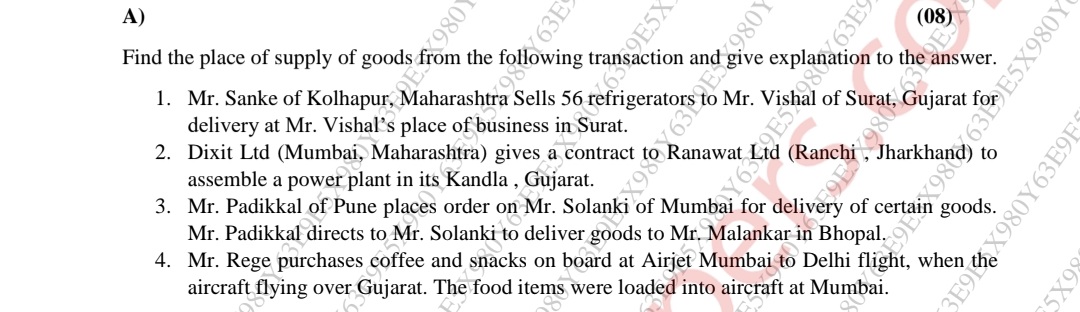

Find the place of supply of goods from the following transactions and give explanations to the answers: 1. Mr. Sanke of Kolhapur, Maharashtra, sells 56 refrigerators to Mr. Vishal... Find the place of supply of goods from the following transactions and give explanations to the answers: 1. Mr. Sanke of Kolhapur, Maharashtra, sells 56 refrigerators to Mr. Vishal of Surat, Gujarat, for delivery at Mr. Vishal's place of business in Surat. 2. Dixit Ltd. (Mumbai, Maharashtra) gives a contract to Ranawat Ltd (Ranchi, Jharkhand) to assemble a power plant in its Kandla, Gujarat. 3. Mr. Padikkal of Pune places an order on Mr. Solanki of Mumbai for delivery of certain goods. Mr. Padikkal directs Mr. Solanki to deliver goods to Mr. Malankar in Bhopal. 4. Mr. Rege purchases coffee and snacks on board an Airjet Mumbai to Delhi flight, when the aircraft is flying over Gujarat. The food items were loaded into the aircraft at Mumbai.

Understand the Problem

The question is asking to identify the place of supply for various goods in different transactions and provide explanations for each case.

Answer

1. Surat 2. Kandla 3. Bhopal 4. Mumbai

- Surat, as goods are delivered there. 2. Kandla, Gujarat, as the assembly takes place there. 3. Bhopal, as goods are delivered there. 4. Mumbai, as goods were loaded there.

Answer for screen readers

- Surat, as goods are delivered there. 2. Kandla, Gujarat, as the assembly takes place there. 3. Bhopal, as goods are delivered there. 4. Mumbai, as goods were loaded there.

More Information

The place of supply determines where a transaction is taxed under the Goods and Services Tax (GST) regime. It is crucial for determining the state jurisdiction for tax purposes.

Tips

A common mistake is not considering the delivery location in defining the place of supply.

Sources

- Place of Supply - IGST Act - cbec.gov.in

- GST Place of Supply Rules - taxguru.in

AI-generated content may contain errors. Please verify critical information