Compute the static budget variance, the sales-activity variance, and the flexible-budget variance for both (i) revenues and (ii) operating income. Use U or F to indicate whether th... Compute the static budget variance, the sales-activity variance, and the flexible-budget variance for both (i) revenues and (ii) operating income. Use U or F to indicate whether the variances are favorable or unfavorable.

Understand the Problem

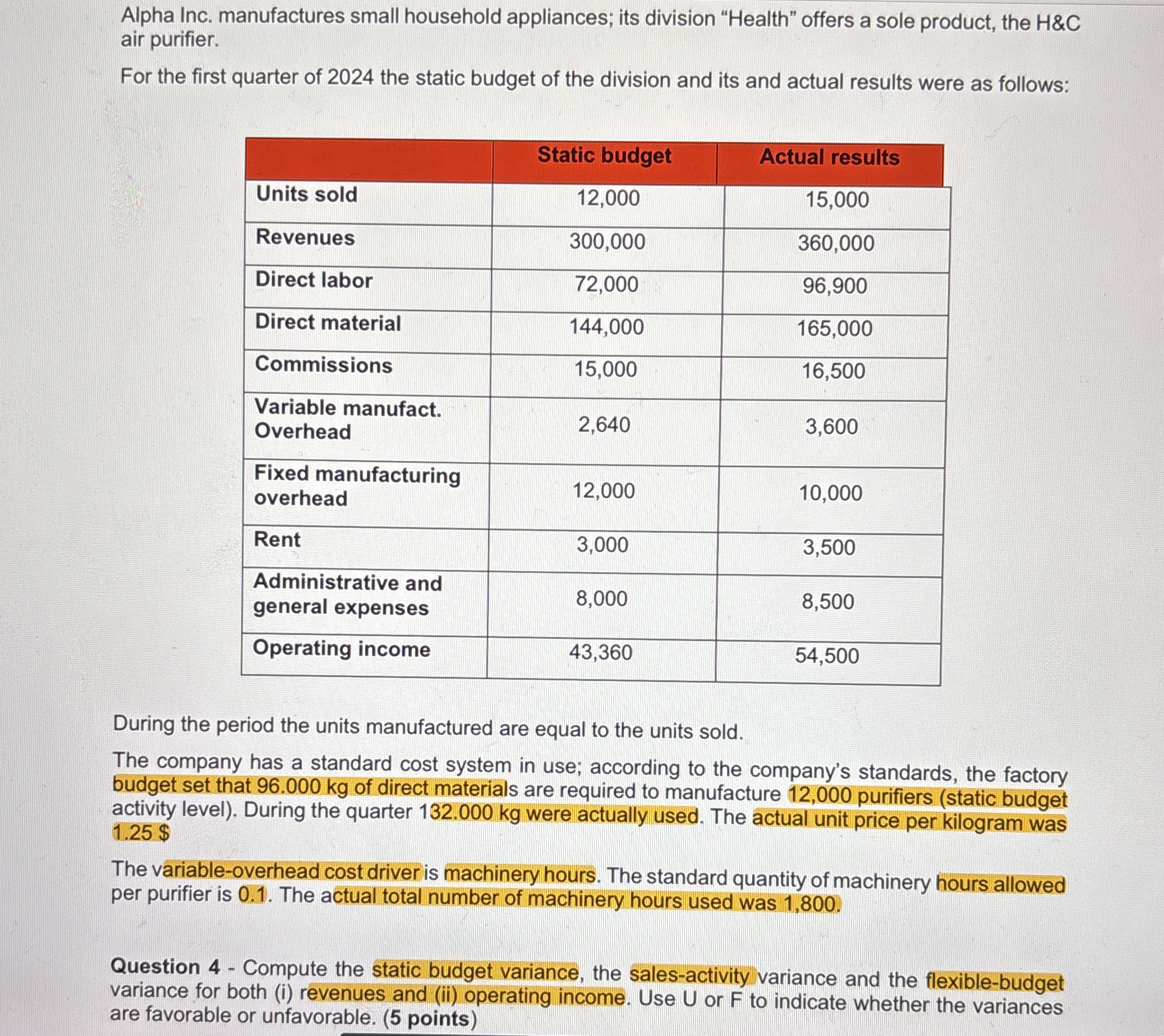

The question is asking to compute the static budget variance, sales-activity variance, and flexible-budget variance based on the provided static budget and actual results for Alpha Inc.'s division. This requires comparing the budgeted amounts with actual figures to identify variances and whether they are favorable or unfavorable.

