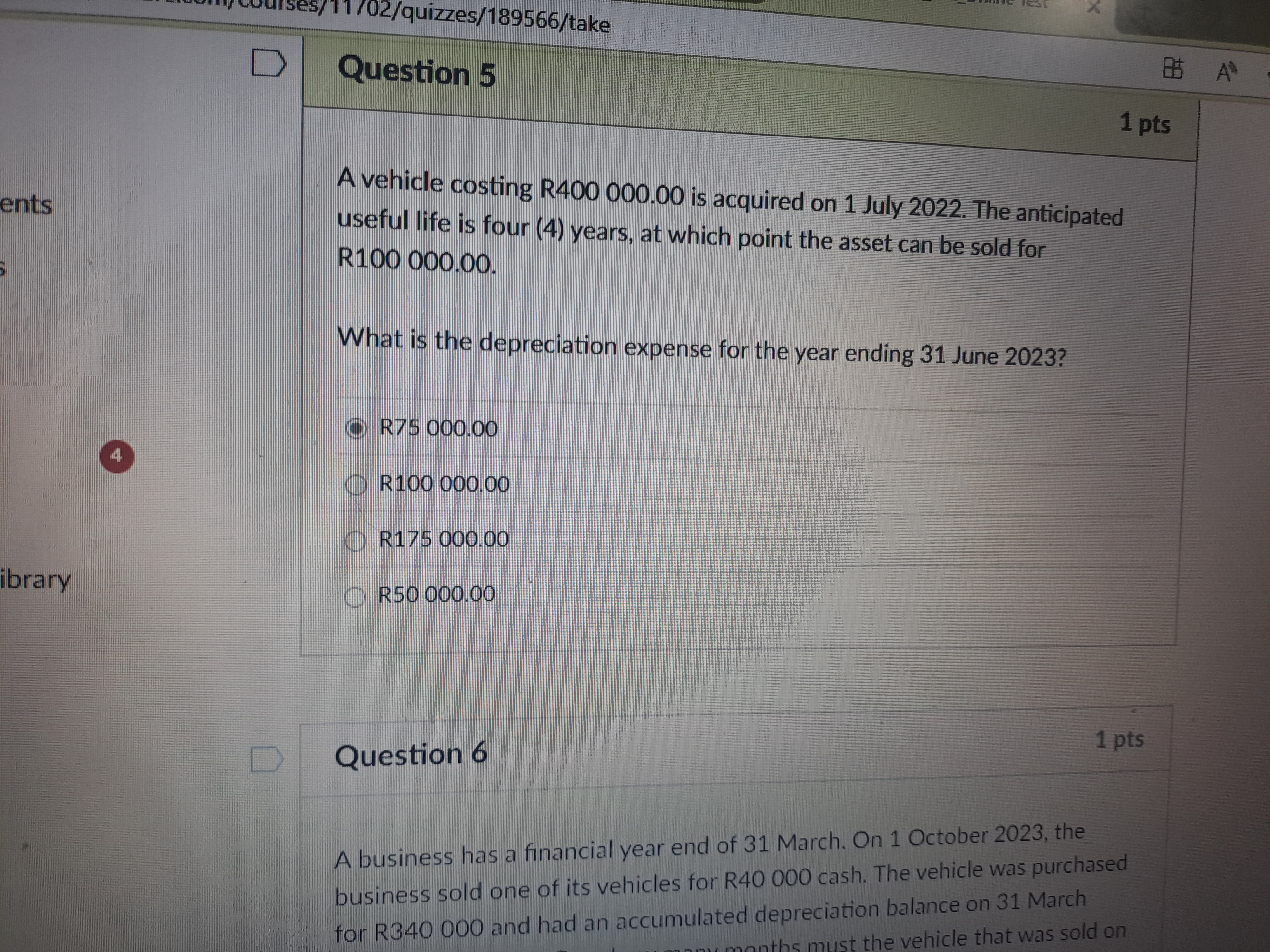

What is the depreciation expense for the year ending 31 June 2023?

Understand the Problem

The question is asking to calculate the depreciation expense for a vehicle that was acquired on 1 July 2022, given its cost, useful life, and resale value. The depreciation needs to be determined for the year ending 31 June 2023.

Answer

The depreciation expense for the year ending 31 June 2023 is R75,000.

Answer for screen readers

The depreciation expense for the year ending 31 June 2023 is R75,000.

Steps to Solve

- Identify Depreciation Method

Here, we will use the straight-line method of depreciation. This means the depreciation expense will be the same each year.

- Calculate Depreciation Expense

The formula for straight-line depreciation is: $$ \text{Depreciation Expense} = \frac{\text{Cost} - \text{Salvage Value}}{\text{Useful Life}} $$

Substituting the given values:

- Cost = R400,000

- Salvage Value = R100,000

- Useful Life = 4 years

The depreciation expense is calculated as follows: $$ \text{Depreciation Expense} = \frac{400,000 - 100,000}{4} = \frac{300,000}{4} = 75,000 $$

- Determine the Depreciation for the relevant period

Since the vehicle was acquired on 1 July 2022 and we are calculating depreciation for the year ending 31 June 2023, it accounts for the full year.

Therefore, the depreciation expense for the year is R75,000.

The depreciation expense for the year ending 31 June 2023 is R75,000.

More Information

Depreciation helps businesses account for the wear and tear of their assets over time. Using the straight-line method allows for predictable expense allocation across the asset's useful life.

Tips

- Mistaking the salvage value or useful life, which can alter the calculated depreciation.

- Not accounting for the correct time frame in which the asset was held, leading to underestimating or overestimating the depreciation expense.

AI-generated content may contain errors. Please verify critical information