Prepare income statements under absorption costing and variable costing, and compute product cost per unit under variable and absorption costing. Compute operating income under var... Prepare income statements under absorption costing and variable costing, and compute product cost per unit under variable and absorption costing. Compute operating income under variable and absorption costing.

Understand the Problem

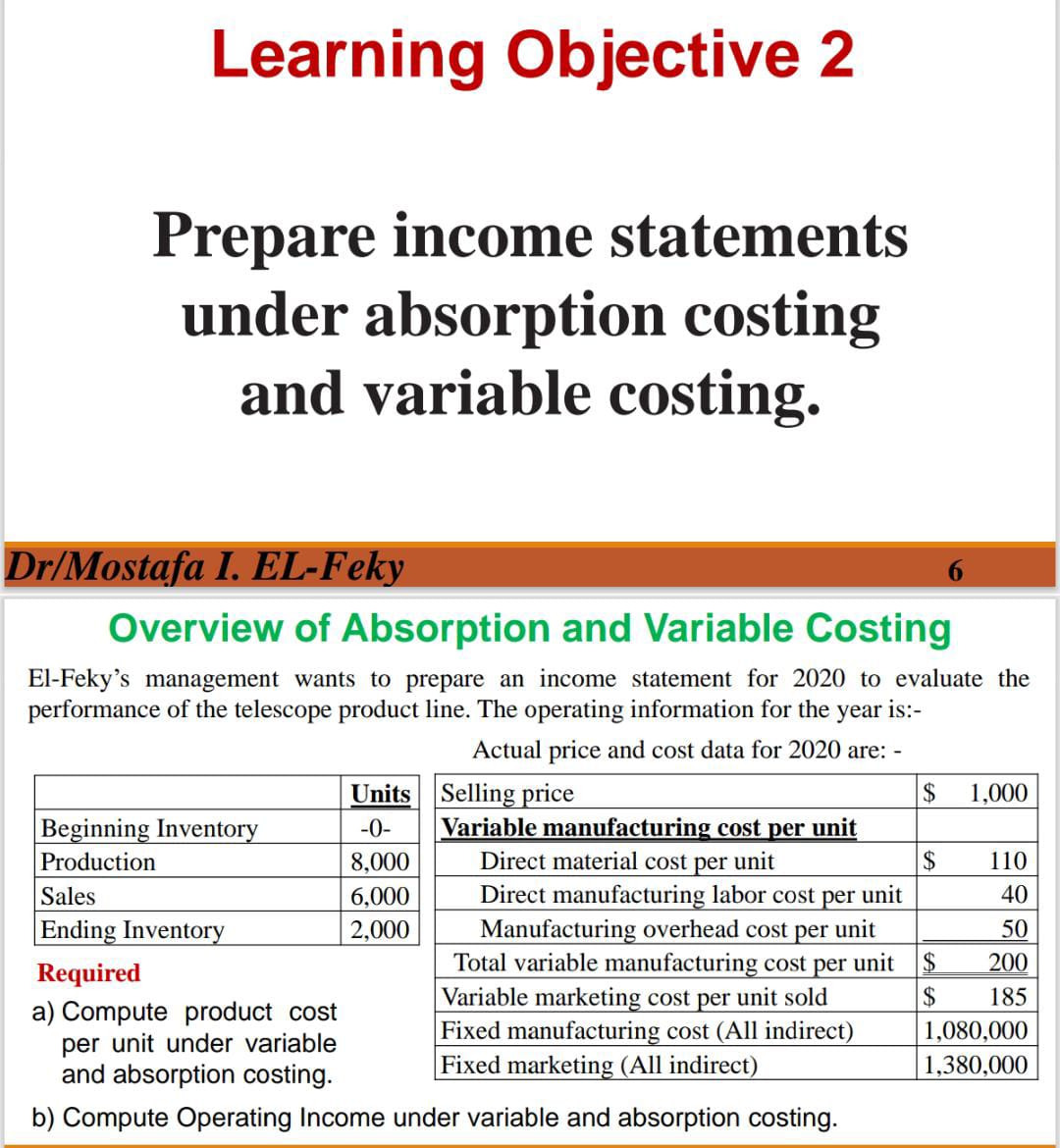

The question is asking to prepare income statements under two different costing methods: absorption costing and variable costing. This involves calculating product costs per unit under each method and determining the operating income for each.

