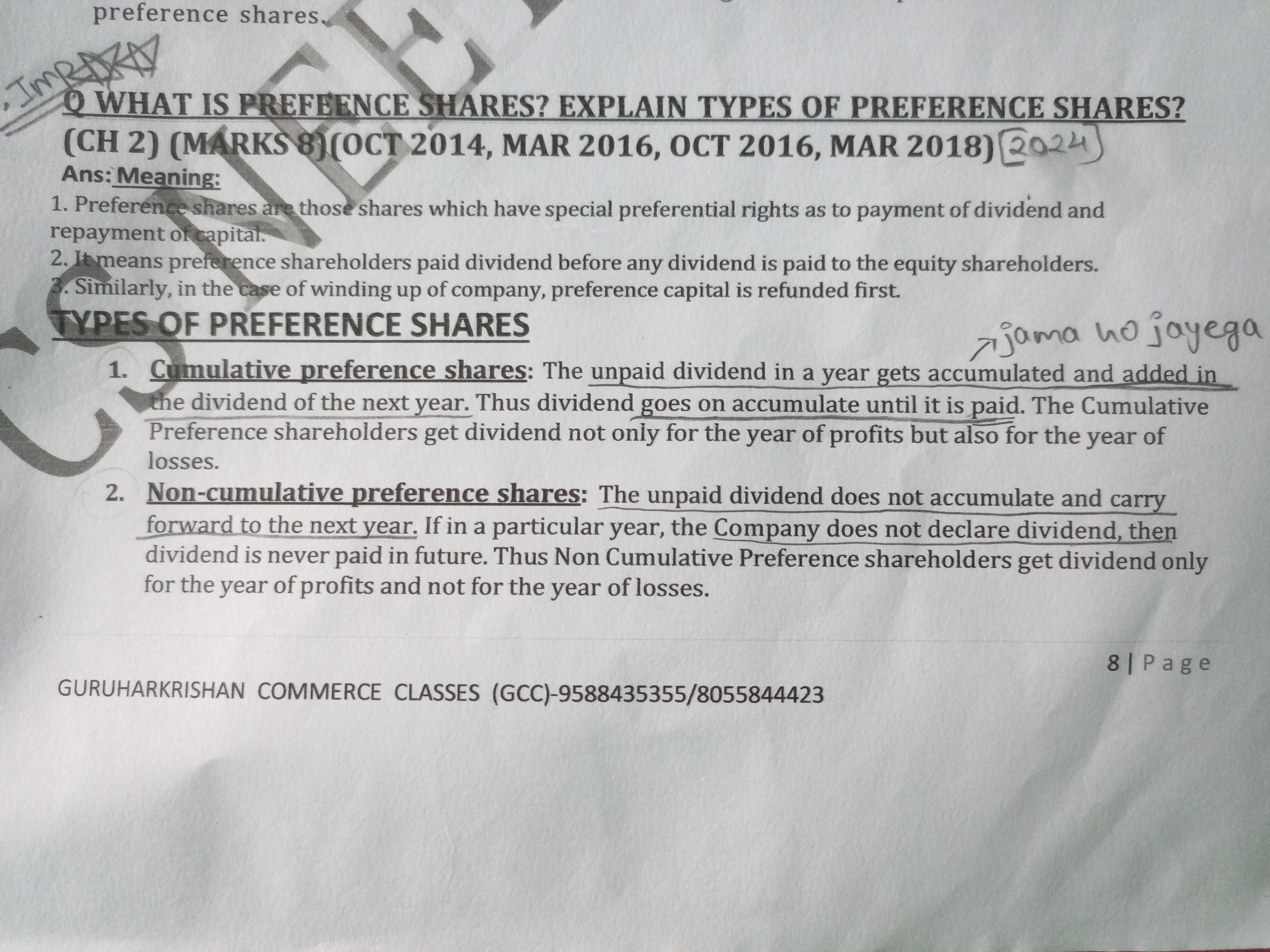

What are preference shares? Explain types of preference shares.

Understand the Problem

The question is asking for an explanation of preference shares and the types of preference shares, specifically cumulative and non-cumulative preference shares. It seeks to clarify their characteristics and differences.

Answer

Preference shares offer fixed dividends with types like cumulative, non-cumulative, participating, and convertible.

Preference shares (preferred stock) are equity securities that receive fixed dividends before common stock dividends. Types include: 1. Cumulative: Unpaid dividends accumulate until paid. 2. Non-cumulative: Unpaid dividends do not accumulate. 3. Participating: Eligible for extra dividends. 4. Convertible: Can be converted into common shares.

Answer for screen readers

Preference shares (preferred stock) are equity securities that receive fixed dividends before common stock dividends. Types include: 1. Cumulative: Unpaid dividends accumulate until paid. 2. Non-cumulative: Unpaid dividends do not accumulate. 3. Participating: Eligible for extra dividends. 4. Convertible: Can be converted into common shares.

More Information

Preference shares prioritize dividend payments and can carry features like dividend accumulation, conversion to common stock, and participation in extra earnings.

Tips

A common mistake is confusing cumulative and non-cumulative shares. Remember: cumulative shares accumulate unpaid dividends.

Sources

- What Are the Different Types of Preference Shares? - Investopedia - investopedia.com

- Preference Shares: Meaning, Types, And Features - nirmalbang.com

- Types of preference shares - AccountingTools - accountingtools.com