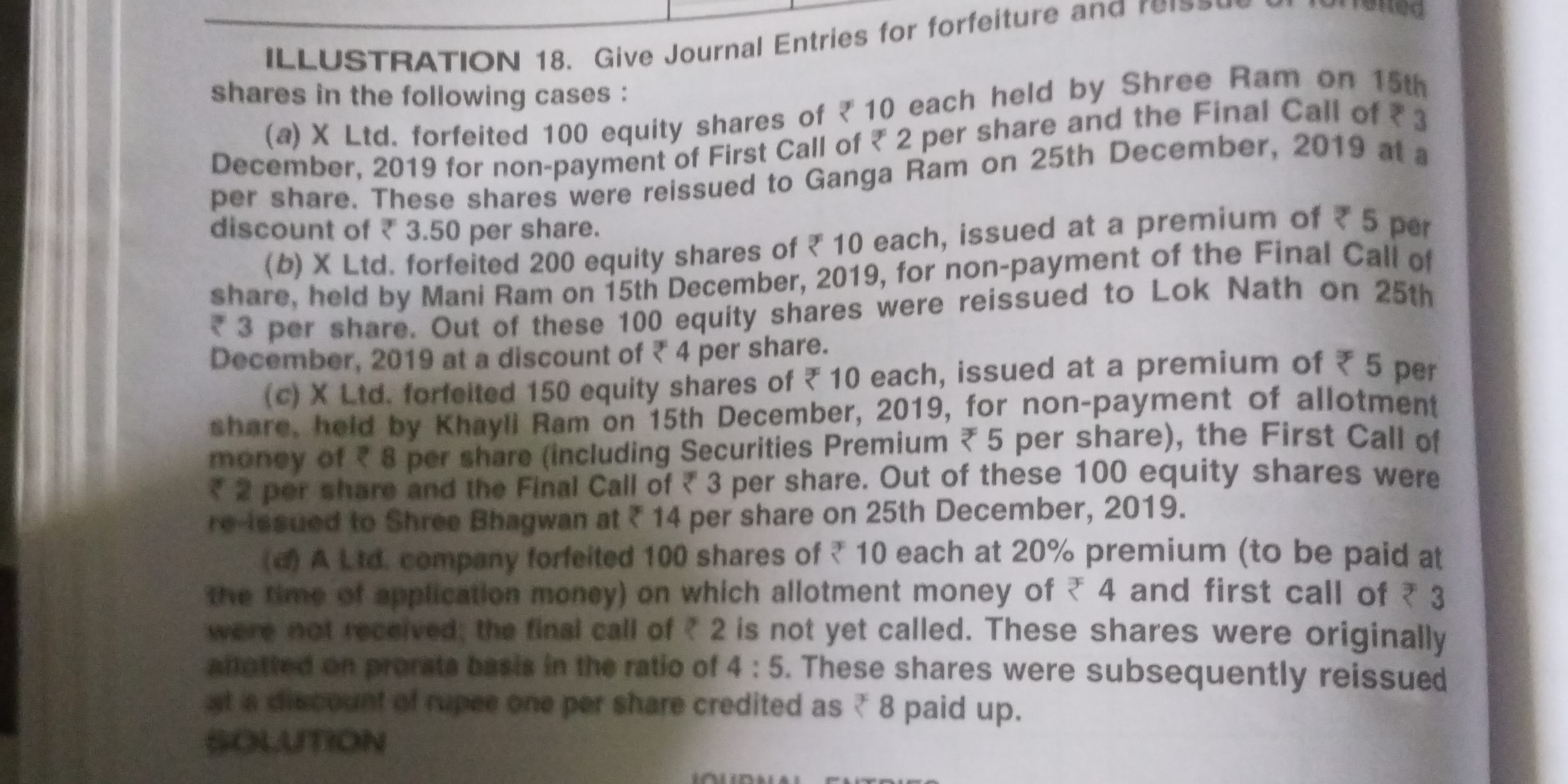

Give Journal Entries for forfeiture and reissue of forfeited shares in the following cases: (a) X Ltd. forfeited 100 equity shares of ₹ 10 each held by Shree Ram on 15th December,... Give Journal Entries for forfeiture and reissue of forfeited shares in the following cases: (a) X Ltd. forfeited 100 equity shares of ₹ 10 each held by Shree Ram on 15th December, 2019 for non-payment of First Call of ₹ 2 per share. These shares were reissued to Ganga Ram on 25th December, 2019 at a discount of ₹ 3.50 per share. (b) X Ltd. forfeited 200 equity shares of ₹ 10 each, held by Mani Ram on 15th December, 2019 for non-payment of the Final Call of ₹ 3 per share. Out of these 100 equity shares were reissued to Lok Nath on 25th December, 2019 at a discount of ₹ 4 per share. (c) X Ltd. forfeited 150 equity shares of ₹ 10 each, held by Khayli Ram on 15th December, 2019 for non-payment of allotment money of ₹ 8 per share (including Securities Premium ₹ 5 per share), the First Call of ₹ 2 per share and the Final Call of ₹ 3 per share. Out of these 100 equity shares were re-issued to Shree Bhagwan at ₹ 14 per share on 25th December, 2019. (d) A Ltd. company forfeited 100 shares of ₹ 10 each at 20% premium (to be paid at the time of application money) on which allotment money of ₹ 4 and first call of ₹ 3 were not received. The final call of ₹ 2 is not yet called. These shares were originally allotted on pro-rata basis in the ratio of 4 : 5. These shares were subsequently reissued at a discount of ₹ 8 per share credited as ₹ 8 paid up.

Understand the Problem

The question is asking for the journal entries related to the forfeiture and reissue of shares in various scenarios involving different shareholders and amounts. It involves accounting treatment for transactions concerning equity shares that were not paid for.

Answer

The journal entries include forfeiture and reissue of shares with respective amounts and accounts updated in the company's ledger.

