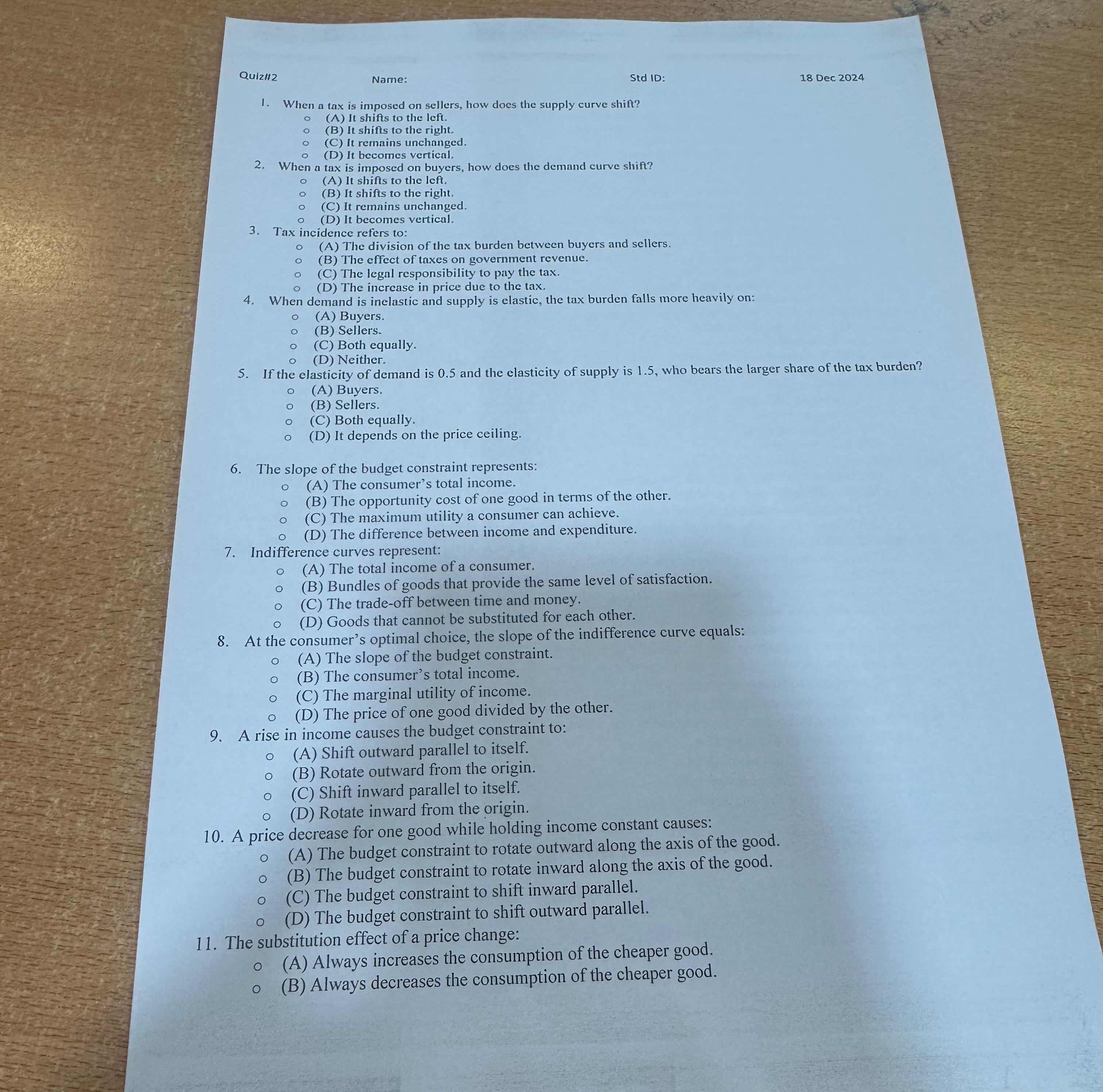

When a tax is imposed on sellers, how does the supply curve shift? When a tax is imposed on buyers, how does the demand curve shift? Tax incidence refers to: When demand is inelast... When a tax is imposed on sellers, how does the supply curve shift? When a tax is imposed on buyers, how does the demand curve shift? Tax incidence refers to: When demand is inelastic and supply is elastic, the tax burden falls more heavily on buyers or sellers? If the elasticity of demand is 0.5 and the elasticity of supply is 1.5, who bears the larger share of the tax burden? The slope of the budget constraint represents: Indifference curves represent: At the consumer's optimal choice, the slope of the indifference curve equals: A rise in income causes the budget constraint to: A price decrease for one good while holding income constant causes: The substitution effect of a price change.

Understand the Problem

The question set comprises multiple-choice questions related to economic concepts, such as supply and demand curves, tax burdens, elasticities, budget constraints, and consumer behavior in economics.

Answer

1. Shifts left. 2. Shifts down. 3. Division of burdens. 4. Buyers. 5. Buyers. 6. Opportunity cost. 7. Bundles of goods. 8. The price ratio. 9. Shift outward. 10. Shift outward. 11. Increases consumption.

- Shifts left. 2. Shifts down. 3. Division of burdens. 4. Buyers. 5. Buyers. 6. Opportunity cost. 7. Bundles of goods. 8. The price ratio. 9. Shift outward. 10. Shift outward. 11. Increases consumption.

Answer for screen readers

- Shifts left. 2. Shifts down. 3. Division of burdens. 4. Buyers. 5. Buyers. 6. Opportunity cost. 7. Bundles of goods. 8. The price ratio. 9. Shift outward. 10. Shift outward. 11. Increases consumption.

More Information

When a tax is imposed on sellers, the supply curve shifts to the left due to increased costs. If on buyers, demand shifts down. Tax incidence shows burden distribution—elasticity influences who pays more. Optimal choice and budget constraints relate to trade-offs and utility maximization.

Tips

Confusing supply/demand curve shifts. Remember taxes on sellers affect supply, typically shifting it left. On buyers, demand shifts down.

Sources

- Tax Incidence | Microeconomics - Lumen Learning - courses.lumenlearning.com

- Elasticity and tax revenue (article) - Khan Academy - khanacademy.org

AI-generated content may contain errors. Please verify critical information