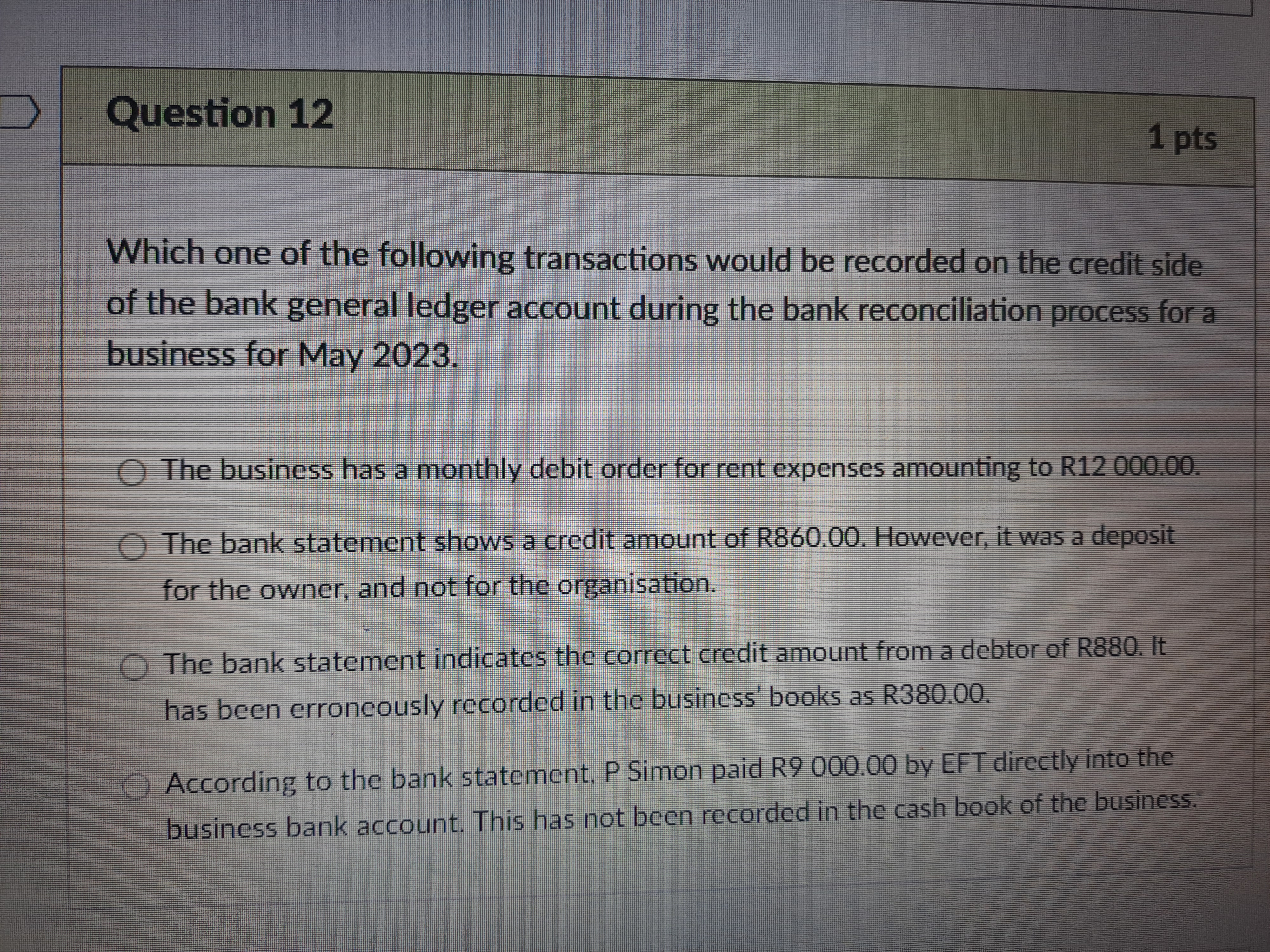

Which one of the following transactions would be recorded on the credit side of the bank general ledger account during the bank reconciliation process for a business for May 2023?

Understand the Problem

The question is asking which transaction should be recorded on the credit side of the bank general ledger for a business in May 2023 as part of the bank reconciliation process. It involves understanding accounting principles related to debits and credits in financial statements.

Answer

The correct credit amount from a debtor: R880.

The correct transaction is: 'The bank statement indicates the correct credit amount from a debtor of R880. It has been erroneously recorded in the business' books as R380.00.'

Answer for screen readers

The correct transaction is: 'The bank statement indicates the correct credit amount from a debtor of R880. It has been erroneously recorded in the business' books as R380.00.'

More Information

In a bank reconciliation process, credit entries typically reflect deposits received by the bank on behalf of the business. Thus, any corrections involving such deposits are credit transactions.

Tips

A common mistake is assuming withdrawals or expenses would be credited. Instead, focus on deposits or receipts.

Sources

- Bank Reconciliation: Purpose, Example, Process - QuickBooks - Intuit - quickbooks.intuit.com

AI-generated content may contain errors. Please verify critical information