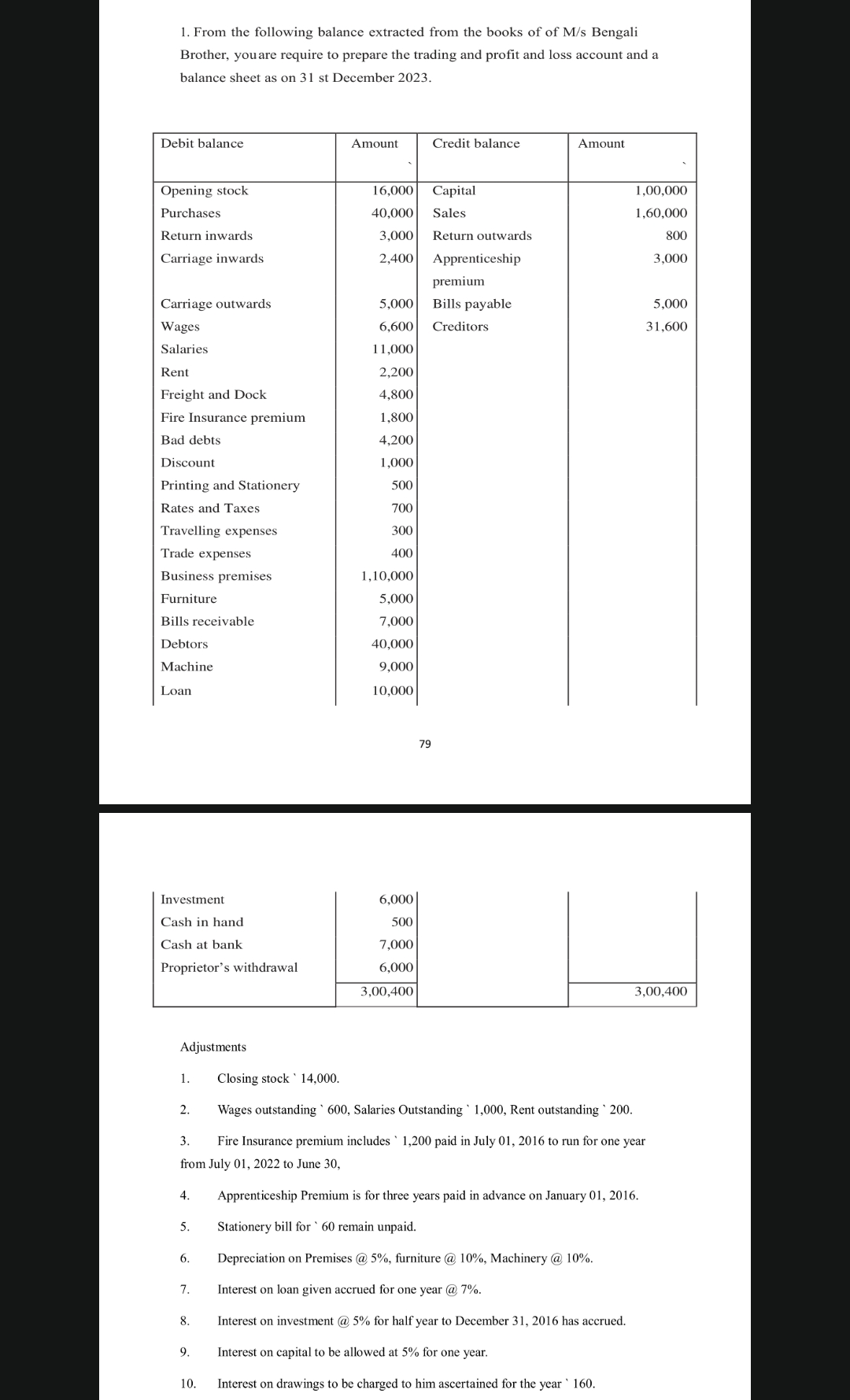

From the following balance extracted from the books of M/s Bengali Brother, you are required to prepare the trading and profit and loss account and a balance sheet as on 31st Decem... From the following balance extracted from the books of M/s Bengali Brother, you are required to prepare the trading and profit and loss account and a balance sheet as on 31st December 2023.

