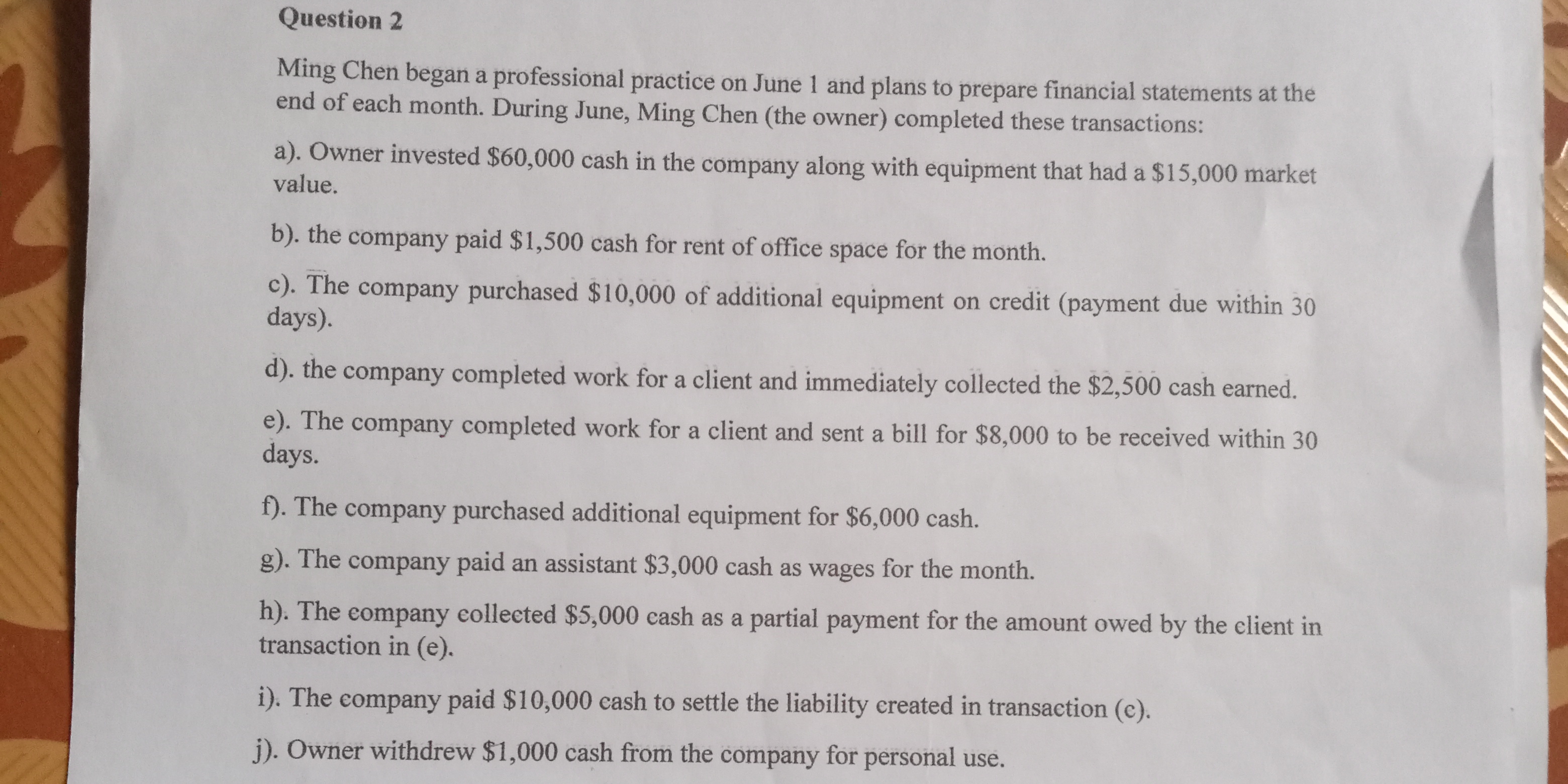

Ming Chen began a professional practice on June 1 and plans to prepare financial statements at the end of each month. During June, Ming Chen (the owner) completed these transaction... Ming Chen began a professional practice on June 1 and plans to prepare financial statements at the end of each month. During June, Ming Chen (the owner) completed these transactions: a) Owner invested $60,000 cash in the company along with equipment that had a $15,000 market value. b) The company paid $1,500 cash for rent of office space for the month. c) The company purchased $10,000 of additional equipment on credit (payment due within 30 days). d) The company completed work for a client and immediately collected the $2,500 cash earned. e) The company completed work for a client and sent a bill for $8,000 to be received within 30 days. f) The company purchased additional equipment for $6,000 cash. g) The company paid an assistant $3,000 cash as wages for the month. h) The company collected $5,000 cash as a partial payment for the amount owed by the client in transaction (e). i) The company paid $10,000 cash to settle the liability created in transaction (c). j) Owner withdrew $1,000 cash from the company for personal use.

Understand the Problem

The question is asking to analyze various financial transactions that Ming Chen's company undertook during June. It requires summarizing and possibly recording these transactions in an accounting format.

Answer

The total of all journal entries reflects the transactions for Ming Chen's company in June. Each entry accurately represents the impacts on cash, equipment, and other accounts.