Answer for screen readers

The final journal entries for each case are:

-

Forfeiture of Shares Held by Shree Ram:

Dr. Calls in Arrear A/C ₹200 Dr. Final Call A/C ₹300 Cr. Share Capital A/C ₹1000 -

Reissue of Shares to Ganga Ram:

Dr. Bank A/C ₹650 Dr. Discount on Reissue A/C ₹350 Cr. Share Capital A/C ₹1000 -

Forfeiture of Shares Held by Mani Ram:

Dr. Final Call A/C ₹600 Dr. Share Premium A/C ₹1000 Cr. Share Capital A/C ₹2000 -

Reissue of Shares to Lok Nath:

Dr. Bank A/C ₹1400 Cr. Share Capital A/C ₹1000 Cr. Share Premium A/C ₹400 -

Forfeiture of Shares Held by Khayil Ram:

Dr. Allotment A/C ₹1200 Dr. First Call A/C ₹450 Cr. Share Capital A/C ₹1500 -

Reissue of Shares to Shree Bhagwan:

Dr. Bank A/C ₹2100 Cr. Share Capital A/C ₹1500 Cr. Share Premium A/C ₹750 -

Forfeiture of Shares from A Ltd.:

Dr. Calls in Arrear A/C ₹400 Cr. Share Capital A/C ₹1000

Steps to Solve

-

Forfeiting Shares Held by Shree Ram

First, we need to record the forfeiture of 100 shares of ₹10 each for non-payment of the first call of ₹2 and the final call of ₹3.

The journal entry will be:

- Debit: Share Capital Account ₹1000 (100 shares × ₹10)

- Credit: Calls in Arrear Account ₹200 (100 shares × ₹2)

- Credit: Final Call Account ₹300 (100 shares × ₹3)

So, the journal entry is:

Dr. Calls in Arrear A/C ₹200 Dr. Final Call A/C ₹300 Cr. Share Capital A/C ₹1000 -

Reissuing Shares to Ganga Ram

Next, record the reissue of these shares at a discount of ₹3.50, meaning the amount received would be ₹6.50 per share (₹10 - ₹3.50).

The journal entry will be:

- Debit: Bank Account ₹650 (100 shares × ₹6.50)

- Credit: Share Capital Account ₹1000

- Debit: Discount on Reissue of Shares Account ₹350 (100 shares × ₹3.50)

So, the journal entry is:

Dr. Bank A/C ₹650 Dr. Discount on Reissue A/C ₹350 Cr. Share Capital A/C ₹1000 -

Forfeiting Shares Held by Mani Ram

For the second case, we need to forfeit 200 shares of ₹10 each for non-payment of the final call of ₹3, where the shares are issued at a premium of ₹5.