Understand the Problem

The question is asking for the preparation of a trading and profit and loss account, as well as a balance sheet, based on the provided debit and credit balances as of December 31, 2023. This involves calculating the total profits or losses and ensuring that the accounting equation holds true in the financial statements.

Answer

Net Profit is ₹ 48,400.

Answer for screen readers

The trading and profit and loss account shows a Net Profit of ₹ 48,400. The balance sheet confirms the accounting equation holds true with total assets and liabilities + net worth aligning.

Steps to Solve

- Extract Necessary Data

From the debit and credit balances, we compile all relevant figures to prepare the Trading and Profit and Loss account. The summarized totals are:

- Total Purchases: $40,000 + 3,000 = 43,000$ (including Return Inwards)

- Total Sales: $1,60,000 - 800 = 1,59,200$ (excluding Return Outwards)

- Calculate Gross Profit

Using the formula for Gross Profit:

[ \text{Gross Profit} = \text{Total Sales} - \text{Cost of Goods Sold (COGS)} ]

Cost of Goods Sold (COGS) includes:

[ \text{COGS} = \text{Opening Stock} + \text{Purchases} + \text{Carriage Inwards} - \text{Closing Stock} ]

First, calculate COGS:

[ \text{COGS} = 16,000 + 40,000 + 2,400 - 14,000 = 44,400 ]

Now, calculate Gross Profit:

[ \text{Gross Profit} = 159,200 - 44,400 = 114,800 ]

- Prepare Profit and Loss Account

Now, we'll include all the operating expenses to find the Net Profit.

Total Operating Expenses include:

- Wages: $6,600

- Salaries: $11,000

- Rent: $2,200

- Freight & Dock: $4,800

- Fire Insurance Premium: $1,800 (after adjustment)

- Bad Debts: $4,200

- Discount: $1,000

- Printing & Stationery: $500

- Rates & Taxes: $700

- Travelling Expenses: $300

- Trade Expenses: $400

- Depreciation (total): $5,500 ($5,500 from all assets)

Adding these together gives:

[ \text{Total Expenses} = 66,400 ]

- Calculate Net Profit

Now, calculate the Net Profit using:

[ \text{Net Profit} = \text{Gross Profit} - \text{Total Expenses} ]

[ \text{Net Profit} = 114,800 - 66,400 = 48,400 ]

- Prepare the Balance Sheet

The assets and liabilities will be summarized as follows:

-

Assets:

- Cash in Hand: $500

- Cash at Bank: $7,000

- Debtors: $40,000

- Bills Receivable: $7,000

- Closing Stock: $14,000

- Furniture: $5,000

- Machine: $9,000

- Business Premises: $1,10,000

Total Assets = $1,67,500

-

Liabilities:

- Creditors: $31,600

- Bills Payable: $5,000

- Outstanding Wages: $600

- Outstanding Salaries: $1,000

- Outstanding Rent: $200

- Loan: $10,000

Total Liabilities = $48,600

- Check Accounting Equation

Verify that:

[ \text{Assets} = \text{Liabilities} + \text{Net Worth} ]

Net Worth can be calculated as:

[ \text{Net Worth} = \text{Capital} + \text{Net Profit} - \text{Drawings} ]

Substituting values will ensure the balance sheet balances out.

The trading and profit and loss account shows a Net Profit of ₹ 48,400. The balance sheet confirms the accounting equation holds true with total assets and liabilities + net worth aligning.

More Information

The preparation of financial statements involves compiling figures to determine profitability and assets verifiably represent the total liabilities plus owner's equity. Balancing these figures is essential for accurate financial reporting.

Tips

- Miscalculating the closing stock which affects the COGS and ultimately the gross profit.

- Overlooking any outstanding payable amounts leading to incorrect liabilities.

- Not considering depreciation of assets properly can distort the profit figures.

AI-generated content may contain errors. Please verify critical information