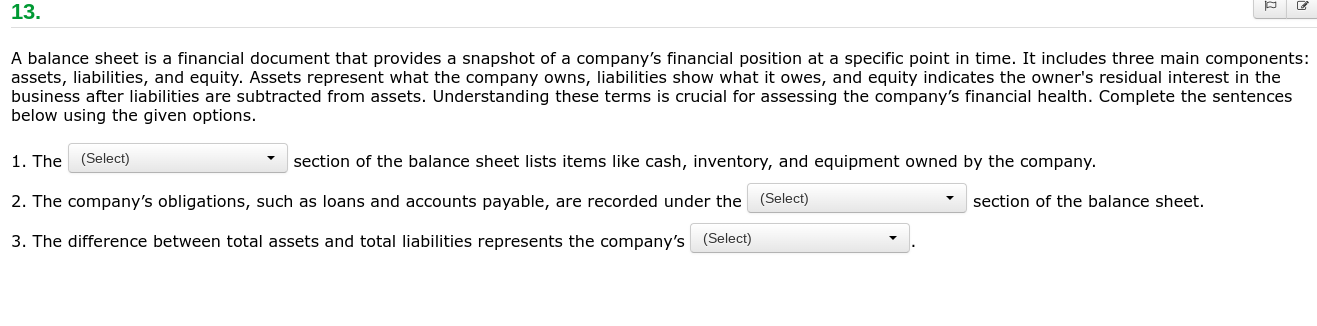

A balance sheet is a financial document that provides a snapshot of a company’s financial position at a specific point in time. It includes three main components: assets, liabiliti... A balance sheet is a financial document that provides a snapshot of a company’s financial position at a specific point in time. It includes three main components: assets, liabilities, and equity. Assets represent what the company owns, liabilities show what it owes, and equity indicates the owner's residual interest in the business after liabilities are subtracted from assets. Understanding these terms is crucial for assessing the company’s financial health. Complete the sentences below using the given options.

Understand the Problem

The question is asking about the components of a balance sheet and requires filling in specific terms in sentences related to assets, liabilities, and equity. This involves understanding the financial terms and their placement within a balance sheet.

Answer

1. Assets. 2. Liabilities. 3. Equity.

- Assets. 2. Liabilities. 3. Equity.

Answer for screen readers

- Assets. 2. Liabilities. 3. Equity.

More Information

The balance sheet shows the company's financial condition at a specific point in time by listing what it owns and owes, alongside the owners' stake.

Tips

A common mistake is confusing assets with equity; remember, equity is the residual interest after liabilities are subtracted from assets.

Sources

- Balance Sheet Components: Assets, Liabilities, and Equity - suozziforny.com

- Balance Sheet - Definition & Examples - corporatefinanceinstitute.com

- Balance sheet - Wikipedia - en.wikipedia.org

AI-generated content may contain errors. Please verify critical information