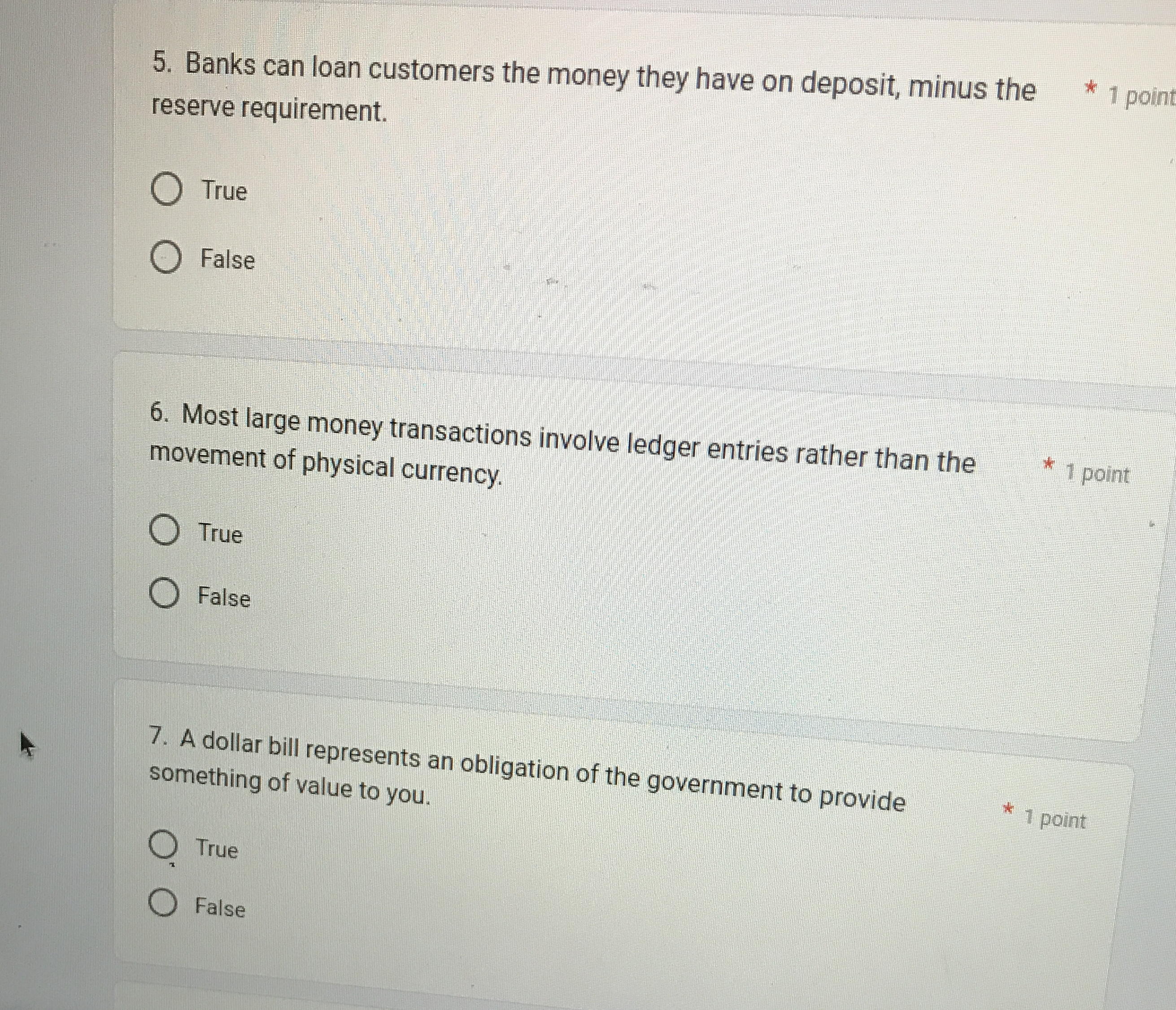

1. Banks can loan customers the money they have on deposit, minus the reserve requirement. 2. Most large money transactions involve ledger entries rather than the movement of physi... 1. Banks can loan customers the money they have on deposit, minus the reserve requirement. 2. Most large money transactions involve ledger entries rather than the movement of physical currency. 3. A dollar bill represents an obligation of the government to provide something of value to you.

Understand the Problem

The question is presenting multiple true/false statements related to banking and financial transactions, likely for assessment purposes. Each statement requires a determination of its accuracy based on financial knowledge.

Answer

5: True; 6: True; 7: True

5: True; 6: True; 7: True

Answer for screen readers

5: True; 6: True; 7: True

More Information

Banks use reserves to determine how much they can lend, large transactions utilize electronic transfers, and currency notes hold value by government decree.

Tips

A common mistake is thinking all transactions need physical cash. Remember, banks normally lend electronically.

Sources

- Lesson summary: banking and the expansion of the money supply - khanacademy.org

- A Lawyer's Perspective on U.S. Payment System Evolution and... - federalreserve.gov

AI-generated content may contain errors. Please verify critical information