Answer for screen readers

The journal entries reflecting all transactions would be:

-

Owner's Investment

- Debit Cash $60,000

- Debit Equipment $15,000

- Credit Owner's Equity $75,000

-

Office Rent Payment

- Debit Rent Expense $1,500

- Credit Cash $1,500

-

Purchase of Equipment on Credit

- Debit Equipment $10,000

- Credit Accounts Payable $10,000

-

Cash Earned from Work

- Debit Cash $2,500

- Credit Revenue $2,500

-

Bill Sent to Client

- Debit Accounts Receivable $8,000

- Credit Revenue $8,000

-

Purchase of Equipment for Cash

- Debit Equipment $6,000

- Credit Cash $6,000

-

Wages Paid

- Debit Wages Expense $3,000

- Credit Cash $3,000

-

Collection from Client

- Debit Cash $5,000

- Credit Accounts Receivable $5,000

-

Payment of Liability

- Debit Accounts Payable $10,000

- Credit Cash $10,000

-

Owner's Withdrawal

- Debit Owner's Withdrawals $1,000

- Credit Cash $1,000

Steps to Solve

-

Record Owner’s Investment

Ming Chen invested $60,000 cash and additional equipment with a market value of $15,000.

This increases assets (Cash + Equipment) and owner’s equity (Owner's Capital).- Journal Entry:

- Debit Cash $60,000

- Debit Equipment $15,000

- Credit Owner's Equity $75,000

- Journal Entry:

-

Record Office Rent Payment

The company paid $1,500 cash for office rent.

This decreases cash and increases expenses (Rent Expense).- Journal Entry:

- Debit Rent Expense $1,500

- Credit Cash $1,500

- Journal Entry:

-

Record Purchase of Additional Equipment on Credit

The company purchased $10,000 of equipment on credit (payment due in 30 days).

This increases equipment and liabilities (Accounts Payable).- Journal Entry:

- Debit Equipment $10,000

- Credit Accounts Payable $10,000

- Journal Entry:

-

Record Cash Earned for Completed Work

The company completed work and immediately collected $2,500 cash.

This increases cash and owner’s equity (Revenue).- Journal Entry:

- Debit Cash $2,500

- Credit Revenue $2,500

- Journal Entry:

-

Record Work Completed for Client with Bill Sent

The company billed a client $8,000 for work completed (payment due in 30 days).

This increases accounts receivable and owner’s equity (Revenue).- Journal Entry:

- Debit Accounts Receivable $8,000

- Credit Revenue $8,000

- Journal Entry:

-

Record Purchase of Equipment for Cash

The company purchased additional equipment for $6,000 cash.

This decreases cash and increases equipment.- Journal Entry:

- Debit Equipment $6,000

- Credit Cash $6,000

- Journal Entry:

-

Record Wages Paid to Assistant

The company paid the assistant $3,000 cash for wages.

This decreases cash and increases expenses (Wages Expense).- Journal Entry:

- Debit Wages Expense $3,000

- Credit Cash $3,000

- Journal Entry:

-

Record Collection of Partial Payment from Client

The company collected $5,000 as a partial payment from the client for previous work.

This increases cash and decreases accounts receivable.- Journal Entry:

- Debit Cash $5,000

- Credit Accounts Receivable $5,000

- Journal Entry:

-

Record Payment Made to Settle Liability

The company paid $10,000 cash to settle the liability from the previous equipment purchase.

This decreases cash and decreases liabilities (Accounts Payable).- Journal Entry:

- Debit Accounts Payable $10,000

- Credit Cash $10,000

- Journal Entry:

-

Record Owner’s Withdrawal

The owner withdrew $1,000 cash for personal use.

This decreases cash and decreases owner’s equity (Owner's Withdrawals).

- Journal Entry:

- Debit Owner's Withdrawals $1,000

- Credit Cash $1,000

The journal entries reflecting all transactions would be:

-

Owner's Investment

- Debit Cash $60,000

- Debit Equipment $15,000

- Credit Owner's Equity $75,000

-

Office Rent Payment

- Debit Rent Expense $1,500

- Credit Cash $1,500

-

Purchase of Equipment on Credit

- Debit Equipment $10,000

- Credit Accounts Payable $10,000

-

Cash Earned from Work

- Debit Cash $2,500

- Credit Revenue $2,500

-

Bill Sent to Client

- Debit Accounts Receivable $8,000

- Credit Revenue $8,000

-

Purchase of Equipment for Cash

- Debit Equipment $6,000

- Credit Cash $6,000

-

Wages Paid

- Debit Wages Expense $3,000

- Credit Cash $3,000

-

Collection from Client

- Debit Cash $5,000

- Credit Accounts Receivable $5,000

-

Payment of Liability

- Debit Accounts Payable $10,000

- Credit Cash $10,000

-

Owner's Withdrawal

- Debit Owner's Withdrawals $1,000

- Credit Cash $1,000

More Information

These entries summarize the financial transactions for Ming Chen in June, affecting assets, liabilities, and equity. Each transaction is recorded to ensure accurate tracking of the company's financial position.

Tips

- Confusing debits and credits, leading to incorrect journal entries. Always remember that debits increase assets and expenses, while credits increase liabilities and owner's equity.

- Omitting transactions or failing to include all parts of a transaction can lead to inaccurate financial statements. Always double-check all transactions.

AI-generated content may contain errors. Please verify critical information