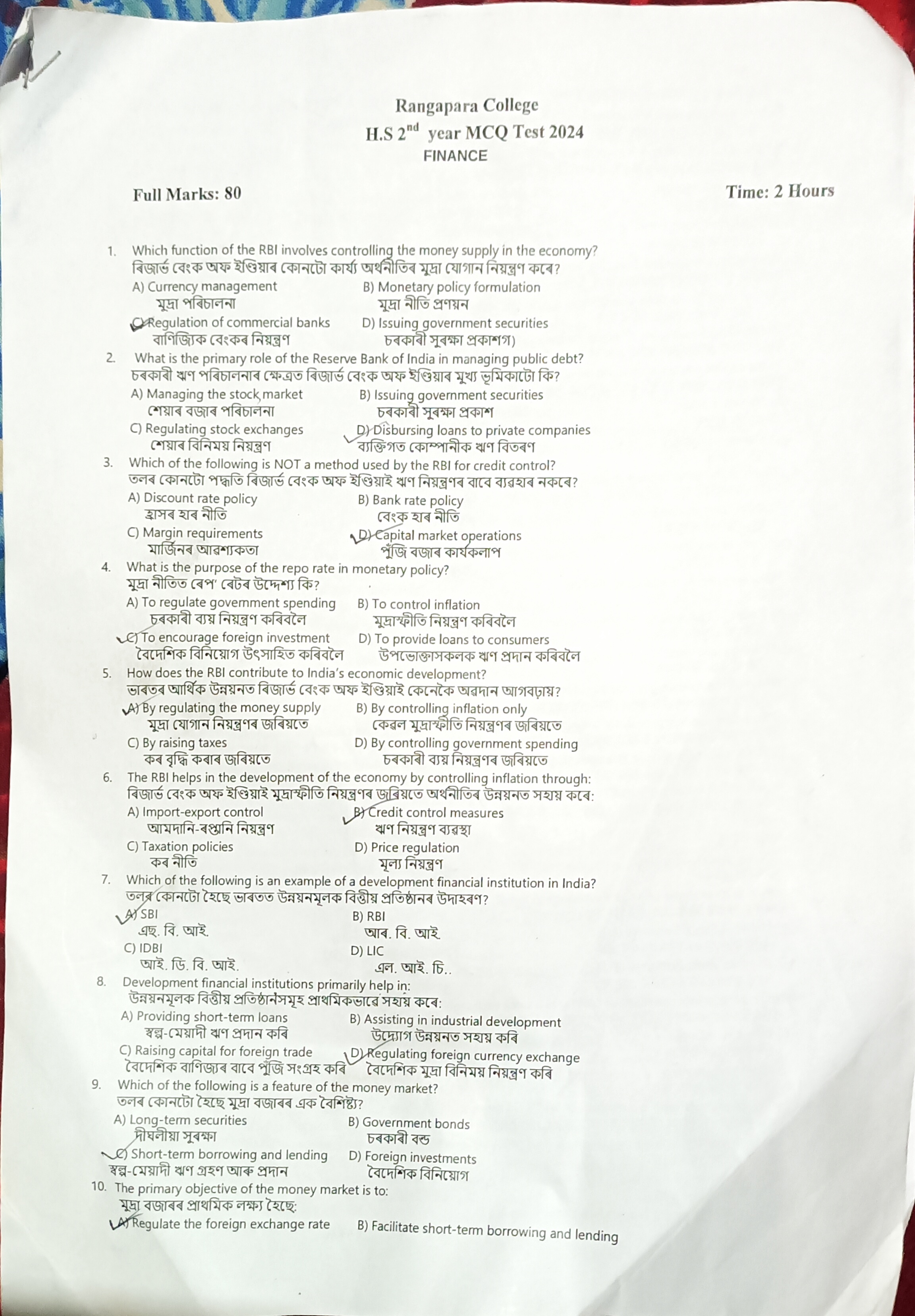

Which function of the RBI involves controlling the money supply in the economy? What is the primary role of the Reserve Bank of India in managing public debt? Which of the followin... Which function of the RBI involves controlling the money supply in the economy? What is the primary role of the Reserve Bank of India in managing public debt? Which of the following is NOT a method used by the RBI for credit control? What is the purpose of the repo rate in monetary policy? How does the RBI contribute to India’s economic development? Which of the following is an example of a development financial institution in India? Development financial institutions primarily help in? Which of the following is a feature of the money market?

Understand the Problem

The question is an examination paper consisting of multiple-choice questions related to finance and the functions of the Reserve Bank of India.

Answer

1) Regulation of commercial banks, 2) Issuing government securities, 3) Capital market operations, 4) To control inflation, 5) Regulating money supply, 6) Credit control measures, 7) IDBI, 8) Assisting in industrial development, 9) Facilitate short-term borrowing and lending

- Regulation of commercial banks, 2) Issuing government securities, 3) Capital market operations, 4) To control inflation, 5) By regulating the money supply, 6) Credit control measures, 7) IDBI, 8) Assisting in industrial development, 9) Facilitate short-term borrowing and lending

Answer for screen readers

- Regulation of commercial banks, 2) Issuing government securities, 3) Capital market operations, 4) To control inflation, 5) By regulating the money supply, 6) Credit control measures, 7) IDBI, 8) Assisting in industrial development, 9) Facilitate short-term borrowing and lending

More Information

The RBI uses various monetary tools, such as regulating interest rates and credit policies, to control the money supply and inflation. Development financial institutions like IDBI play a key role in providing long-term finance for industrial development.

Tips

A common mistake is confusing the tools of monetary policy and credit control with fiscal policy measures handled by the government.

Sources

- Reserve Bank of India - Wikipedia - en.wikipedia.org

- Understanding Reserve Bank of India (RBI) and Its Role - Acquire.Fi - acquire.fi

- Monetary Policy in India: The RBI's Balancing Act, Interest Rates - linkedin.com

AI-generated content may contain errors. Please verify critical information