Understand the Problem

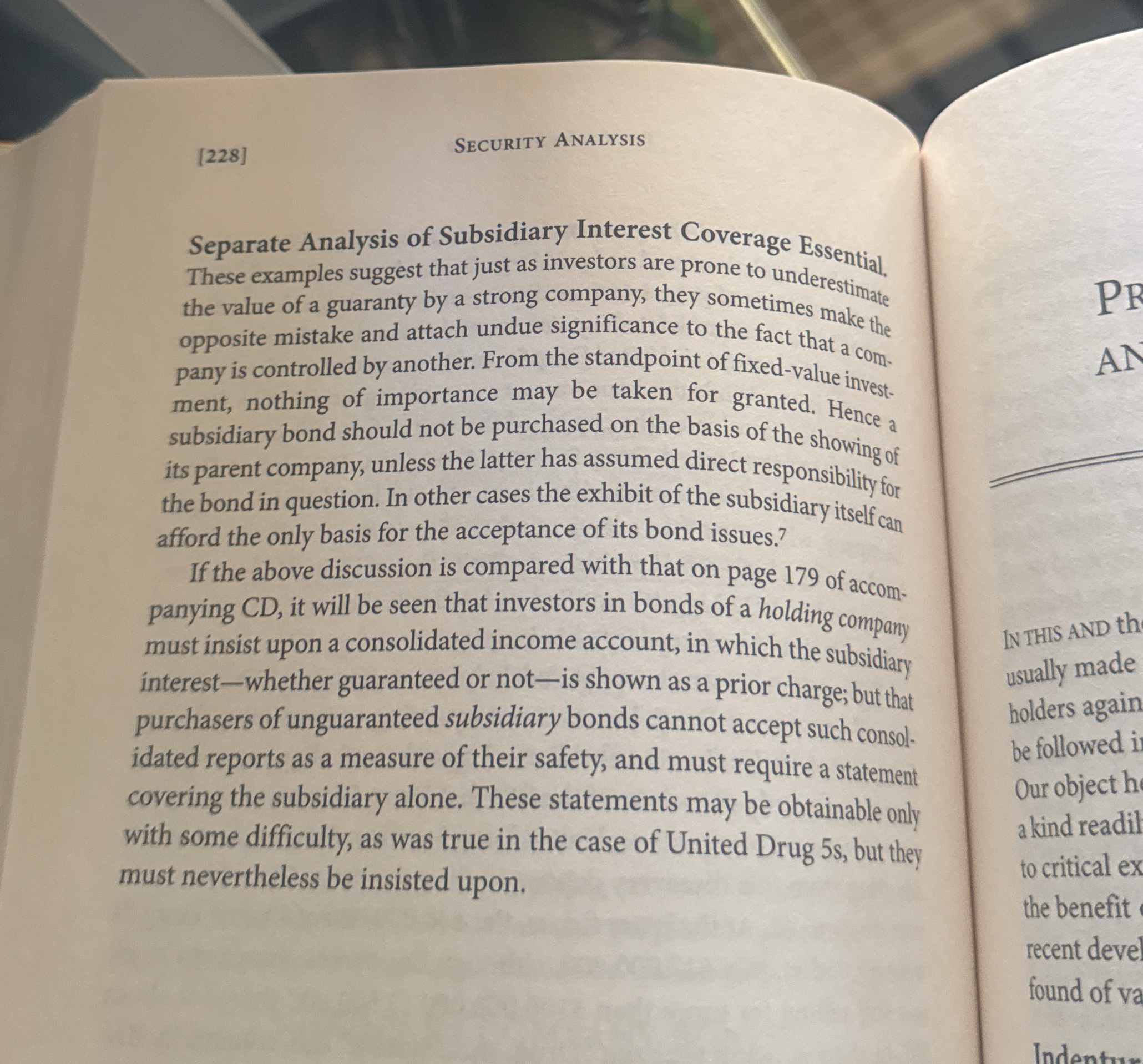

The text discusses the importance of separately analyzing subsidiary bonds in the context of investment, emphasizing the necessity of ensuring that the parent company has assumed responsibility for those bonds. It cautions against overestimating the relevance of guarantees and highlights the differences in bond investor expectations between guaranteed and unguaranteed bonds. This text is likely intended for those studying security analysis.

Answer

Investors must analyze subsidiary bonds independently unless guaranteed by the parent company.

The final answer is that investors should not assume subsidiary bonds are safe based on the parent company's performance unless there's a direct guarantee. Separate analysis of the subsidiary is crucial.

Answer for screen readers

The final answer is that investors should not assume subsidiary bonds are safe based on the parent company's performance unless there's a direct guarantee. Separate analysis of the subsidiary is crucial.

More Information

This underscores the necessity for investors to look beyond consolidated reports and assess subsidiaries on their own merits to avoid undue reliance on the parent company's backing.

Tips

Avoid relying solely on a parent company's performance; ensure the subsidiary's financials are sound independently.

AI-generated content may contain errors. Please verify critical information