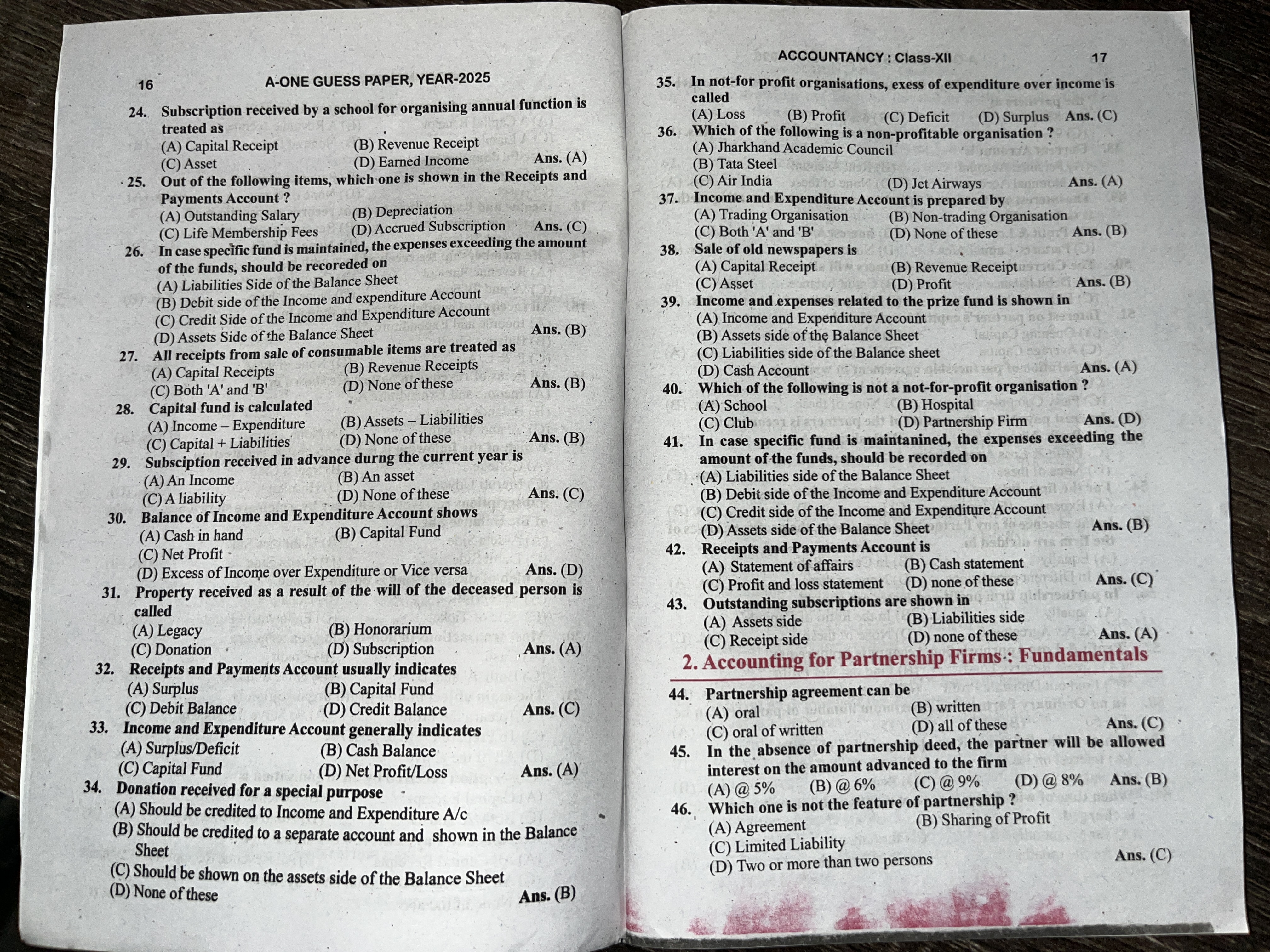

What is the treatment of subscription received by a school for organizing an annual function?

Understand the Problem

The question is part of a guess paper for an Accountancy exam, specifically focusing on topics such as subscriptions, receipts, and the accounting treatment for various financial transactions relevant to non-profit organisations and partnerships.

Answer

Capital Receipt.

The final answer is Capital Receipt.

Answer for screen readers

The final answer is Capital Receipt.

More Information

This subscription is treated as a capital receipt because it is a one-time, significant amount collected for a specific purpose, rather than regular income.

Tips

A common mistake is to classify it as a revenue receipt; however, this type of income is not earned regularly.

Sources

- Subscription received by a school - Byju's - byjus.com

AI-generated content may contain errors. Please verify critical information