Answer

- Static Budget Variance: $11,140$ (Favorable) - Flexible Budget Variance: $-80,450$ (Unfavorable) - Sales Activity Variance: $91,590$ (Favorable)

Answer for screen readers

- Static Budget Variance: $11,140$ (Favorable)

- Flexible Budget Variance: $-80,450$ (Unfavorable)

- Sales Activity Variance: $91,590$ (Favorable)

Steps to Solve

-

Calculate the Static Budget Variance for Operating Income

The static budget variance is the difference between actual results and the static budget amounts.

[ \text{Static Budget Variance} = \text{Actual Operating Income} - \text{Static Budget Operating Income} ]

Plugging in the values:

[ \text{Static Budget Variance} = 54,500 - 43,360 = 11,140 \text{ (Favorable)} ]

-

Calculate the Flexible Budget for Operating Income

Next, we need to determine the flexible budget amounts based on actual units sold (15,000) using the standard costs.

-

Revenues: [ \text{Flexible Revenues} = 15,000 \text{ units} \times 30 \text{ (price per unit)} = 450,000 ]

-

Direct Labor: [ \text{Flexible Direct Labor} = 15,000 \text{ units} \times 6 \text{ (per unit)} = 90,000 ]

-

Direct Material: [ \text{Flexible Direct Material} = 15,000 \text{ units} \times 12 \text{ (per unit)} = 180,000 ]

-

Commissions: [ \text{Flexible Commissions} = 15,000 \text{ units} \times 1.25 \text{ (per unit)} = 18,750 ]

-

Variable Manufacturing Overhead: [ \text{Flexible Variable Manufacturing Overhead} = 15,000 \text{ units} \times 0.22 \text{ (per unit)} = 3,300 ]

-

Fixed Manufacturing Overhead, Rent, and Administrative Expenses: These remain the same as the static budget: 12,000, 3,000, and 8,000 respectively.

Now, summing these:

[ \text{Total Flexible Costs} = 90,000 + 180,000 + 18,750 + 3,300 + 12,000 + 3,000 + 8,000 = 315,050 ]

Finally, calculate flexible-budget operating income:

[ \text{Flexible-budget Operating Income} = \text{Flexible Revenues} - \text{Total Flexible Costs} = 450,000 - 315,050 = 134,950 ]

-

-

Calculate the Flexible Budget Variance for Operating Income

Here we compare the actual operating income to the flexible budget operating income:

[ \text{Flexible Budget Variance} = \text{Actual Operating Income} - \text{Flexible Budget Operating Income} ]

Using our values:

[ \text{Flexible Budget Variance} = 54,500 - 134,950 = -80,450 \text{ (Unfavorable)} ]

-

Calculate the Sales-Activity Variance

This variance breaks down to the difference between the flexible budget and the static budget amounts:

[ \text{Sales Activity Variance} = \text{Flexible Budget Operating Income} - \text{Static Budget Operating Income} ]

We previously calculated:

[ \text{Sales Activity Variance} = 134,950 - 43,360 = 91,590 \text{ (Favorable)} ]

- Static Budget Variance: $11,140$ (Favorable)

- Flexible Budget Variance: $-80,450$ (Unfavorable)

- Sales Activity Variance: $91,590$ (Favorable)

More Information

The variances help in measuring how well the division performed compared to its set goals. A favorable variance indicates better-than-expected performance, while an unfavorable variance indicates underperformance.

Tips

- Failing to differentiate between static and flexible budget; ensure you are using the correct values for each calculation.

- Not adjusting calculations for the actual number of units sold; always base flexible budgets on actual activity levels.

AI-generated content may contain errors. Please verify critical information