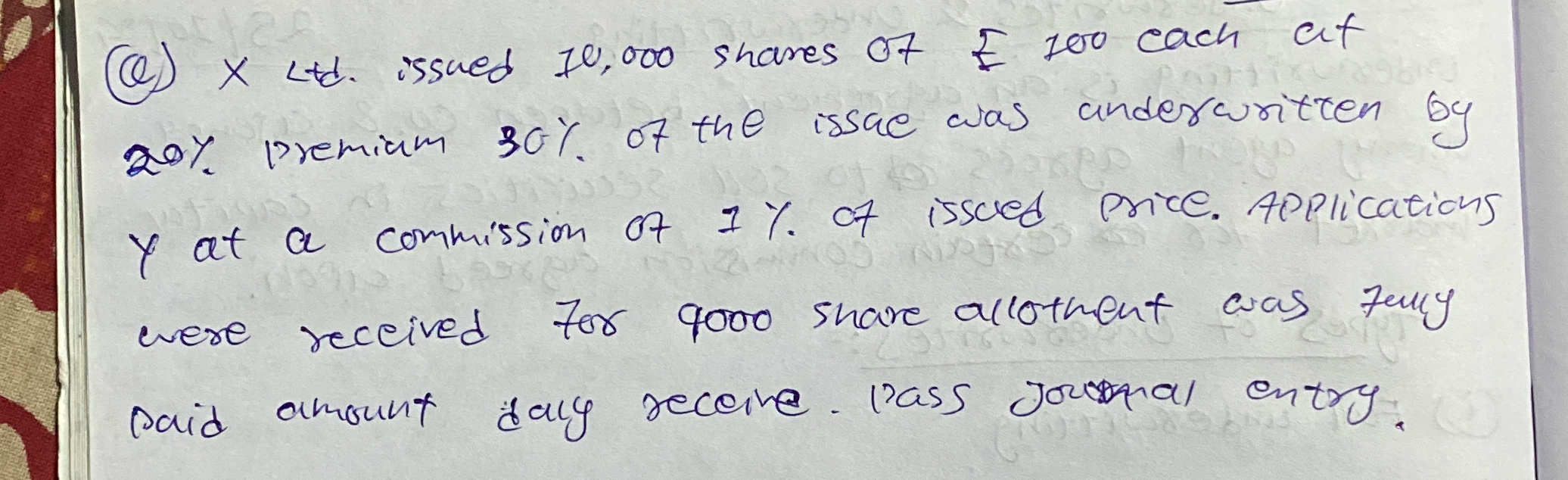

X Ltd. issued 10,000 shares of £100 each at a 20% premium. 30% of the issue was underwritten by Y at a commission of 1% of issued price. Applications were received for 9000 shares.... X Ltd. issued 10,000 shares of £100 each at a 20% premium. 30% of the issue was underwritten by Y at a commission of 1% of issued price. Applications were received for 9000 shares. Allotment was fully paid. Pass the journal entry.

Understand the Problem

The question is asking how to pass the journal entry related to the issuance of shares for X Ltd, which involves a premium and a commission and details about share allotment.

Answer

The journal entry is: ``` Bank Dr. £1,188,000 Share Capital Cr. £1,000,000 Share Premium Cr. £200,000 Commission Expense Dr. £12,000 ```

Answer for screen readers

The journal entry for the issuance of shares is:

Bank Dr. £1,188,000

Share Capital Cr. £1,000,000

Share Premium Cr. £200,000

Commission Expense Dr. £12,000

Steps to Solve

- Calculate Total Share Capital

To find the total share capital, multiply the number of shares by the nominal value per share.

Total shares = (10,000)

Nominal value per share = £100

Total share capital = (10,000 \times 100 = £1,000,000)

- Calculate Share Premium

The share premium is calculated based on the premium percentage applied to the nominal value.

Premium = 20%

Premium amount per share = (20% \times 100 = £20)

Total premium for total shares = (10,000 \times 20 = £200,000)

- Calculate Total Issued Price

The issue price per share consists of the nominal value plus the premium.

Issue price per share = Nominal value + Premium = (100 + 20 = £120)

Total amount received from the total shares issued = (10,000 \times 120 = £1,200,000)

- Determine Commission on Issued Price

The commission is charged on the issued price. The commission percentage is 1%.

Commission = 1%

Commission amount per share = (1% \times 120 = £1.20)

Total commission = (10,000 \times 1.20 = £12,000)

- Record Journal Entry

We need to record the journal entry for the share allotment:

- Debit "Bank" for the total amount received after commission

- Credit "Share Capital" for the total share capital

- Credit "Share Premium" for the total premium

- Debit "Commission" for the total commission amount if applicable.

The total bank amount would be:

Total received - Total commission = (1,200,000 - 12,000 = £1,188,000)

- Construct the Journal Entry

The journal entry should look like this:

Bank Dr. £1,188,000

Share Capital Cr. £1,000,000

Share Premium Cr. £200,000

Commission Expense Dr. £12,000

The journal entry for the issuance of shares is:

Bank Dr. £1,188,000

Share Capital Cr. £1,000,000

Share Premium Cr. £200,000

Commission Expense Dr. £12,000

More Information

The entry reflects the net amount received from the issue of shares, accounting for both the share premium and any commissions paid. This illustrates the accounting treatment involved in share issuance and its implications for a company's financial records.

Tips

- Failing to include the share premium or commission in the calculations.

- Miscalculating the net amount received after deducting the commission.

AI-generated content may contain errors. Please verify critical information