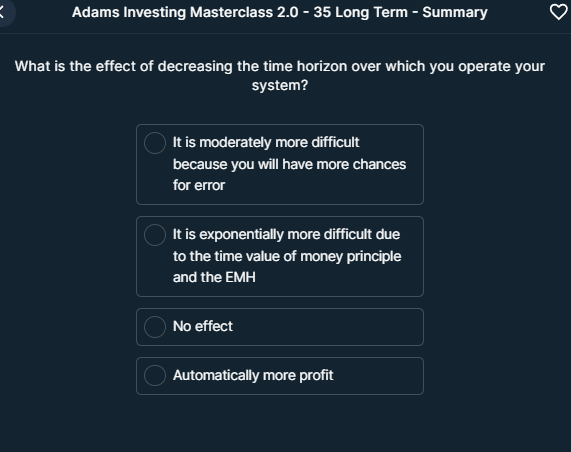

What is the effect of decreasing the time horizon over which you operate your system?

Understand the Problem

The question is asking about the implications of reducing the time horizon for operating an investment system, specifically its effects on difficulty and potential outcomes.

Answer

Exponentially more difficult due to the time value of money and EMH.

The final answer is that it is exponentially more difficult due to the time value of money principle and the EMH.

Answer for screen readers

The final answer is that it is exponentially more difficult due to the time value of money principle and the EMH.

More Information

Decreasing the time horizon can complicate financial decision-making due to the time value of money and the efficient market hypothesis (EMH). Shorter horizons reduce the ability to leverage market efficiencies, making the system more challenging to operate effectively.

Tips

A common mistake is underestimating the impact of the time value of money. Ensure you account for changing financial circumstances when planning for shorter time horizons.

Sources

AI-generated content may contain errors. Please verify critical information