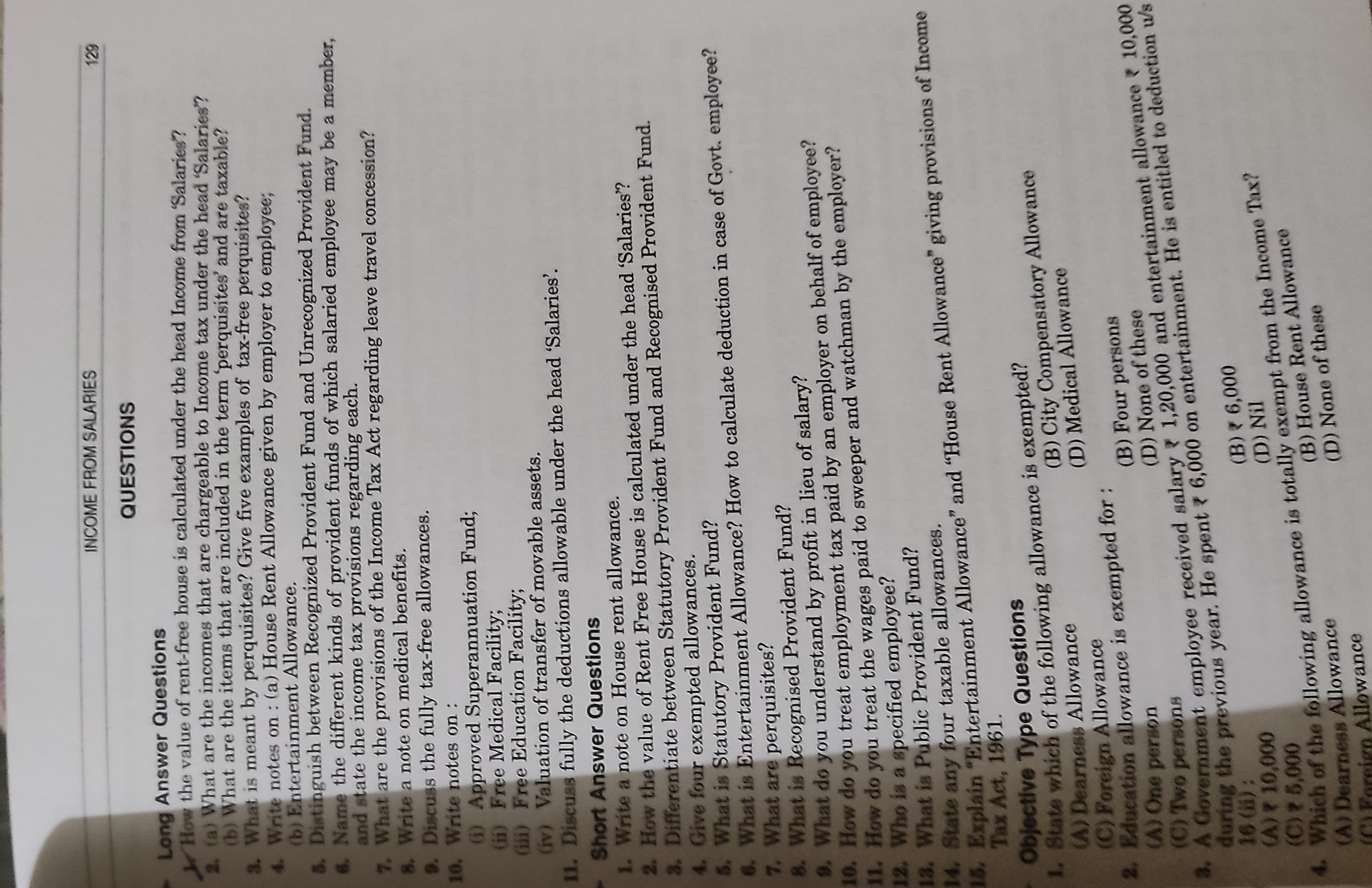

What are the incomes that are chargeable to income tax under the head 'Salaries'? Explain various examples of tax-free perquisites. What is the difference between Recognised Provid... What are the incomes that are chargeable to income tax under the head 'Salaries'? Explain various examples of tax-free perquisites. What is the difference between Recognised Provident Fund and Unrecognised Provident Fund? How is House Rent Allowance calculated under the head 'Salaries'? How to calculate deduction in case of Government employee?

Understand the Problem

The question is asking about income from salaries and its calculation, including tax implications and various allowances. It requests information about what constitutes taxable income and the relevant exemptions under the Income Tax Act.

Answer

'Salaries' include wages, gratuities, and perquisites. Recognised PF is tax-beneficial. HRA is computed based on certain calculations. Govt. employee deductions apply under sections like 80C.

Income chargeable under 'Salaries' includes wages, pensions, annuities, gratuities, and perquisites. Tax-free perquisites include medical facilities and education for dependents. Recognised Provident Fund receives tax benefits, while Unrecognised Provident Fund does not. HRA is calculated as the minimum of three components: actual HRA received, rent paid minus 10% of salary, or 50% of salary. Government employee deductions are eligible under various sections such as 80C.

Answer for screen readers

Income chargeable under 'Salaries' includes wages, pensions, annuities, gratuities, and perquisites. Tax-free perquisites include medical facilities and education for dependents. Recognised Provident Fund receives tax benefits, while Unrecognised Provident Fund does not. HRA is calculated as the minimum of three components: actual HRA received, rent paid minus 10% of salary, or 50% of salary. Government employee deductions are eligible under various sections such as 80C.

More Information

Perquisites can be both taxable and non-taxable based on conditions specified in the Income Tax Act. Recognised Provident Funds are generally more favorable due to tax exemptions on interest earned and contributions.

Tips

Ensure calculation details align with income tax laws, especially while computing HRA and handling provident fund contributions.

Sources

AI-generated content may contain errors. Please verify critical information