The journal entry will be:

- Debit: Share Capital Account ₹2000 (200 shares × ₹10)

- Credit: Final Call Account ₹600 (200 shares × ₹3)

- Credit: Share Premium Account ₹1000 (200 shares × ₹5)

So, the journal entry is:

Dr. Final Call A/C ₹600 Dr. Share Premium A/C ₹1000 Cr. Share Capital A/C ₹2000 -

Reissuing Shares to Lok Nath

Next, record the reissue of 100 shares at a premium of ₹4. The amount received would be ₹14 per share (₹10 + ₹4).

The journal entry will be:

- Debit: Bank Account ₹1400 (100 shares × ₹14)

- Credit: Share Capital Account ₹1000

- Credit: Share Premium Account ₹400 (100 shares × ₹4)

So, the journal entry is:

Dr. Bank A/C ₹1400 Cr. Share Capital A/C ₹1000 Cr. Share Premium A/C ₹400 -

Forfeiting Shares Held by Khayil Ram

Here, we forfeit 150 shares for non-payment of the allotment money of ₹8, and the first and final calls.

The journal entry will be:

- Debit: Share Capital Account ₹1500 (150 shares × ₹10)

- Credit: Allotment Account ₹1200 (150 shares × ₹8)

- Credit: First Call Account ₹450 (150 shares × ₹3)

So, the journal entry is:

Dr. Allotment A/C ₹1200 Dr. First Call A/C ₹450 Cr. Share Capital A/C ₹1500 -

Reissuing Shares to Shree Bhagwan

Finally, record the reissue of these 100 shares at ₹14 each.

The journal entry will be:

- Debit: Bank Account ₹2100 (150 shares × ₹14)

- Credit: Share Capital Account ₹1500

- Credit: Premium Account ₹750 (150 shares × ₹5)

So, the journal entry is:

Dr. Bank A/C ₹2100 Cr. Share Capital A/C ₹1500 Cr. Share Premium A/C ₹750 -

Forfeiting Shares from A Ltd.

For the last case, 100 shares of ₹10 each with an allotment money of ₹4 are forfeited.

The journal entry for forfeiture:

- Debit: Share Capital Account ₹1000 (100 shares × ₹10)

- Credit: Calls in Arrear Account ₹400 (100 shares × ₹4)

So, the journal entry is:

Dr. Calls in Arrear A/C ₹400 Cr. Share Capital A/C ₹1000

The final journal entries for each case are:

-

Forfeiture of Shares Held by Shree Ram:

Dr. Calls in Arrear A/C ₹200 Dr. Final Call A/C ₹300 Cr. Share Capital A/C ₹1000 -

Reissue of Shares to Ganga Ram:

Dr. Bank A/C ₹650 Dr. Discount on Reissue A/C ₹350 Cr. Share Capital A/C ₹1000 -

Forfeiture of Shares Held by Mani Ram:

Dr. Final Call A/C ₹600 Dr. Share Premium A/C ₹1000 Cr. Share Capital A/C ₹2000 -

Reissue of Shares to Lok Nath:

Dr. Bank A/C ₹1400 Cr. Share Capital A/C ₹1000 Cr. Share Premium A/C ₹400 -

Forfeiture of Shares Held by Khayil Ram:

Dr. Allotment A/C ₹1200 Dr. First Call A/C ₹450 Cr. Share Capital A/C ₹1500 -

Reissue of Shares to Shree Bhagwan:

Dr. Bank A/C ₹2100 Cr. Share Capital A/C ₹1500 Cr. Share Premium A/C ₹750 -

Forfeiture of Shares from A Ltd.:

Dr. Calls in Arrear A/C ₹400 Cr. Share Capital A/C ₹1000

More Information

These journal entries represent the proper accounting treatment for the forfeiture and reissue of shares, illustrating the impact on various accounts such as Share Capital, Calls in Arrear, and Premium.

Tips

- Failing to correctly calculate the amounts for the share forfeiture or reissue.

- Not accounting for the premium when reissuing shares.

- Misclassifying amounts; for instance, treating discounts incorrectly.

AI-generated content may contain errors. Please verify critical information