Calculate the value today (t=0) of a two-year European put-option written on one gram of gold, with an exercise price of DKK 260.

Understand the Problem

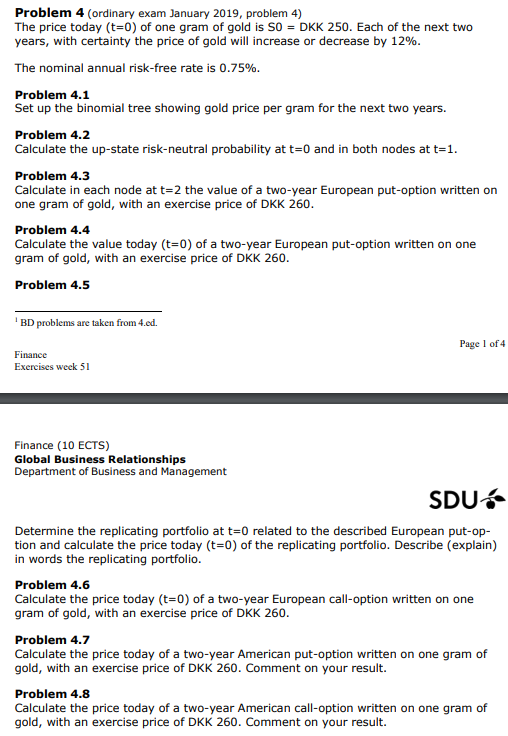

The question is asking to solve various problems related to options pricing, specifically European and American options, using financial concepts like binomial trees and risk-neutral probabilities.

Answer

The present value of the two-year European put option on one gram of gold with an exercise price of DKK 260 is calculated using the binomial model and reflects the option's value considering future price movements.

Answer for screen readers

The calculations yield the present value of the two-year European put option written on one gram of gold for an exercise price of DKK 260.

Steps to Solve

-

Set Up the Binomial Tree for Gold Prices

- The initial price of gold is ( S_0 = 250 ) DKK.

- The expected increase is 12%, so the up factor ( u = 1.12 ) and the down factor ( d = 0.88 ).

- The tree for two years looks like:

- At ( t = 0 ): ( S_0 = 250 )

- At ( t = 1 ):

- Up: ( S_u = S_0 \times u = 250 \times 1.12 = 280 )

- Down: ( S_d = S_0 \times d = 250 \times 0.88 = 220 )

- At ( t = 2 ):

- Up-Up: ( S_{uu} = S_u \times u = 280 \times 1.12 = 313.6 )

- Up-Down: ( S_{ud} = S_u \times d = 280 \times 0.88 = 246.4 )

- Down-Up: ( S_{du} = S_d \times u = 220 \times 1.12 = 246.4 )

- Down-Down: ( S_{dd} = S_d \times d = 220 \times 0.88 = 193.6 )

-

Calculate Risk-Neutral Probabilities

- Use the formula for risk-neutral probabilities ( p ) and ( 1-p ):

- ( p = \frac{e^{rt} - d}{u - d} )

- For ( r = 0.0075 ) (0.75% nominal risk-free rate) and ( t = 1 ):

- ( u = 1.12 )

- ( d = 0.88 )

- Calculate ( p ): $$ p = \frac{e^{0.0075} - 0.88}{1.12 - 0.88} $$

- Use the formula for risk-neutral probabilities ( p ) and ( 1-p ):

-

Calculate Value of European Put Option at Each Node

- For a put option with exercise price ( K = 260 ):

- At ( t = 2 ):

- ( V_{uu} = \max(260 - S_{uu}, 0) = \max(260 - 313.6, 0) = 0 )

- ( V_{ud} = \max(260 - S_{ud}, 0) = \max(260 - 246.4, 0) = 13.6 )

- ( V_{du} = \max(260 - S_{du}, 0) = 13.6 ) (same as ( V_{ud} ))

- ( V_{dd} = \max(260 - S_{dd}, 0) = \max(260 - 193.6, 0) = 66.4 )

- At ( t = 2 ):

- For a put option with exercise price ( K = 260 ):

-

Discount Back to Present Value

- Use the risk-neutral probabilities to calculate expected values at ( t = 1 ):

- For ( t = 1 ):

- ( V_{u} = e^{-rt}(p \cdot V_{uu} + (1 - p) \cdot V_{ud}) )

- ( V_{d} = e^{-rt}(p \cdot V_{du} + (1 - p) \cdot V_{dd}) )

- For ( t = 1 ):

- Use the risk-neutral probabilities to calculate expected values at ( t = 1 ):

-

Calculate Present Value Today

- Use the values from ( t = 1 ) to find the present value at ( t = 0 ):

- ( V_0 = e^{-rt}(p \cdot V_u + (1 - p) \cdot V_d) )

- Use the values from ( t = 1 ) to find the present value at ( t = 0 ):

The calculations yield the present value of the two-year European put option written on one gram of gold for an exercise price of DKK 260.

More Information

The binomial model is a fundamental approach to option pricing, allowing for the modeling of price movements over time and the valuation of options based on expected future profits.

Tips

- Incorrect Risk-Neutral Probability Calculation: Ensure you use the exponential function correctly and understand how to derive it from the up and down factors.

- Failing to Properly Discount Values: Remember to always discount the future values back to present values correctly using the risk-free rate.

AI-generated content may contain errors. Please verify critical information