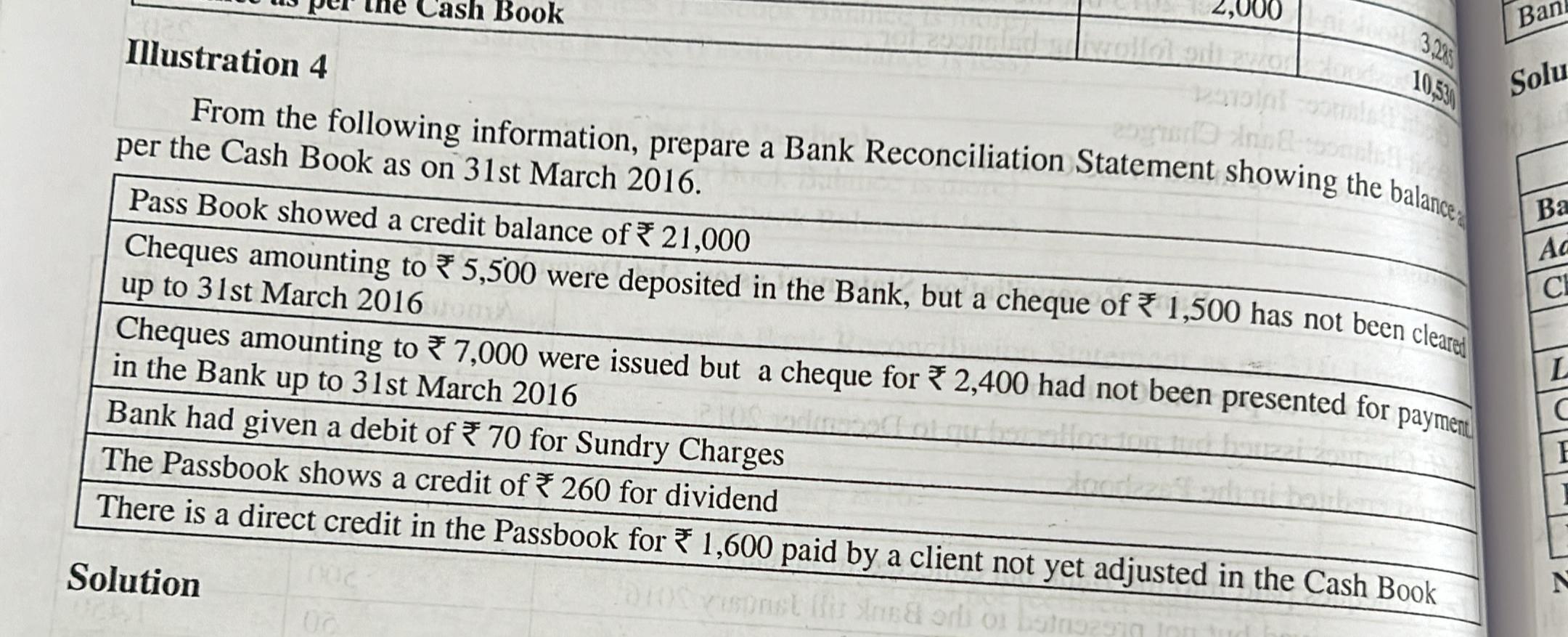

From the following information, prepare a Bank Reconciliation Statement showing the balance as per the Cash Book as on 31st March 2016. Pass Book showed a credit balance of ₹21,000... From the following information, prepare a Bank Reconciliation Statement showing the balance as per the Cash Book as on 31st March 2016. Pass Book showed a credit balance of ₹21,000. Cheques amounting to ₹5,500 were deposited, but a cheque of ₹1,500 has not been cleared. Cheques amounting to ₹7,000 were issued, but a cheque for ₹2,400 had not been presented. Bank had given a debit of ₹70 for sundry charges. The Passbook shows a credit of ₹260 for dividend. There is a direct credit in the Passbook for ₹1,600 paid by a client not yet adjusted in the Cash Book.

Understand the Problem

The question is asking us to prepare a Bank Reconciliation Statement based on information regarding balances and transactions provided for a specific date, emphasizing adjustments needed due to unpresented cheques and bank charges.

Answer

The balance as per the Cash Book on 31st March 2016 is ₹25,930.

Answer for screen readers

The balance as per the Cash Book on 31st March 2016 is ₹25,930.

Steps to Solve

-

Start with the Pass Book Balance

The Pass Book shows a credit balance of ₹21,000. This is the amount we will adjust to find the Cash Book balance.

-

Adjust for Unpresented Cheques

Calculate the total amount of cheques issued but not yet presented.

Cheques issued: ₹7,000

Cheque not presented: ₹2,400The adjustment amount is:

$$ 7,000 - 2,400 = 4,600 $$

-

Adjust for Unclear Deposits

Calculate the total amount of cheques deposited but not yet cleared.

Cheques deposited: ₹5,500

Cheque not cleared: ₹1,500The adjustment amount is:

$$ 5,500 - 1,500 = 4,000 $$

-

Adjust for Bank Charges

Take into account the bank charges that have not yet been recorded in the Cash Book.

Bank charges: ₹70

-

Adjust for Direct Credit

Include the amount directly credited in the Pass Book that’s not yet in the Cash Book.

Direct credit amount: ₹1,600

-

Prepare the Final Bank Reconciliation Statement

Calculate the Cash Book balance by combining all adjustments with the Pass Book balance:

Using the formula:

$$ \text{Cash Book balance} = \text{Pass Book balance} + \text{Unpresented Cheques} - \text{Uncleared Deposits} - \text{Bank Charges} + \text{Direct Credit} $$

Substitute in the values:

$$ \text{Cash Book balance} = 21,000 + 2,400 - 70 + 1,600 $$

Final calculation:

$$ 21,000 + 2,400 - 70 + 1,600 = 25,930 $$

-

Conclude with the final Cash Book balance

The balance as per the Cash Book on 31st March 2016 is ₹25,930.

The balance as per the Cash Book on 31st March 2016 is ₹25,930.

More Information

This reconciliation ensures that all transactions between the bank and the company are accounted for, highlighting any discrepancies that need to be addressed. It's a crucial step in maintaining accurate financial records.

Tips

- Ignoring bank charges: Always remember to include bank charges, which can be easily overlooked.

- Confusing deposits and cheques: Keep track of which cheques have cleared and which have not; it impacts the final balance.

AI-generated content may contain errors. Please verify critical information