Answer

- Variable Costing Product Cost per Unit: $200 - Absorption Costing Product Cost per Unit: $335 - Variable Costing Operating Income: $3,690,000 - Absorption Costing Operating Income: $1,530,000

Answer for screen readers

-

Product Cost per Unit under Variable Costing: $200

-

Product Cost per Unit under Absorption Costing: $335

-

Operating Income under Variable Costing: $3,690,000

-

Operating Income under Absorption Costing: $1,530,000

Steps to Solve

- Calculate Product Cost per Unit under Variable Costing

To find the product cost per unit under variable costing, sum the variable costs.

[ \text{Total Variable Manufacturing Cost per unit} = \text{Direct Material Cost} + \text{Direct Labor Cost} + \text{Variable Manufacturing Overhead} ]

Substituting in the values:

[ \text{Total Variable Manufacturing Cost per unit} = 110 + 40 + 50 = 200 ]

- Calculate Product Cost per Unit under Absorption Costing

For absorption costing, include both variable and fixed costs.

[ \text{Total Manufacturing Cost per unit} = \text{Total Variable Manufacturing Cost per unit} + \text{Fixed Manufacturing Cost per unit} ]

Calculate the fixed manufacturing cost per unit as follows:

[ \text{Fixed Manufacturing Cost per unit} = \frac{\text{Total Fixed Manufacturing Costs}}{\text{Units Produced}} ]

Substituting the values:

[ \text{Fixed Manufacturing Cost per unit} = \frac{1,080,000}{8,000} = 135 ]

Now sum the fixed cost with the variable costs:

[ \text{Total Manufacturing Cost per unit} = 200 + 135 = 335 ]

- Calculate Total Costs for Sales under Both Methods

Next, find the total cost for sales under both costing methods:

For variable costing:

[ \text{Total Variable Cost of Goods Sold} = \text{Variable Cost per unit} \times \text{Units Sold} ]

[ \text{Total Variable Cost of Goods Sold} = 200 \times 6,000 = 1,200,000 ]

For absorption costing:

[ \text{Total Absorption Cost of Goods Sold} = \text{Absorption Cost per unit} \times \text{Units Sold} ]

[ \text{Total Absorption Cost of Goods Sold} = 335 \times 6,000 = 2,010,000 ]

- Compute Operating Income under Both Costing Methods

Finally, compute the operating income for both methods.

Variable Costing:

[ \text{Operating Income} = \text{Total Sales} - \text{Total Variable Cost of Goods Sold} - \text{Total Variable Selling Costs} ]

Calculating total sales:

[ \text{Total Sales} = \text{Selling Price} \times \text{Units Sold} = 1,000 \times 6,000 = 6,000,000 ]

Calculating variable marketing expenses:

[ \text{Total Variable Marketing Cost} = \text{Variable Marketing Cost per unit} \times \text{Units Sold} ]

[ = 185 \times 6,000 = 1,110,000 ]

Now calculate:

[ \text{Operating Income} = 6,000,000 - 1,200,000 - 1,110,000 = 3,690,000 ]

Absorption Costing:

[ \text{Operating Income} = \text{Total Sales} - \text{Total Absorption Cost of Goods Sold} - \text{Total Fixed Manufacturing Costs} - \text{Total Marketing Costs} ]

Calculating marketing expenses:

[ \text{Total Fixed Marketing Cost} = 1,380,000 ]

Now calculate:

[ \text{Operating Income} = 6,000,000 - 2,010,000 - 1,080,000 - 1,380,000 = 1,530,000 ]

-

Product Cost per Unit under Variable Costing: $200

-

Product Cost per Unit under Absorption Costing: $335

-

Operating Income under Variable Costing: $3,690,000

-

Operating Income under Absorption Costing: $1,530,000

More Information

Absorption costing includes all manufacturing costs, while variable costing includes only variable manufacturing costs. This results in different operating incomes depending on the method used. Understanding these differences is crucial for analyzing financial performance.

Tips

- Forgetting to include fixed manufacturing costs when calculating absorption costing.

- Confusing total costs with unit costs.

- Not correctly applying the sales figures in the profit calculations.

AI-generated content may contain errors. Please verify critical information