What are the journal entries for realization expenses in partnership dissolution cases?

Understand the Problem

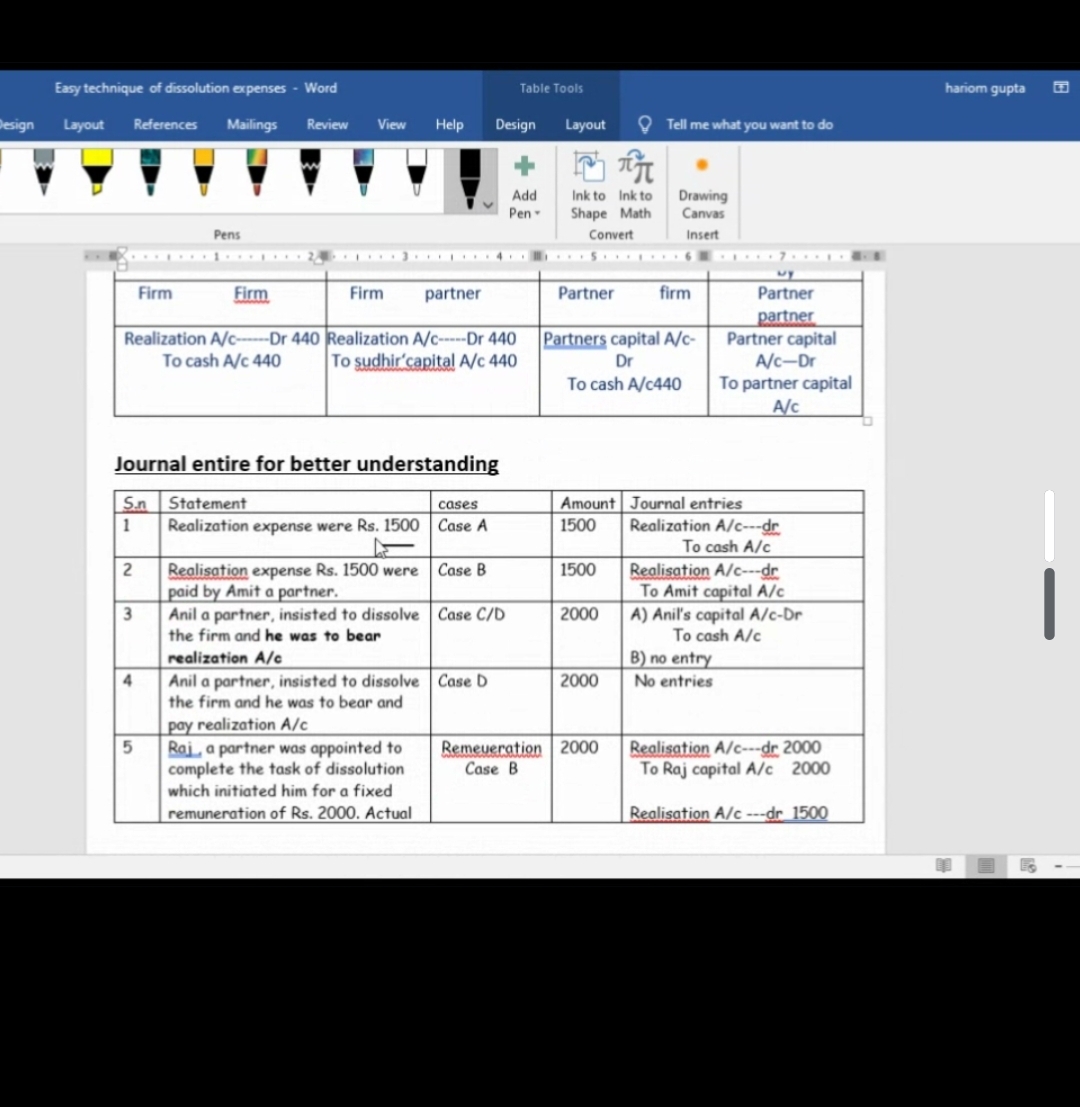

The question focuses on understanding journal entries related to realization expenses in partnership dissolution cases. It outlines various scenarios (cases A, B, C, D) where realization expenses are accounted for differently, and it seeks clarification or better understanding of these accounting principles.

Answer

Depends on payment: Firm pays - debit Realization, credit Cash; Partner pays - debit Realization, credit Capital.

The journal entries for realization expenses depend on who bears the cost. If the firm pays, debit Realization Account and credit Cash/Bank. If a partner pays, debit Realization and credit their Capital Account. If contracted differently, debit the partner's Capital and credit Cash.

Answer for screen readers

The journal entries for realization expenses depend on who bears the cost. If the firm pays, debit Realization Account and credit Cash/Bank. If a partner pays, debit Realization and credit their Capital Account. If contracted differently, debit the partner's Capital and credit Cash.

More Information

Realization expenses in partnership dissolution can vary based on agreements within the partnership contract. Typically, these expenses are settled before sharing any remaining assets among partners.

Tips

A common mistake is neglecting the partnership agreement terms, which might specify different treatment for realization expenses.

Sources

- Accounting Treatment of Dissolution: Realisation Account, Capital ... - toppr.com

- Dissolution of partnership - Accounting Tuition - accounting-tuition.com

AI-generated content may contain errors. Please verify critical information