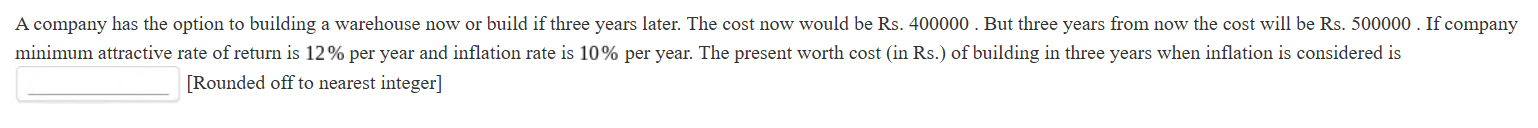

A company has the option to build a warehouse now or three years later. The current cost is Rs. 400000, while the cost three years from now will be Rs. 500000. If the minimum attra... A company has the option to build a warehouse now or three years later. The current cost is Rs. 400000, while the cost three years from now will be Rs. 500000. If the minimum attractive rate of return is 12% per year and the inflation rate is 10% per year, what is the present worth cost (in Rs.) of building in three years when inflation is considered? [Rounded off to nearest integer]

Understand the Problem

The question asks to determine the present worth of a warehouse's future cost considering inflation and the company's required rate of return. We need to calculate the adjusted cost of building the warehouse three years later, taking into account the specified rates of return and inflation.

Answer

The present worth cost is Rs. 473386.

Answer for screen readers

The present worth cost of building in three years, when inflation is considered, is Rs. 473386.

Steps to Solve

-

Identify Future Cost and Rates

The future cost of the warehouse in three years is Rs. 500,000. The company's required rate of return is 12% per year, and the inflation rate is 10% per year. -

Calculate the Real Rate of Return

The real rate of return can be calculated using the formula:

$$ r_{real} = \frac{1 + r}{1 + i} - 1 $$

where $r$ is the nominal interest rate (12%) and $i$ is the inflation rate (10%).

Substituting in the values:

$$ r_{real} = \frac{1 + 0.12}{1 + 0.10} - 1 $$ -

Calculate the Future Value Adjusted for Inflation

First, calculate the values:

$$ r_{real} = \frac{1.12}{1.10} - 1 \approx 0.0182 \text{ or } 1.82% $$ -

Calculate Present Worth

To find the present worth (PW) of the future cost, we use the formula:

$$ PW = \frac{FV}{(1 + r_{real})^n} $$

where $FV$ is the future value (Rs. 500,000) and $n$ is the number of years (3).

Substituting the values:

$$ PW = \frac{500000}{(1 + 0.0182)^3} $$ -

Compute the Calculation

Calculate:

$$ PW = \frac{500000}{(1.0182)^3} $$

First, compute $(1.0182)^3 \approx 1.0554$, then:

$$ PW = \frac{500000}{1.0554} \approx 473,385.56 $$ -

Round the Final Result

Round the present worth to the nearest integer:

$$ PW \approx 473386 $$

The present worth cost of building in three years, when inflation is considered, is Rs. 473386.

More Information

The present worth factoring in inflation helps companies determine the best time to invest in projects. Understanding the impact of inflation on future costs can significantly influence financial decisions.

Tips

- Miscalculating the real rate of return by not using the correct formula.

- Forgetting to use the adjusted rate for future value calculations.

- Not rounding the answer correctly to the nearest integer.

AI-generated content may contain errors. Please verify critical information