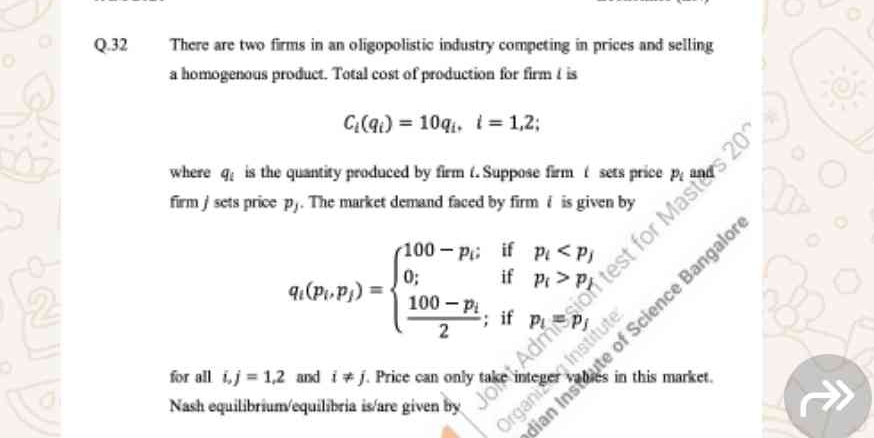

There are two firms in an oligopolistic industry competing in prices and selling a homogeneous product. Total cost of production for firm i is C_i(q_i) = 10q_i, i = 1, 2; where q_i... There are two firms in an oligopolistic industry competing in prices and selling a homogeneous product. Total cost of production for firm i is C_i(q_i) = 10q_i, i = 1, 2; where q_i is the quantity produced by firm i. Suppose firm i sets price p_i and firm j sets price p_j. The market demand faced by firm i is given by: q_i(p_i, p_j) = { (100 - p_i) if p_i < p_j; 0 if p_i > p_j; (100 - p_i) / 2 if p_i = p_j. For all i, j = 1, 2 and i ≠ j, price can only take integer values in this market. Nash equilibrium/equilibria is/are given by?

Understand the Problem

The question presents a scenario of two firms in an oligopolistic market and asks for the Nash equilibrium based on their prices and production costs. We need to identify the equilibrium pricing strategies for firms based on the provided demand and cost functions.

Answer

The equilibrium depends on solving the best response functions derived from the profit equations for both firms based on given cost and demand structures.

Answer for screen readers

The Nash equilibrium prices will depend on the pricing strategies derived from the best response functions.

Steps to Solve

-

Identify Cost Functions The cost function for each firm ( C_i(q_i) ) is given by: $$ C_i(q_i) = 10q_i, \quad i = 1, 2 $$ This shows that the cost depends linearly on the quantity produced ( q_i ).

-

Determine Revenue Functions The revenue for firm ( i ) when selling at price ( p_i ) is given by: $$ R_i(p_i) = p_i \cdot q_i(p_i, p_j) $$ where ( q_i(p_i, p_j) ) is the quantity demanded given the pricing strategies of both firms.

-

Analyze Demand Functions The demand faced by firm ( i ) is: $$ q_i(p_i, p_j) = \begin{cases} 100 - p_i & \text{if } p_i < p_j \ 0 & \text{if } p_i > p_j \ \frac{100 - p_i}{2} & \text{if } p_i = p_j \end{cases} $$ We will need to consider these cases while determining the Nash equilibrium.

-

Set Up Profit Functions The profit function for firm ( i ): $$ \pi_i(p_i) = R_i(p_i) - C_i(q_i) $$ which becomes: $$ \pi_i(p_i) = p_i \cdot q_i(p_i, p_j) - 10q_i(p_i, p_j) $$

-

Find Best Response Functions Each firm maximizes its profit with respect to its price. We will find ( \frac{d\pi_i}{dp_i} = 0 ) to derive the best response functions.

-

Calculate Nash Equilibrium Solve the simultaneous equations formed by the best response functions for both firms to find ( (p_1^, p_2^) ).

The Nash equilibrium prices will depend on the pricing strategies derived from the best response functions.

More Information

In oligopolistic markets, the Nash equilibrium represents a situation where both firms choose prices optimally, given the price of the other firm, leading to no incentive for either firm to deviate.

Tips

- Not considering all three cases for the demand function when calculating equilibrium prices.

- Forgetting to subtract total costs when computing profits.

- Incorrectly differentiating the profit function, leading to erroneous best responses.

AI-generated content may contain errors. Please verify critical information