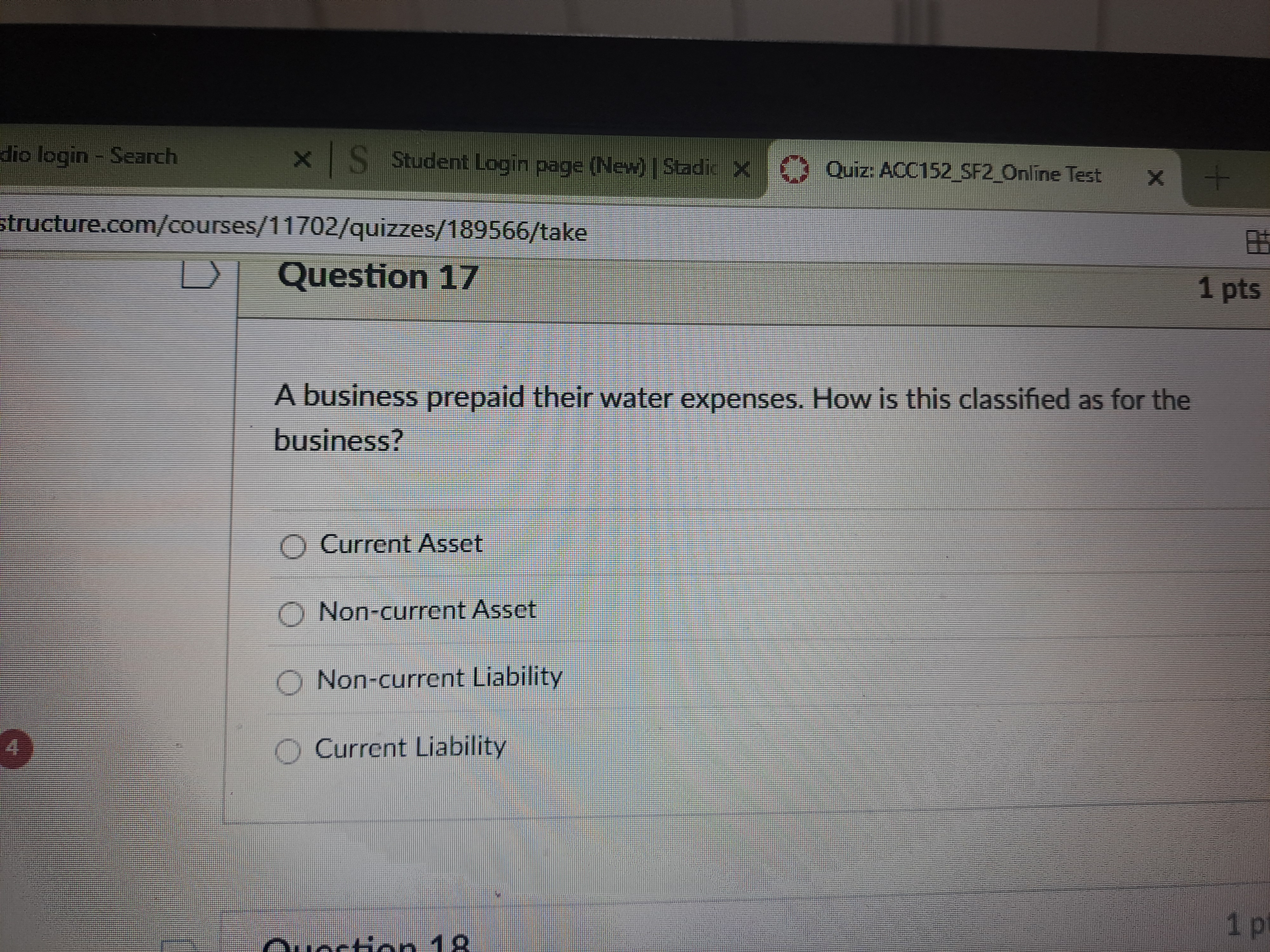

A business prepaid their water expenses. How is this classified as for the business?

Understand the Problem

The question is asking for the classification of prepaid water expenses in accounting terms. This involves understanding whether it should be categorized as an asset or liability, and if so, whether it is current or non-current.

Answer

Current Asset

The prepayment of water expenses by a business is classified as a Current Asset.

Answer for screen readers

The prepayment of water expenses by a business is classified as a Current Asset.

More Information

Prepaid expenses like water payments are considered assets because they provide future economic benefits. They are recorded on the balance sheet and reduce as the expenses are realized over time.

Tips

A common mistake is categorizing prepaid expenses under liabilities. Remember, they are assets as they represent future benefits.

Sources

- Prepaid Expenses - Investopedia - investopedia.com

- Prepaid Expenses - Studocu - studocu.com

- How To Record Prepaid Expenses - Ramp - ramp.com

AI-generated content may contain errors. Please verify critical information