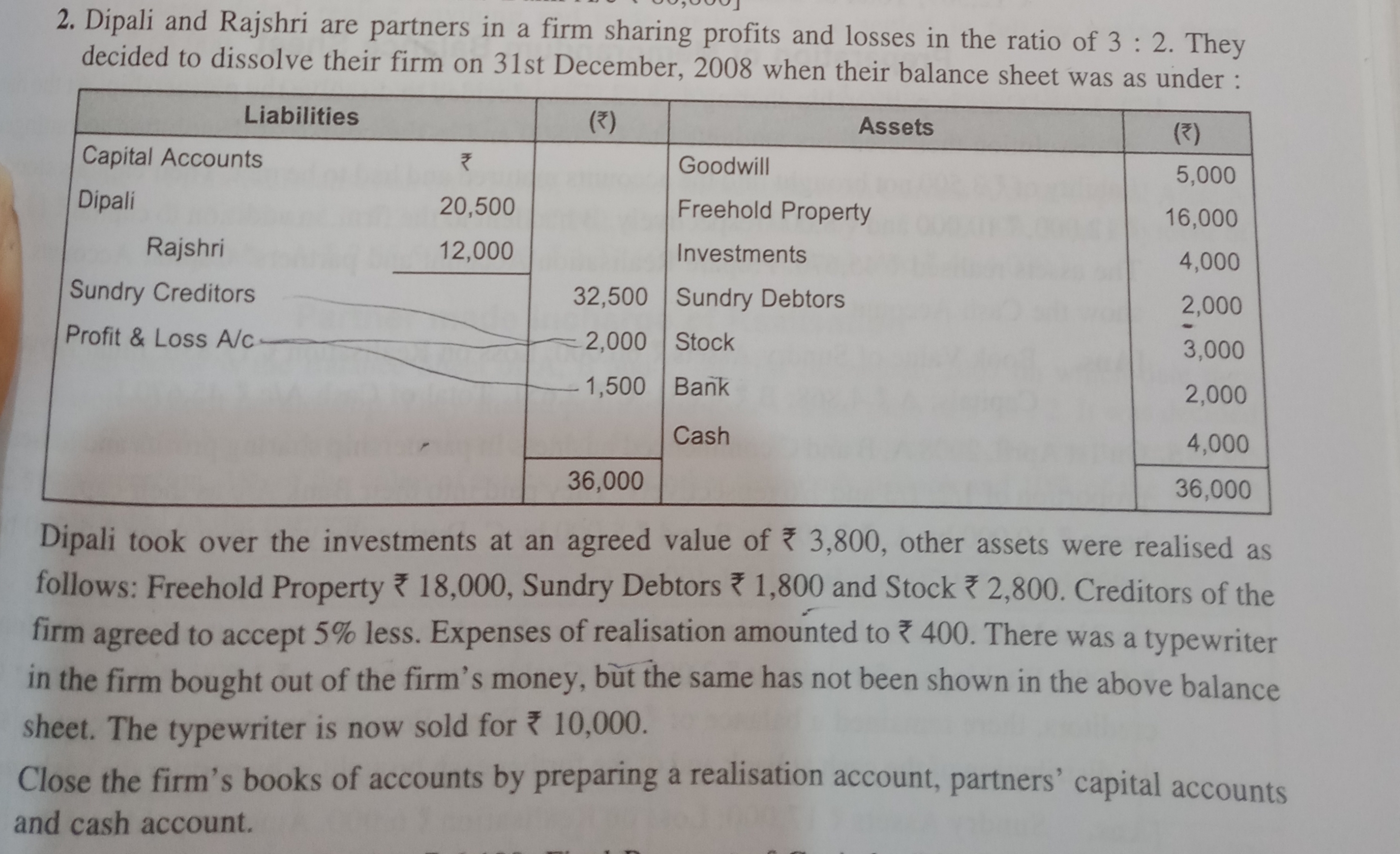

Dipali and Rajshri are partners in a firm sharing profits and losses in the ratio of 3:2. They decided to dissolve their firm on 31st December 2008 when their balance sheet was as... Dipali and Rajshri are partners in a firm sharing profits and losses in the ratio of 3:2. They decided to dissolve their firm on 31st December 2008 when their balance sheet was as under: [Balance Sheet Details]. Dipali took over the investments at an agreed value of ₹3,800; freehold property at ₹18,000; sundry debtors at ₹1,800; and stock at ₹2,800. Expenses of realisation amounted to ₹400. There was a typewriter sold for ₹10,000. Close the firm’s books of accounts by preparing a realization account, partners’ capital accounts, and cash account.

