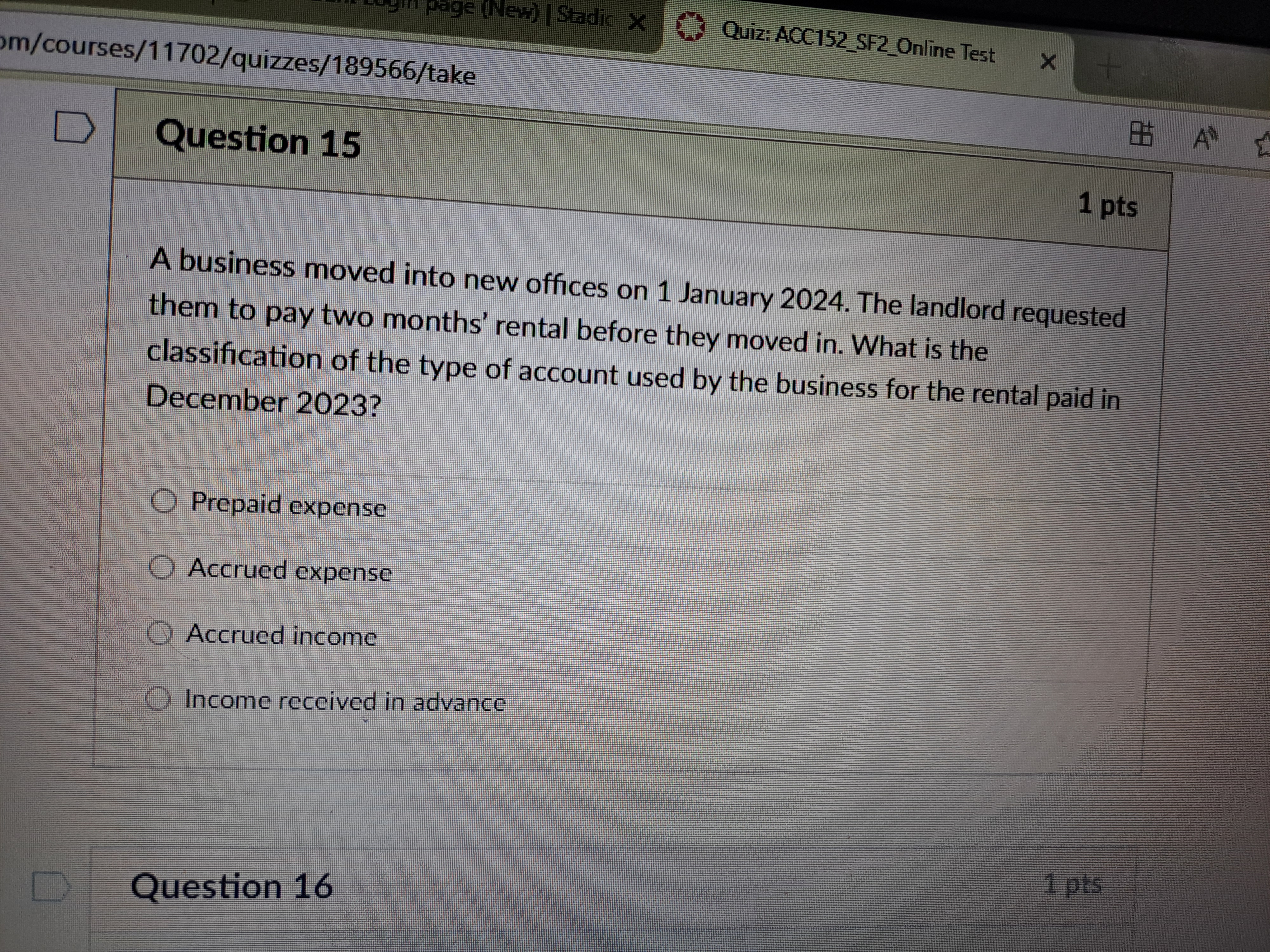

A business moved into new offices on 1 January 2024. The landlord requested them to pay two months’ rental before they moved in. What is the classification of the type of account u... A business moved into new offices on 1 January 2024. The landlord requested them to pay two months’ rental before they moved in. What is the classification of the type of account used by the business for the rental paid in December 2023?

Understand the Problem

The question is asking for the classification of the type of account used by a business for rental payments made prior to moving in, specifically focusing on the accounting principles that define the nature of these payments.

Answer

Prepaid expense.

The classification of the type of account used by the business for the rental paid in December 2023 is a Prepaid Expense.

Answer for screen readers

The classification of the type of account used by the business for the rental paid in December 2023 is a Prepaid Expense.

More Information

Prepaid expenses are assets that represent payments for services to be received in future accounting periods.

Tips

A common mistake is classifying prepaid expenses as incurred expenses, which are for services already received.

Sources

AI-generated content may contain errors. Please verify critical information