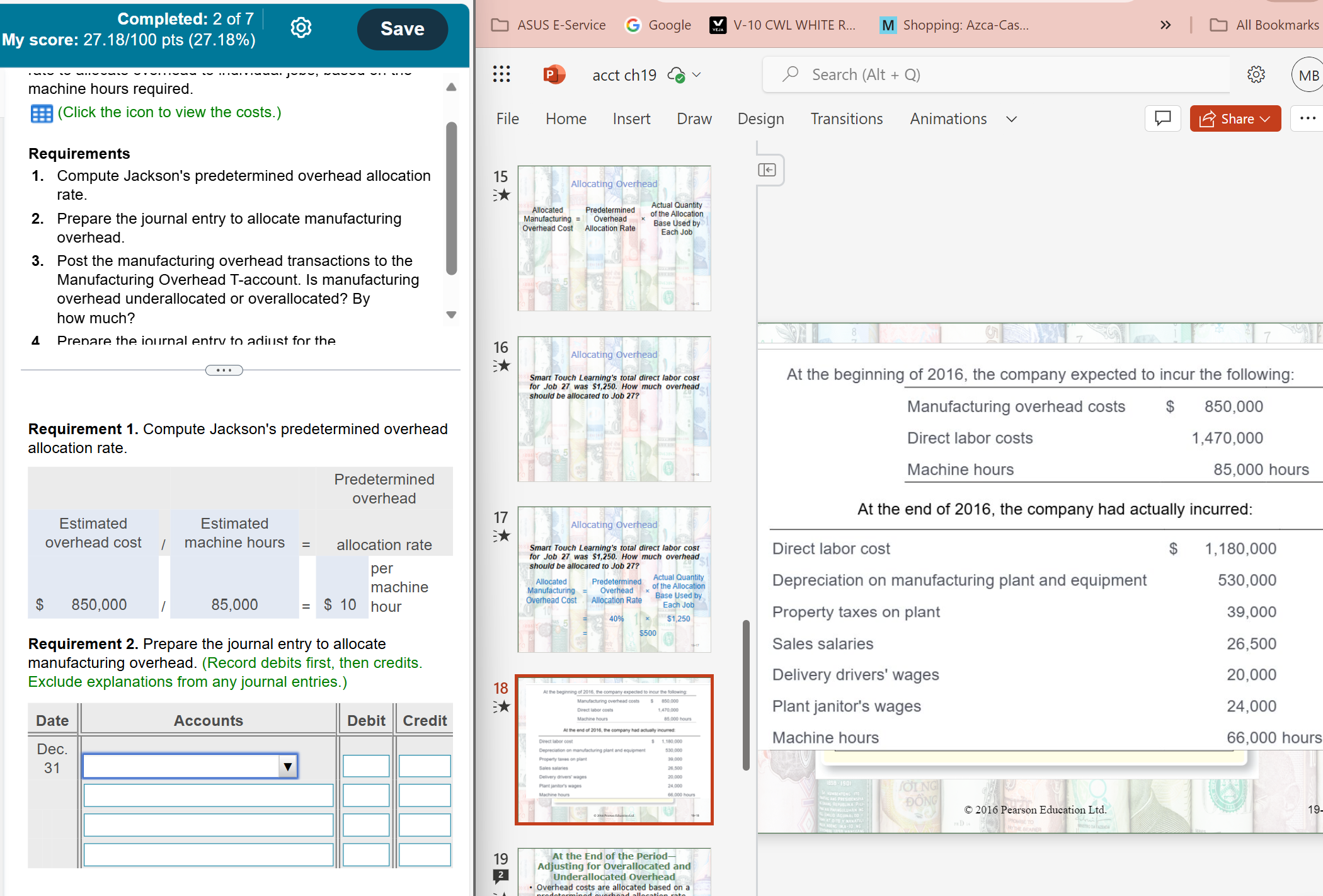

Prepare the journal entry to allocate manufacturing overhead.

Understand the Problem

The question is asking for the journal entry to allocate manufacturing overhead based on given costs and machine hours. This involves identifying the appropriate accounts, determining the debit and credit amounts, and formatting the entry correctly.

Answer

The journal entry is: ``` Date Accounts Debit Credit Dec. 31 Manufacturing Overhead 660,000 Manufacturing Overhead Allocated 660,000 ``` The overhead is overallocated by $190,000.

Answer for screen readers

The journal entry to allocate manufacturing overhead is:

Date Accounts Debit Credit

Dec. 31 Manufacturing Overhead 660,000

Manufacturing Overhead Allocated 660,000

The manufacturing overhead is overallocated by $190,000.

Steps to Solve

- Calculate the Predetermined Overhead Rate

The predetermined overhead rate is calculated using the estimated overhead cost and the estimated machine hours.

[ \text{Predetermined Overhead Rate} = \frac{\text{Estimated Overhead Cost}}{\text{Estimated Machine Hours}} = \frac{850,000}{85,000} = 10 \text{ per machine hour} ]

- Calculate the Allocated Overhead

Use the actual machine hours worked during the year to find the total allocated overhead.

[ \text{Allocated Overhead} = \text{Predetermined Overhead Rate} \times \text{Actual Machine Hours} = 10 \times 66,000 = 660,000 ]

- Prepare the Journal Entry

Based on the calculation, the journal entry on December 31 should reflect the allocation of manufacturing overhead.

- Debit: Manufacturing Overhead $660,000

- Credit: Manufacturing Overhead Allocated $660,000

The journal entry will look like this:

Date Accounts Debit Credit

Dec. 31 Manufacturing Overhead 660,000

Manufacturing Overhead Allocated 660,000

- Determine Under- or Over-allocated Overhead

Compare the allocated overhead to the actual overhead incurred.

[ \text{Under- or Over-allocated Overhead} = \text{Actual Overhead} - \text{Allocated Overhead} ] Assuming total overhead (from direct labor costs and other expenses) at year-end is $850,000: [ 850,000 - 660,000 = 190,000 \text{ (overallocated)} ]

The journal entry to allocate manufacturing overhead is:

Date Accounts Debit Credit

Dec. 31 Manufacturing Overhead 660,000

Manufacturing Overhead Allocated 660,000

The manufacturing overhead is overallocated by $190,000.

More Information

The predetermined overhead rate helps companies allocate manufacturing overhead costs more accurately throughout the year. It's a crucial concept in managerial accounting, ensuring costs are matched with revenues accurately.

Tips

- Incorrect Calculation of Predetermined Rate: Ensure that both the estimated overhead costs and machine hours are correctly input.

- Neglecting Actual Machine Hours: Be sure to use the actual machine hours instead of estimated hours for allocation.

- Confusing Debit and Credit Accounts: Remember that manufacturing overhead is debited and allocated overhead is credited.

AI-generated content may contain errors. Please verify critical information