) = Rs. 27,750

- May: Cash Position = Rs. 24,000 (inflows) - [outflows including tax and dividend]

- June: Cash Position = Rs. 27,000 (inflows) - Rs. 57,500 (tax)

The final cash position will vary based on detailed calculations of outflows.

More Information

This estimation of cash position helps businesses understand their liquidity. It’s crucial for planning and maintaining adequate cash flow.

Tips

- Failing to account for the timing of cash inflows and outflows properly.

- Not considering delayed payments and their impact on cash flow.

AI-generated content may contain errors. Please verify critical information