What are repos and reverse repos in banking, and how does the RBI manage liquidity through these mechanisms?

Understand the Problem

The question is asking for an explanation of the concepts related to repos and reverse repos in the context of banking and financial markets, specifically referencing the roles of RBI in managing liquidity.

Answer

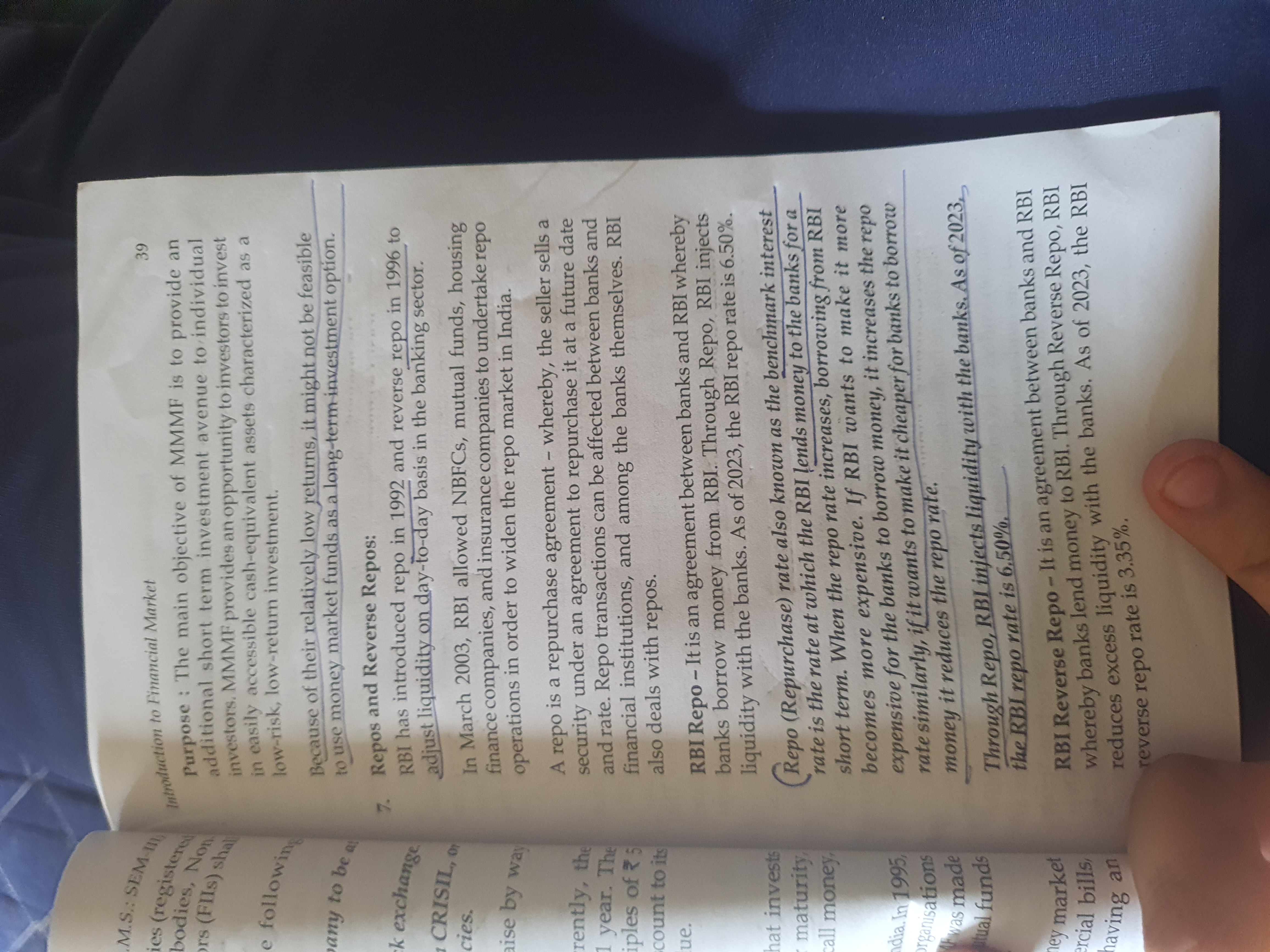

RBI uses repos to inject liquidity and reverse repos to absorb it. Repo rate (2023): 6.50%, reverse repo rate (2023): 3.35%.

The final answer is that the RBI uses repos to inject liquidity into the banking system and reverse repos to absorb excess liquidity. As of 2023, the repo rate is 6.50% and the reverse repo rate is 3.35%.

Answer for screen readers

The final answer is that the RBI uses repos to inject liquidity into the banking system and reverse repos to absorb excess liquidity. As of 2023, the repo rate is 6.50% and the reverse repo rate is 3.35%.

More Information

The RBI utilizes repo and reverse repo operations as instruments of monetary policy to manage liquidity in the banking sector effectively. Higher repo rates generally curb inflation by making borrowing more expensive, while lower rates encourage borrowing and spending.

Tips

Common mistakes include confusing which party initiates the transaction and misunderstanding the impact of rate changes on borrowing costs.

Sources

- What is Repo Rate and Reverse Repo? - groww.in

- Repo Rate Vs Reverse Repo Rate | Paytm Blog - paytm.com

AI-generated content may contain errors. Please verify critical information