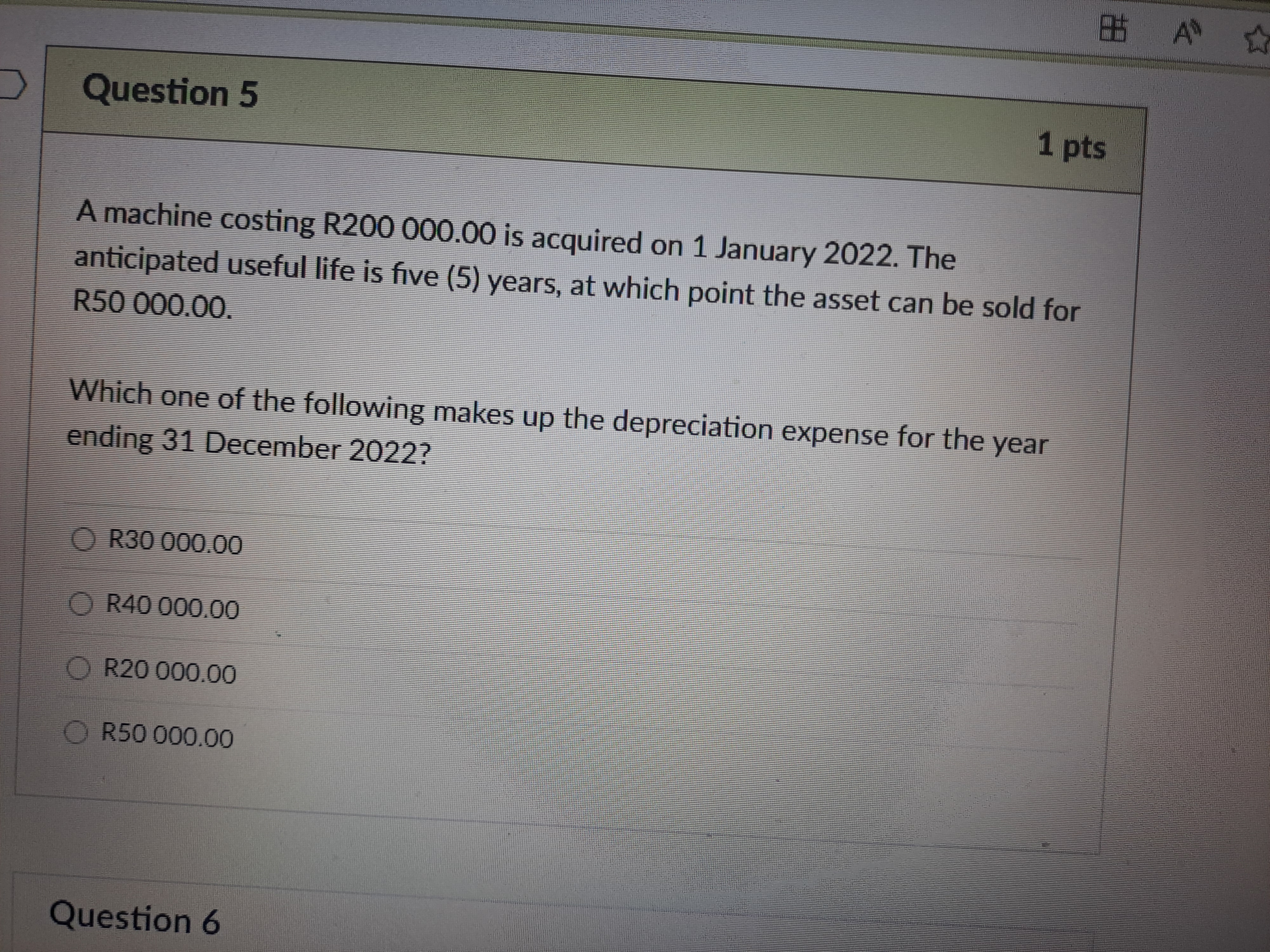

A machine costing R200,000 is acquired on 1 January 2022. The anticipated useful life is five (5) years, at which point the asset can be sold for R50,000. Which one of the followin... A machine costing R200,000 is acquired on 1 January 2022. The anticipated useful life is five (5) years, at which point the asset can be sold for R50,000. Which one of the following makes up the depreciation expense for the year ending 31 December 2022?

Understand the Problem

The question is asking to calculate the depreciation expense for a machine acquired for R200,000 with a useful life of 5 years and a salvage value of R50,000. The task is to determine the correct annual depreciation expense for the year ending December 31, 2022.

Answer

R30,000.

Answer for screen readers

The annual depreciation expense for the year ending December 31, 2022, is R30,000.

Steps to Solve

- Identify the values First, we identify the cost of the machine, its useful life, and the salvage value:

- Cost of the machine (C): R200,000

- Useful life (L): 5 years

- Salvage value (S): R50,000

-

Calculate the depreciable amount Next, we calculate the depreciable amount by subtracting the salvage value from the cost: $$ \text{Depreciable Amount} = C - S = R200,000 - R50,000 = R150,000 $$

-

Calculate annual depreciation expense To find the annual depreciation expense, we divide the depreciable amount by the useful life: $$ \text{Annual Depreciation} = \frac{\text{Depreciable Amount}}{L} = \frac{R150,000}{5} = R30,000 $$

-

Identify the answer choice The calculated annual depreciation expense is R30,000. Checking the answer options:

- R30,000 is among the choices.

The annual depreciation expense for the year ending December 31, 2022, is R30,000.

More Information

Depreciation is an essential accounting concept that allows businesses to allocate the cost of tangible assets over their useful lives. It reflects the wear and tear or consumption of the asset.

Tips

Common mistakes include:

- Failing to subtract the salvage value from the cost before calculating depreciation.

- Miscalculating the annual depreciation by not dividing the depreciable amount by the useful life appropriately.

AI-generated content may contain errors. Please verify critical information