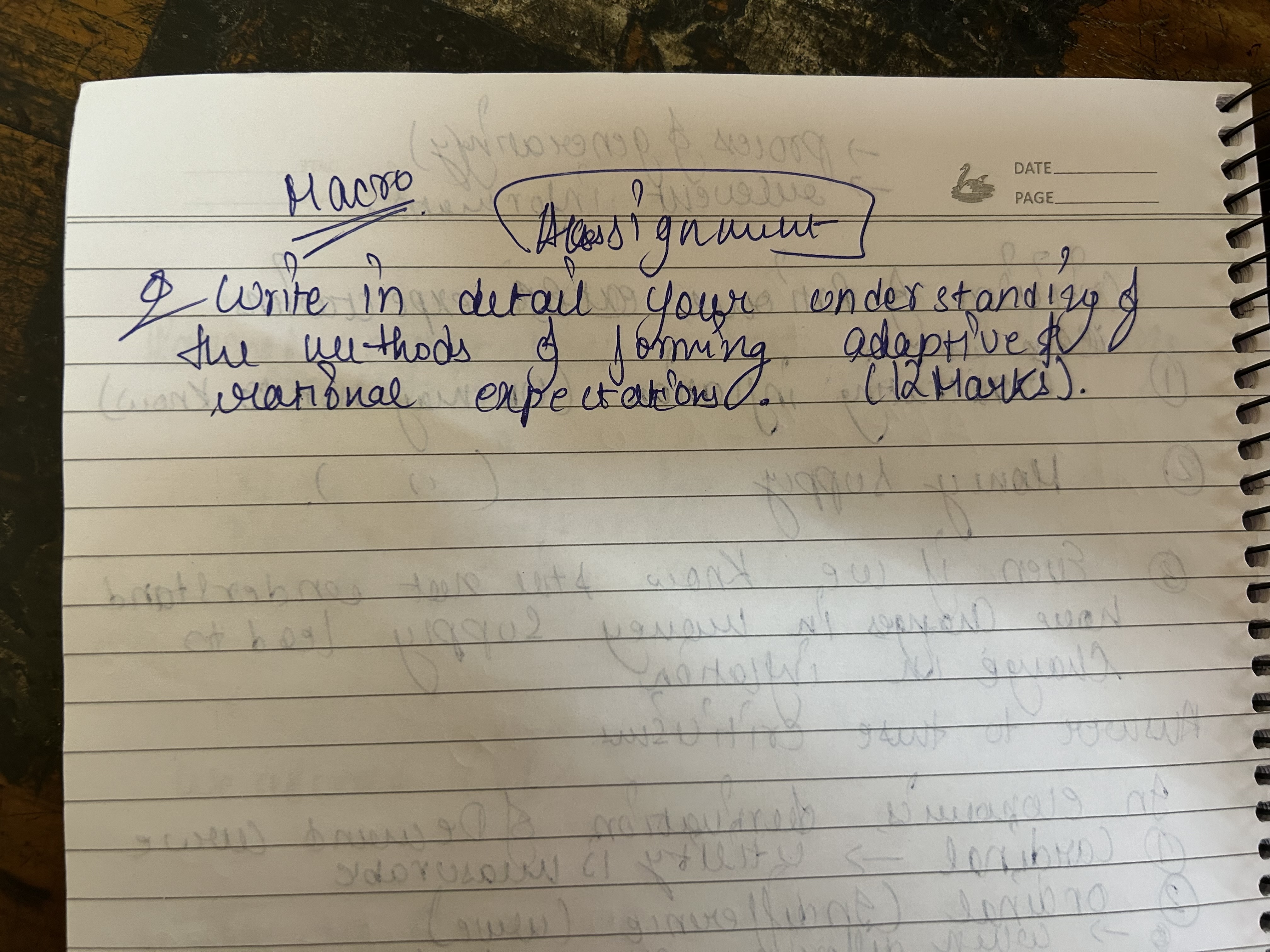

Write in detail your understanding of the methods of forming adaptive rational expectations. (12 Marks)

Understand the Problem

The question is asking for a detailed written explanation of the methods used to form adaptive rational expectations, which is likely related to economic theory. The user is expected to provide a comprehensive understanding of this concept.

Answer

Adaptive expectations are formed based on past experiences, adjusting as new data becomes available. Rational expectations assume individuals use all available information to make predictions.

Adaptive expectations is a theory stating that individuals form their expectations about future values of certain economic variables (such as inflation) based on past values of that variable. Here's a detailed look at the methods of forming adaptive and rational expectations for a comprehensive understanding:

-

Adaptive Expectations: Method of Forming

- Overview: People adjust their expectations of the future based on past experiences. The simplest form is given by E(t)(X(t+1)) = X(t-1) + λ (X(t) - X(t-1)), where λ is a coefficient between 0 and 1.

- Key Features: Initially, individuals form expectations using past data; as new data becomes available, they adjust their expectations accordingly.

