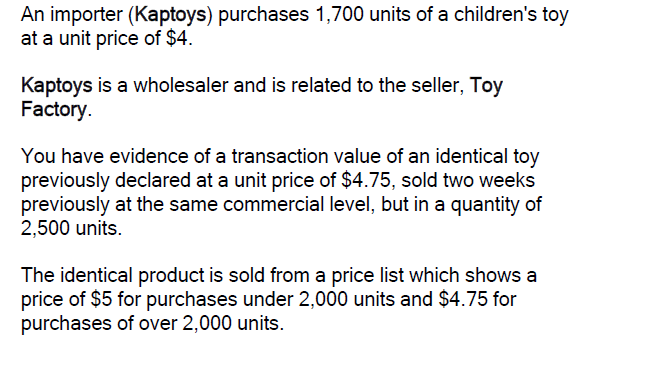

An importer (Kaptoys) purchases 1,700 units of a children's toy at a unit price of $4. Kaptoys is a wholesaler and is related to the seller, Toy Factory. You have evidence of a tra... An importer (Kaptoys) purchases 1,700 units of a children's toy at a unit price of $4. Kaptoys is a wholesaler and is related to the seller, Toy Factory. You have evidence of a transaction value of an identical toy previously declared at a unit price of $4.75, sold two weeks previously at the same commercial level, but in a quantity of 2,500 units. The identical product is sold from a price list which shows a price of $5 for purchases under 2,000 units and $4.75 for purchases of over 2,000 units.

Understand the Problem

The question is discussing the pricing and transactions of a children's toy involving an importer and a seller. It presents various unit prices based on different quantities purchased, and likely seeks to analyze or resolve an issue related to pricing, transaction values, or valuation.

Answer

Answer for screen readers

AI-generated content may contain errors. Please verify critical information