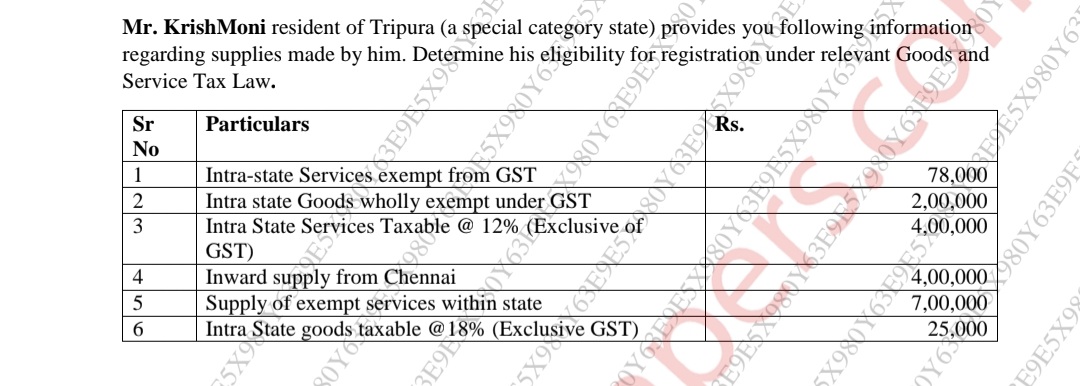

Determine Mr. KrishMoni's eligibility for registration under relevant Goods and Service Tax Law based on the following information: Intra-state Services exempt from GST: 78,000, In... Determine Mr. KrishMoni's eligibility for registration under relevant Goods and Service Tax Law based on the following information: Intra-state Services exempt from GST: 78,000, Intra state Goods wholly exempt under GST: 2,00,000, Intra State Services Taxable @ 12%: 4,00,000, Inward supply from Chennai: 4,00,000, Supply of exempt services within state: 7,00,000, Intra State goods taxable @ 18%: 25,000.

Understand the Problem

The question is asking to determine Mr. KrishMoni's eligibility for registration under the Goods and Service Tax Law based on the various financial data related to his supplies in Tripura, which includes details of exempt and taxable services and goods.

Answer

Mr. KrishMoni is not required to register for GST in Tripura.

The aggregate taxable turnover is Rs. 4,25,000, which is below the threshold limit of Rs. 10,00,000 for Tripura (a special category state). Therefore, Mr. KrishMoni is not required to register under GST.

Answer for screen readers

The aggregate taxable turnover is Rs. 4,25,000, which is below the threshold limit of Rs. 10,00,000 for Tripura (a special category state). Therefore, Mr. KrishMoni is not required to register under GST.

More Information

Special category states have a lower threshold for GST registration to account for their economic conditions. Exempt supplies are not counted toward this threshold.

Tips

A common mistake is including exempt supplies in the aggregate turnover calculation for registration purposes.

Sources

- D 07 Mr KrishMoni resident of Tripura a | StudyX - studyx.ai

AI-generated content may contain errors. Please verify critical information