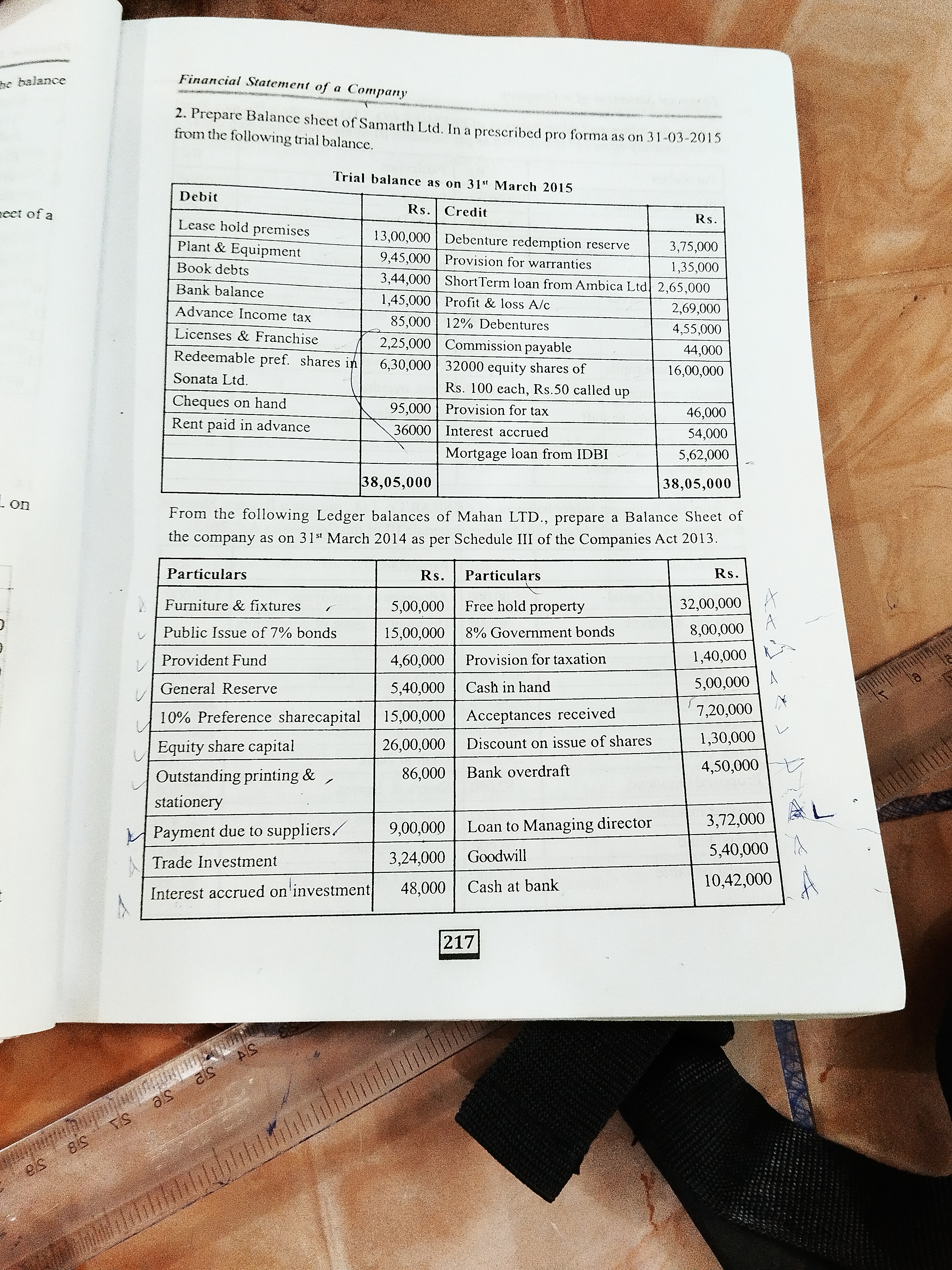

Prepare a balance sheet of Samarth Ltd. in a prescribed pro forma as on 31-03-2015 from the following trial balance.

Understand the Problem

The question is asking to prepare a balance sheet for Samarth Ltd. based on the provided trial balance as of March 31, 2015, along with additional ledger balances for Mahan Ltd. as of March 31, 2014. This involves organizing the given financial data into the prescribed format for a balance sheet.

Answer

The balance sheet for Samarth Ltd. shows total assets and liabilities of ₹38,05,000.

