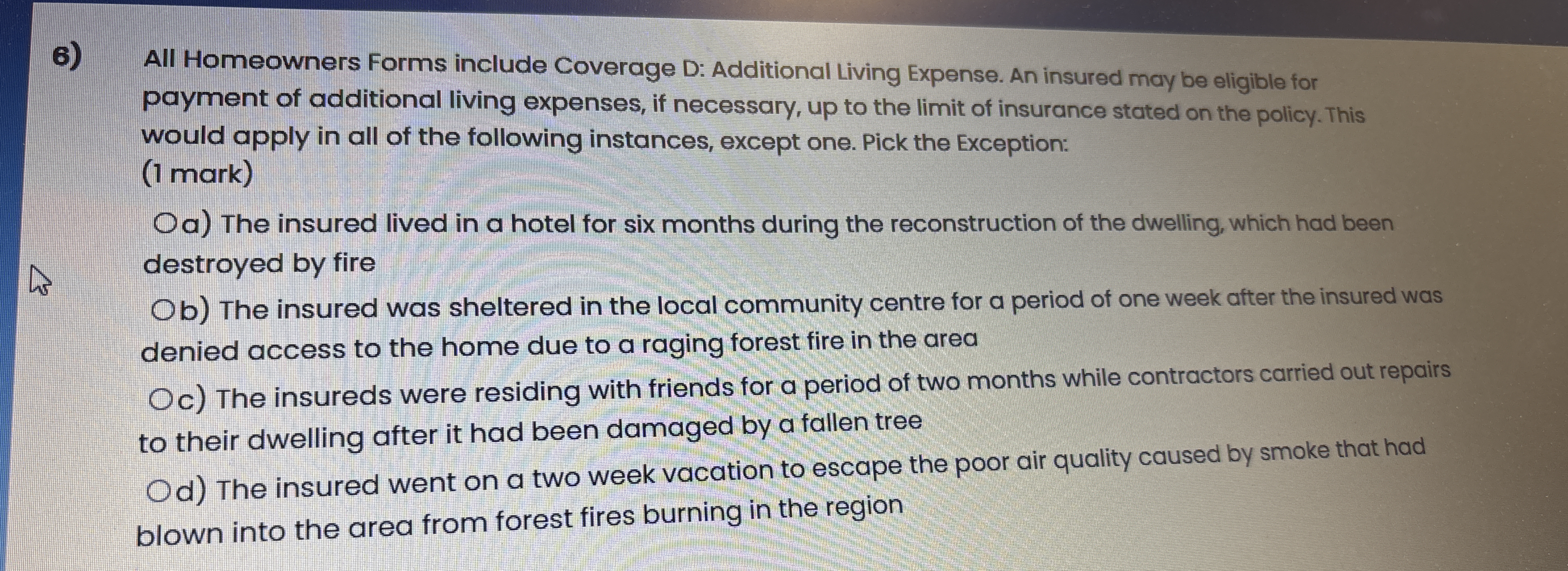

All Homeowners Forms include Coverage D: Additional Living Expense. An insured may be eligible for payment of additional living expenses, if necessary, up to the limit of insurance... All Homeowners Forms include Coverage D: Additional Living Expense. An insured may be eligible for payment of additional living expenses, if necessary, up to the limit of insurance stated on the policy. This would apply in all of the following instances, except one. Pick the Exception: The insured lived in a hotel for six months during the reconstruction of the dwelling, which had been destroyed by fire. The insured was sheltered in the local community centre for a period of one week after the insured was denied access to the home due to a raging forest fire in the area. The insured were residing with friends for a period of two months while contractors carried out repairs to their dwelling after it had been damaged by a fallen tree. The insured went on a two week vacation to escape the poor air quality caused by smoke that had blown into the area from forest fires burning in the region.

Understand the Problem

The question is asking to identify which instance does not qualify for coverage under homeowners' insurance for additional living expenses. This requires understanding insurance policy details and the specific contexts in which coverage can be denied.

Answer

Option d.

The final answer is option d.

Answer for screen readers

The final answer is option d.

More Information

Coverage D typically applies when the home is uninhabitable due to covered perils. A voluntary vacation to escape poor air quality doesn't qualify.

Tips

A common mistake is assuming ALE covers voluntary relocation. It only applies when the home is uninhabitable or inaccessible due to insured perils.

Sources

- Additional Living Expense Coverage | Allstate - allstate.com

- Additional Living Expense (ALE) Insurance: Meaning and Examples - investopedia.com

AI-generated content may contain errors. Please verify critical information