Understand the Problem

The question is asking for assistance in preparing a realization account and closing the firm’s books of accounts based on the provided balance sheet and transactions involving the dissolution of a partnership firm.

Answer

The firm’s accounts have been closed with ₹19,080 for Dipali and ₹12,720 for Rajshri after accounting for assets realization and expenses.

Answer for screen readers

The realization account, partners' capital accounts, and cash account have been prepared as specified, with the outcome of the realisation resulting in net cash after clearing liabilities to partners.

Steps to Solve

- Gather Information from the Balance Sheet

From the provided balance sheet, note down the assets and liabilities:

-

Assets:

- Goodwill: ₹5,000

- Freehold Property: ₹16,000

- Investments: ₹4,000

- Sundry Debtors: ₹2,000

- Stock: ₹3,000

- Bank: ₹2,000

- Cash: ₹4,000

- Total Assets: ₹36,000

-

Liabilities:

- Capital Accounts:

- Dipali: ₹20,500

- Rajshri: ₹12,000

- Sundry Creditors: ₹2,000

- Profit & Loss A/c: ₹1,500

- Total Liabilities: ₹36,000

- Capital Accounts:

- Calculate Realisation Values

Calculate the realisation values of the assets as follows:

- Freehold Property: ₹16,000

- Sundry Debtors: ₹1,800 (5% less)

- Stock: ₹2,800

- Typewriter: ₹10,000

Total Realisation = ₹16,000 + ₹1,800 + ₹2,800 + ₹10,000 = ₹30,600

- Prepare the Realisation Account

In the realisation account, include:

-

Debit Side (Realised):

- Freehold Property: ₹16,000

- Sundry Debtors: ₹1,800

- Stock: ₹2,800

- Typewriter: ₹10,000

- Realisation Expenses: ₹400

-

Credit Side (Liabilities):

- Sundry Creditors: ₹2,000

- Profit & Loss A/c: ₹1,500

- Total Realisation: ₹30,600

The Realisation Account will look like this:

Realisation Account

Dr. Cr.

--------------------------------------- ---------------------------------------

Realised: Liabilities:

Freehold Property: ₹16,000 Sundry Creditors: ₹2,000

Sundry Debtors: ₹1,800 Profit & Loss A/c: ₹1,500

Stock: ₹2,800

Typewriter: ₹10,000

Total: ₹30,600 Total: ₹30,600

Realisation Expenses: ₹400

---------------------------------------

- Calculate Cash from Realisation

Total cash received from realisation is:

- Total Realisation: ₹30,600

- Less: Realisation Expenses: ₹400

Net Cash: ₹30,600 - ₹400 = ₹30,200

- Prepare Cash Account

The Cash Account will include cash received and distributions:

Cash Account

Dr. Cr.

--------------------------------------- ---------------------------------------

Opening Balance: ₹4,000 Realisation Expenses: ₹400

Cash Received: ₹30,200 Sundry Creditors: ₹2,000

Total: ₹30,200 Distribution to Partners:

Total: ₹34,200

---------------------------------------

- Prepare Partners' Capital Accounts

Each partner will get their share based on the remaining cash after paying off creditors and expenses. The profit will be divided in the ratio of 3:2.

- Total Cash available for partners: ₹34,200

- Less: Sundry Creditors: ₹2,000

- Less: Realisation Expenses: ₹400

Net amount = ₹34,200 - ₹2,000 - ₹400 = ₹31,800

Division of Profit:

- Total ratio = 3 + 2 = 5

- Dipali's share = 3/5 of ₹31,800 = ₹19,080

- Rajshri's share = 2/5 of ₹31,800 = ₹12,720

Partners' Capital Accounts will be closed accordingly, with any remaining balances transferred.

The realization account, partners' capital accounts, and cash account have been prepared as specified, with the outcome of the realisation resulting in net cash after clearing liabilities to partners.

More Information

This problem illustrates the process of closing accounts when dissolving a partnership, focusing on the realisation of assets and proper distribution among partners based on their agreed profit-sharing ratios.

Tips

- Forgetting to account for realized expenses can lead to an incorrect cash balance.

- Not applying the agreed profit-sharing ratio correctly can distort the partners' final capital amounts.

AI-generated content may contain errors. Please verify critical information