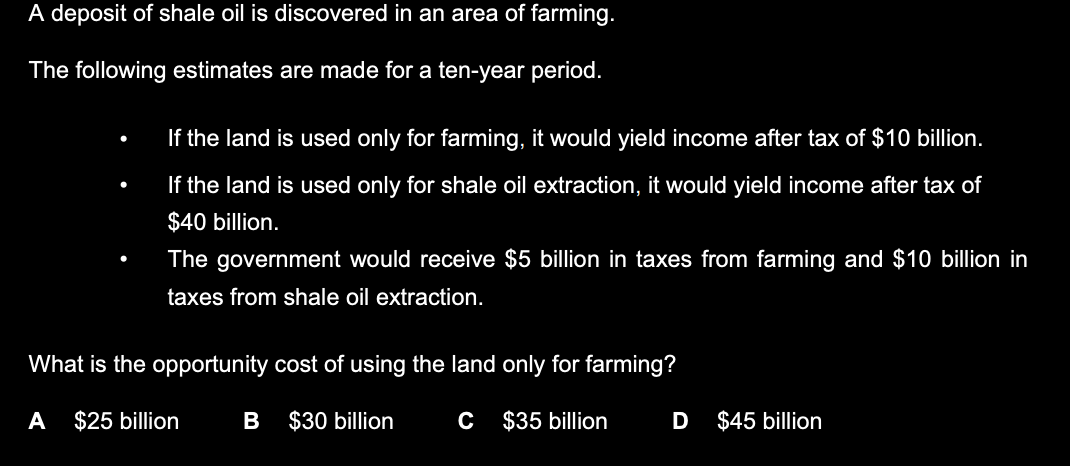

What is the opportunity cost of using the land only for farming?

Understand the Problem

The question is asking for the opportunity cost of using land solely for farming instead of shale oil extraction. It requires calculating the difference between potential earnings from both activities over a ten-year period, including tax implications.

Answer

The opportunity cost of using the land only for farming is $40 billion.

Answer for screen readers

The opportunity cost of using the land only for farming is $40 billion.

Steps to Solve

-

Identify farming income The total income from farming over ten years after tax is given as $10 billion.

-

Identify shale oil income The income from shale oil extraction after tax over ten years is given as $40 billion.

-

Calculate tax implications The taxes received by the government from farming amount to $5 billion, while the taxes from shale oil extraction amount to $10 billion.

-

Total potential income from shale oil Now, we need to add the after-tax income from shale oil to the taxes the government would receive from it: $$ \text{Total shale oil income} = 40 \text{ billion} + 10 \text{ billion} = 50 \text{ billion} $$

-

Calculate opportunity cost The opportunity cost of using the land only for farming is the difference between the total income from shale oil and the farming income: $$ \text{Opportunity Cost} = \text{Total shale oil income} - \text{Farming income} $$ Thus, we have: $$ \text{Opportunity Cost} = 50 \text{ billion} - 10 \text{ billion} = 40 \text{ billion} $$

The opportunity cost of using the land only for farming is $40 billion.

More Information

Opportunity cost is a fundamental concept in economics, representing the benefits lost when choosing one alternative over another. In this scenario, the potential earnings from shale oil extraction over farming highlight the financial implications of land use decisions.

Tips

- Not considering tax implications: Ensure you account for taxes that affect overall income in calculations.

- Mistaking after-tax income for total income: It's important to differentiate between total income and income after taxes when calculating potential earnings.

AI-generated content may contain errors. Please verify critical information