Answer for screen readers

Balance Sheet of Samarth Ltd. as on 31st March 2015

Assets

-

Non-Current Assets:

- Lease hold premises: ₹13,00,000

- Plant & Equipment: ₹9,45,000

- Redeemable Prefer. shares in Sonatas Ltd.: ₹6,30,000

- Licenses & Franchise: ₹2,25,000

-

Current Assets:

- Book debts: ₹3,44,000

- Bank balance: ₹1,45,000

- Advance Income tax: ₹85,000

- Cheques on hand: ₹95,000

- Rent paid in advance: ₹36,000

Total Assets: ₹38,05,000

Liabilities

-

Non-Current Liabilities:

- Debenture redemption reserve: ₹3,75,000

- 12% Debentures: ₹4,50,000

- Mortgage loan from IDBI: ₹5,62,000

-

Current Liabilities:

- Provision for warranties: ₹1,35,000

- Short Term Loan from Ambica Ltd.: ₹2,65,000

- Profit & Loss A/c: ₹2,69,000

- Commission payable: ₹44,000

- Provision for tax: ₹46,000

- Equity shares of ₹100 each: ₹16,00,000

Total Liabilities: ₹38,05,000

Steps to Solve

- Organize the Trial Balance for Samarth Ltd.

Start by listing all the debit and credit balances from the trial balance provided for Samarth Ltd. as of March 31, 2015.

-

Debits

- Lease hold premises: ₹13,00,000

- Plant & Equipment: ₹9,45,000

- Book debts: ₹3,44,000

- Bank balance: ₹1,45,000

- Advance Income tax: ₹85,000

- Licenses & Franchise: ₹2,25,000

- Redeemable Prefer. shares in Sonatas Ltd.: ₹6,30,000

- Cheques on hand: ₹95,000

- Rent paid in advance: ₹36,000

-

Credits

- Debenture redemption reserve: ₹3,75,000

- Provision for warranties: ₹1,35,000

- Short Term Loan from Ambica Ltd.: ₹2,65,000

- Profit & Loss A/c: ₹2,69,000

- 12% Debentures: ₹4,50,000

- Commission payable: ₹44,000

- Equity shares of ₹100 each: ₹16,00,000

- Provision for tax: ₹46,000

- Mortgage loan from IDBI: ₹5,62,000

- Prepare the Balance Sheet Format

Set up the balance sheet format including sections for Assets and Liabilities.

-

Assets should include:

- Non-Current Assets

- Current Assets

-

Liabilities should include:

- Non-Current Liabilities

- Current Liabilities

- Calculate Total Assets and Total Liabilities

For each section, sum up the debit (asset) accounts and the credit (liability) accounts separately.

-

Total Assets: $$ 13,00,000 + 9,45,000 + 3,44,000 + 1,45,000 + 85,000 + 2,25,000 + 6,30,000 + 95,000 + 36,000 $$

-

Total Liabilities: $$ 3,75,000 + 1,35,000 + 2,65,000 + 2,69,000 + 4,50,000 + 44,000 + 16,00,000 + 46,000 + 5,62,000 $$

- Fill in the Balance Sheet

Under each section, fill in the associated values calculated previously. Ensure that total assets equal total liabilities to confirm that the balance sheet is balanced.

- Double Check Calculations

Finally, review all calculations to ensure accuracy. Check that every number from the trial balance is included and correctly categorized in the balance sheet.

Balance Sheet of Samarth Ltd. as on 31st March 2015

Assets

-

Non-Current Assets:

- Lease hold premises: ₹13,00,000

- Plant & Equipment: ₹9,45,000

- Redeemable Prefer. shares in Sonatas Ltd.: ₹6,30,000

- Licenses & Franchise: ₹2,25,000

-

Current Assets:

- Book debts: ₹3,44,000

- Bank balance: ₹1,45,000

- Advance Income tax: ₹85,000

- Cheques on hand: ₹95,000

- Rent paid in advance: ₹36,000

Total Assets: ₹38,05,000

Liabilities

-

Non-Current Liabilities:

- Debenture redemption reserve: ₹3,75,000

- 12% Debentures: ₹4,50,000

- Mortgage loan from IDBI: ₹5,62,000

-

Current Liabilities:

- Provision for warranties: ₹1,35,000

- Short Term Loan from Ambica Ltd.: ₹2,65,000

- Profit & Loss A/c: ₹2,69,000

- Commission payable: ₹44,000

- Provision for tax: ₹46,000

- Equity shares of ₹100 each: ₹16,00,000

Total Liabilities: ₹38,05,000

More Information

The balance sheet displays the financial position of Samarth Ltd. as of March 31, 2015, summarizing its assets, liabilities, and equity. A balance sheet must balance, meaning total assets must equal total liabilities plus equity.

Tips

- Misclassifying Assets or Liabilities: Make sure to categorize each account correctly as either an asset or a liability.

- Forgetting to Include Accounts: Double-check to ensure all accounts from the trial balance are accounted for in the balance sheet.

AI-generated content may contain errors. Please verify critical information