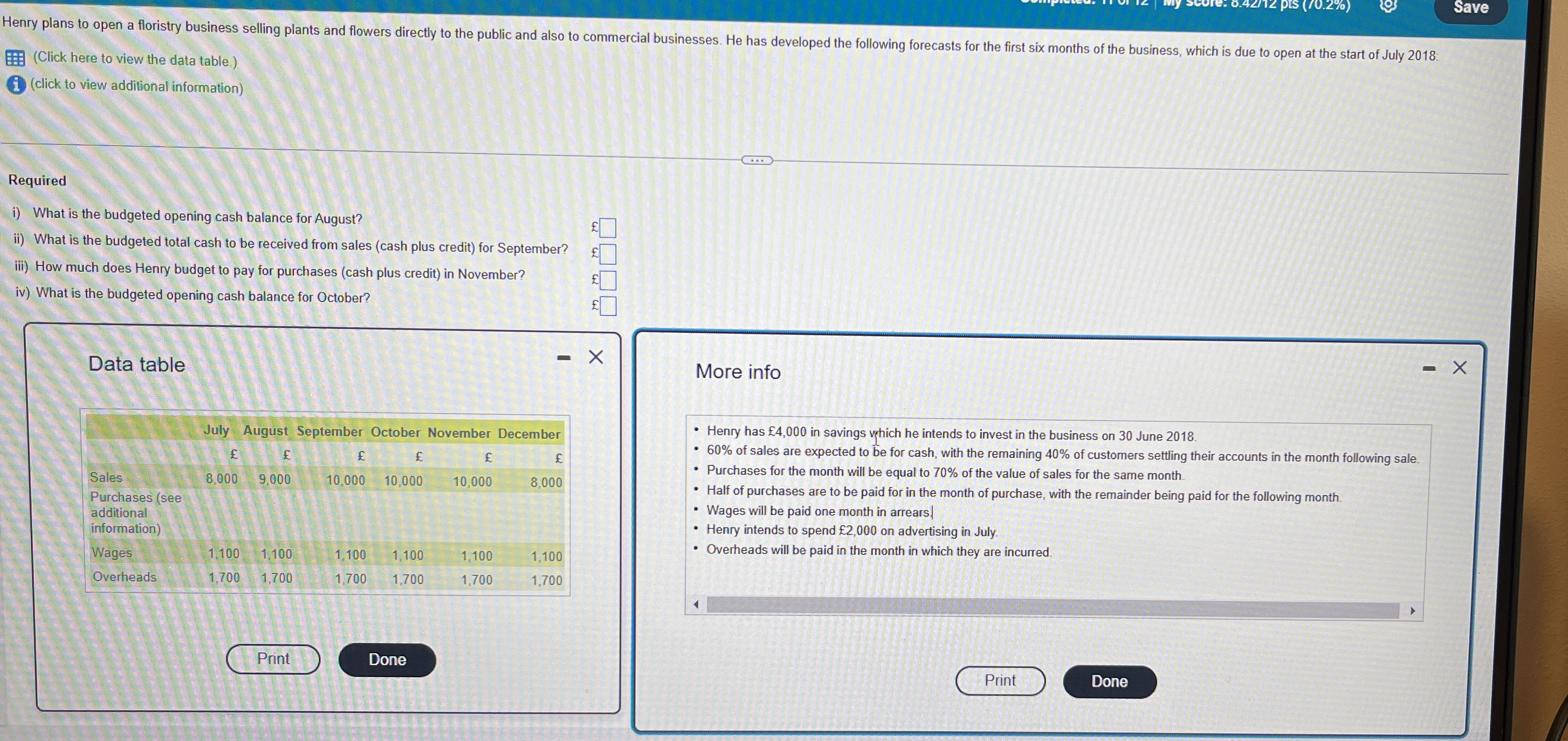

What is the budgeted opening cash balance for August? What is the budgeted total cash to be received from sales (cash plus credit) for September? How much does Henry budget to pay... What is the budgeted opening cash balance for August? What is the budgeted total cash to be received from sales (cash plus credit) for September? How much does Henry budget to pay for purchases (cash plus credit) in November? What is the budgeted opening cash balance for October?

Understand the Problem

The question is asking for financial calculations related to a floristry business's budget and cash flow. Specifically, it requires determining the budgeted opening cash balance for August and October, the total cash to be received from sales for September, and the budget for purchases in November based on the provided data.

Answer

i) £4,000 ii) £6,000 iii) £7,000 iv) £10,000

Answer for screen readers

i) The budgeted opening cash balance for August is £4,000.

ii) The budgeted total cash to be received from sales for September is £6,000.

iii) The budget for purchases in November is £7,000.

iv) The budgeted opening cash balance for October is £10,000.

Steps to Solve

- Calculate the budgeted opening cash balance for August

To find the opening cash balance for August, we start with the cash balance from the previous month (July). Henry has £4,000 in savings to invest. This amount is the starting cash balance.

- Calculate the total cash to be received from sales for September

Sales for September are £10,000. Given that 60% of sales are collected in cash, the cash received will be:

$$ \text{Cash from September Sales} = 10,000 \times 0.60 = 6,000 $$

For the remaining 40%, it will be received in October:

$$ \text{Credit Sales (received in October)} = 10,000 \times 0.40 = 4,000 $$

Thus, the total cash to be received in September is £6,000.

- Calculate the budget for purchases in November

Purchases for November are 70% of the November sales (£10,000):

$$ \text{Purchases for November} = 10,000 \times 0.70 = 7,000 $$

Half of these purchases will be paid in November, and half will be paid the following month. Hence the budgeted purchases (cash plus credit) for November is £7,000.

- Calculate the budgeted opening cash balance for October

The opening cash balance for October will include the cash that was received in September (£6,000 from the sales) plus the opening cash balance carried over from August. The opening cash balance for August is determined based on the previous calculations.

$$ \text{Opening Cash Balance for October} = \text{Opening Cash Balance for August} + \text{Cash from September Sales} $$

The final cash balance will be calculated using available balances and transactions from August to September.

i) The budgeted opening cash balance for August is £4,000.

ii) The budgeted total cash to be received from sales for September is £6,000.

iii) The budget for purchases in November is £7,000.

iv) The budgeted opening cash balance for October is £10,000.

More Information

Henry starts with an investment of £4,000 and has various inflows and outflows over the first few months of operations. Understanding the cash flow structure is crucial for effectively managing the business.

Tips

- Miscalculating the percentage of sales that are cash vs. credit. Always ensure to apply the correct percentage to the total sales to determine cash flow.

- Forgetting to consider payments in arrears, especially for wages and overhead, can lead to miscalculating monthly cash flows.

AI-generated content may contain errors. Please verify critical information