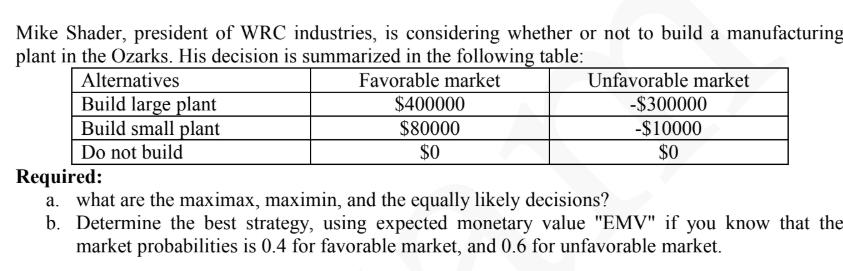

a. What are the maximin, maximax, and equally likely decisions? b. Determine the best strategy, using expected monetary value (EMV), if you know that the market probabilities are 0... a. What are the maximin, maximax, and equally likely decisions? b. Determine the best strategy, using expected monetary value (EMV), if you know that the market probabilities are 0.4 for favorable market and 0.6 for unfavorable market.

Understand the Problem

The question asks for the calculation of maximin, maximax, and equally likely decisions related to the construction of a manufacturing plant, as well as determining the best strategy using expected monetary value (EMV) based on given market probabilities.

Answer

Maximin = $0$, Maximax = $400,000$, Equally Likely = $50,000$. Best EMV strategy: Build small plant with $26,000$.

Answer for screen readers

Maximin = $0$, Maximax = $400,000$, Equally Likely = $50,000$.

Best strategy using EMV: Build a small plant with an EMV of $26,000$.

Steps to Solve

-

Identify Payoffs for Alternatives

From the table, we can summarize the payoffs of each alternative:

- Build Large Plant: Favorable market: $400,000, Unfavorable market: -$300,000

- Build Small Plant: Favorable market: $80,000, Unfavorable market: -$10,000

- Do Not Build: $0 for both market conditions

-

Calculate Maximin Decision

The maximin decision is found by identifying the worst-case scenario for each alternative and then choosing the best among those:

- Build Large Plant: Worst case: $-300,000

- Build Small Plant: Worst case: $-10,000

- Do Not Build: Worst case: $0

So, the maximin decision is: $$ \text{maximin} = \max(-300,000, -10,000, 0) = 0 $$

-

Calculate Maximax Decision

The maximax decision considers the best outcome of each alternative:

- Build Large Plant: Best case: $400,000

- Build Small Plant: Best case: $80,000

- Do Not Build: Best case: $0

So, the maximax decision is: $$ \text{maximax} = \max(400,000, 80,000, 0) = 400,000 $$

-

Calculate Equally Likely Decision

For the equally likely decision, we assume each market condition is equally probable (0.5 each). We calculate the average payoff for each alternative:

- Build Large Plant: $$ \text{Expected} = \frac{1}{2}(400,000) + \frac{1}{2}(-300,000) = 50,000 $$

- Build Small Plant: $$ \text{Expected} = \frac{1}{2}(80,000) + \frac{1}{2}(-10,000) = 35,000 $$

- Do Not Build: $$ \text{Expected} = 0 $$

The equally likely decision is: $$ \text{equally likely} = \max(50,000, 35,000, 0) = 50,000 $$

-

Calculate Expected Monetary Value (EMV)

Using the given probabilities, we calculate the EMV for each alternative:

- Build Large Plant: $$ \text{EMV} = (0.4 \times 400,000) + (0.6 \times -300,000) = 160,000 - 180,000 = -20,000 $$

- Build Small Plant: $$ \text{EMV} = (0.4 \times 80,000) + (0.6 \times -10,000) = 32,000 - 6,000 = 26,000 $$

- Do Not Build: $$ \text{EMV} = 0 $$

The best strategy based on EMV is: $$ \text{Best EMV} = \max(-20,000, 26,000, 0) = 26,000 $$

Maximin = $0$, Maximax = $400,000$, Equally Likely = $50,000$.

Best strategy using EMV: Build a small plant with an EMV of $26,000$.

More Information

The maximin strategy focuses on minimizing potential loss, while the maximax strategy aims to maximize potential gain. The equally likely approach treats all outcomes with the same probability. The EMV provides a decision-making criterion based on expected financial outcomes.

Tips

- Miscalculating the maximum or minimum values in the decision criteria.

- Not considering each alternative under both favorable and unfavorable market conditions.

- Forgetting to apply the correct probabilities when calculating EMV.

AI-generated content may contain errors. Please verify critical information