- Example: If inflation was 3% last year and people expect inflation to remain the same unless new data suggests otherwise.

- Mathematical Representation: Often depicted in equations, where past periods' errors and actual values determine future expectations.

- Limitations: This method may be slower to adapt if there are sudden changes, and assumes constant error adjustment over time.

- Usage in Economics: Used in models such as the Phillips curve, which relates inflation and unemployment.

-

Rational Expectations: Method of Forming

- Overview: People use all available information (including expectations about future policy) rather than just past data. They make forecasts based on a deep understanding of economic models.

- Key Features: Assumes individuals are perfectly informed and can predict future variables correctly on average.

- Example: Individuals might forecast inflation by considering both past trends and future monetary policy changes.

- Mathematical Representation: Expectations are model-consistent; depicted as E(t)(X(t+1)) = E(model)(X(t+1)), where E(model) indicates expectations derived from the model.

- Limitations: Requires individuals to be highly informed and rational, which may not always be realistic.

- Usage in Economics: Often used in modern macroeconomic models, such as the Lucas critique of econometric policy, which asserts that agents' expectations should be consistent with the model.

-

Comparative Analysis

- Speed of Adjustment: Rational expectations adjust immediately to new information, whereas adaptive expectations adjust more slowly, based on past errors.

- Model Consistency: Rational expectations assume perfect knowledge of the economy’s functioning, while adaptive expectations rely purely on historical data.

- Realism: Adaptive expectations are simpler and often closer to real-world behaviors, though less precise.

- Policy Implications: Rational expectations suggest policy ineffectiveness under certain conditions because people anticipate the effects of policy changes.

In summary, while adaptive expectations offer a straightforward way of predicting future outcomes based on past trends, rational expectations provide a more complex, model-consistent approach that assumes individuals use all available data to make forecasts.

Answer for screen readers

Adaptive expectations is a theory stating that individuals form their expectations about future values of certain economic variables (such as inflation) based on past values of that variable. Here's a detailed look at the methods of forming adaptive and rational expectations for a comprehensive understanding:

-

Adaptive Expectations: Method of Forming

- Overview: People adjust their expectations of the future based on past experiences. The simplest form is given by E(t)(X(t+1)) = X(t-1) + λ (X(t) - X(t-1)), where λ is a coefficient between 0 and 1.

- Key Features: Initially, individuals form expectations using past data; as new data becomes available, they adjust their expectations accordingly.

- Example: If inflation was 3% last year and people expect inflation to remain the same unless new data suggests otherwise.

- Mathematical Representation: Often depicted in equations, where past periods' errors and actual values determine future expectations.

- Limitations: This method may be slower to adapt if there are sudden changes, and assumes constant error adjustment over time.

- Usage in Economics: Used in models such as the Phillips curve, which relates inflation and unemployment.

-

Rational Expectations: Method of Forming

- Overview: People use all available information (including expectations about future policy) rather than just past data. They make forecasts based on a deep understanding of economic models.

- Key Features: Assumes individuals are perfectly informed and can predict future variables correctly on average.

- Example: Individuals might forecast inflation by considering both past trends and future monetary policy changes.

- Mathematical Representation: Expectations are model-consistent; depicted as E(t)(X(t+1)) = E(model)(X(t+1)), where E(model) indicates expectations derived from the model.

- Limitations: Requires individuals to be highly informed and rational, which may not always be realistic.

- Usage in Economics: Often used in modern macroeconomic models, such as the Lucas critique of econometric policy, which asserts that agents' expectations should be consistent with the model.

-

Comparative Analysis

- Speed of Adjustment: Rational expectations adjust immediately to new information, whereas adaptive expectations adjust more slowly, based on past errors.

- Model Consistency: Rational expectations assume perfect knowledge of the economy’s functioning, while adaptive expectations rely purely on historical data.

- Realism: Adaptive expectations are simpler and often closer to real-world behaviors, though less precise.

- Policy Implications: Rational expectations suggest policy ineffectiveness under certain conditions because people anticipate the effects of policy changes.

In summary, while adaptive expectations offer a straightforward way of predicting future outcomes based on past trends, rational expectations provide a more complex, model-consistent approach that assumes individuals use all available data to make forecasts.

More Information

By understanding the methods of forming adaptive and rational expectations, individuals can better predict future economic trends. Adaptive expectations rely on past data, making them more gradually responsive, while rational expectations incorporate all relevant information, offering a more immediate adjustment.

Tips

Common mistakes include confusing the two types of expectations (adaptive and rational) and overestimating the accuracy of rational expectations' assumption of perfect information.

Sources

- Rational Expectations Theory Definition and How It Works - investopedia.com

- Chapter 4 Expectations | Macroeconomics - Bookdown - bookdown.org

- Adaptive expectations - Wikipedia - en.wikipedia.org

AI-generated content may contain errors. Please verify critical information